|

We continue our examination of global oil markets with Part 2 of the series Oil Markets - Evolution of the Body Politic. To read Part 1 click here. Last week we made a call that the OPEC meetings would most likely result in a maintenance of the status quo and though this initially seemed to be the case, things changed rather quickly. The Saudi delegation led by the Crown Prince himself played a hand that took many analysts by surprise, he managed to negotiate a bigger than expected production cut with the Russians in what could only be considered a warning shot to Washington. The OPEC members agreed to cut production by 800,000 barrels per day (bpd) with Saudi Arabia shouldering around 250 000 bpd and Russia et al agreeing to take a further 400,000 bpd offline. Exemptions were made for Libya, Iran and Venezuela. It seems that Mohammed Bin Salman has decided to make a decisive gamble on either having the American’s dial back the rhetoric around the Khashoggi killing or diversifying the Kingdoms geopolitical interests by walking into the welcoming arms of Russia. The fact that exemptions were made for Iran will also likely assuage the Chinese who have resumed importing from that particular country. In fact, according to trade data, Chinese crude imports jumped to an all time high in the previous month led by independent refiners (colloquially referred to as the teapots) rushing to meet expanded import quotas and refinery capacity. This unfolding series of events tie in well given that this article looks at US Energy Policy. America & Oil - A question of pragmatism? Arguably the most important factor when it comes to understanding the future of oil prices and how oil markets are likely to evolve going forward is to understand US Energy Policy. And though it is not within the scope of this article to try and unravel the mystery that is the inner workings of the United States Federal Government, we can nevertheless try to understand the motivations and key milestones that led us to our present situation. We begin our walk down history lane with the advent of the Bretton Woods system post-WWII. This system of currency controls designed to prevent a repeat of the pre-war problems and incentivise nation-states to avoid competitive devaluations of currencies in a ‘beggar-thy neighbour manner’ also effectively made the USD the world's reserve currency. To put it simply, the essential problem most countries faced with the proliferation of international trade was to find an effective medium of monetary exchange which required a degree of coordination. The plan was simple on face value, governments around the world would agree to peg their own currencies to the USD which would then be guaranteed against Gold. However, here we run into two problems. Firstly, this required the United States to maintain an adequate supply of gold and secondly, in order for the rest of the world to do business the United States would have to maintain a Current Account Deficit for an indefinite period of time (referred to as the Triffin Dilemma). To avoid the associated problems, President Nixon unilaterally dismantled the agreement by suspending the convertibility of USD against gold in August 1971. Nevertheless during the decades leading up to this point, the United States Dollar had become so well-entrenched in the financial system that it was in effect the only major currency that provided enough liquidity to support the buying and selling of oil on global markets. This also happens to be the reason for the historically inverse relationship between oil and the US Dollar and why the Fed’s interest rate policies have a significant impact on the price of oil. Beyond the unilateral dismantling of the Bretton Woods agreement, the 1970’s were also significant in the oil markets since it was the decade of the 73’ Oil Crisis and the eventual 1973 Passage of ‘Energy Policy and Conservation Act’ by Congress. This decade had profound implications on how the White House and the American Political Complex saw energy and increasingly tied it in with broader issues around national security and foreign policy. In the first instance, the United States’s support of Israel during the Yom Kippur War saw the Arab states, through OPEC, impose an embargo on oil exports which, beyond shorter term and rather drastic implications for the economy, galvanised policy makers into action. The immediate reaction was the creation of a national framework in order to guarantee energy sustainability through direct regulatory intervention. These interventions were targeted at building domestic capacity, subsidizing companies both within the fossil fuel sectors and alternatives. This also included the creation of the strategic petroleum reserve and a ban on exports that was to last until 2015. This effectively created two separate oil markets (the domestic one being dominated by WTI and the global markets by Brent). The second perceptible difference was in foreign policy with the United States taking an increasing interest and interventionist role in the middle-east. Where to next (The Age of Trump)?

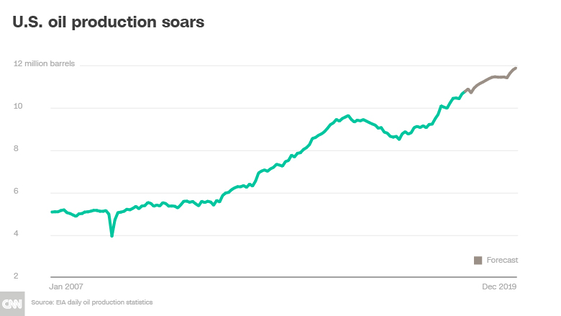

At the very least, we hope it is clear by now that oil markets, far from being determined by market forces of supply and demand, are very much linked inextricably to the policy agenda of Washington and the broader geopolitical dynamics at play. On one level, government intervention, though a controversial topic, was in many ways effective in creating domestic capacity with the United States overtaking both Saudi Arabia and Russia as the largest producer of oil. This was enabled by advances in technology, subsidies and a general willingness on the part of both Federal and State governments to make it easier to explore and drill. This served the dual purpose of creating a greater degree of energy independence that led to the eventual lifting of the export ban (creating an entirely new market for traders to arbitrage between the price differentials between WTI and Brent) and, longer-term, enabled the creation of companies in the alternative energy space. Both of these trends are vital to understand the longer-term trajectory of oil. It is in this context that Donald Trump was elected. Much has been said about his use of policy on the go and by rhetoric through twitter, substantively speaking though, the White House’s policy when it comes to Energy has not been beyond the norm. Overt pragmatism when it comes to his relationship with the Saudi’s and ostensibly supporting MBS, are actions that are in-line with his America First policy. The intuition behind his actions and his reluctance to take a hard-line with Saudi Arabia is easy to understand within the context of the re-imposition of sanctions on Iran. The sanctions would hypothetically have taken a substantial amount of oil offline and the State Department’s increasingly vitriolic relationship with Venezuela (another key producer) worsened at the same time. In this scenario the Saudi’s became increasingly vital in order to fill the supply gap. However, we would suggest that one of the key things the administration was unable to account for was the fact that Iran had avenues with which to continue supplying oil. They simply re-route through Iraq (a paper trick). Secondly, and perhaps more important, is the implication for the USD. When the administration decided to unilaterally move against Tehran, their ability to do so was because of the fact that transactions for the buying and selling of oil is denominated in US Dollar as a reserve currency. The very fact that the federal government went down this avenue without consultation will undoubtedly have longer term ramifications in terms of how governments around the world view USD denominated transactions. The introduction of the Petroyuan contract (though nominal at this stage), the use of cryptocurrency (again nothing more than symbolic at this stage by Venezuela) and murmurings earlier this year by the Europeans of circumventing the SWIFT system entirely are perhaps telling signs of what is to come. It is perhaps to allay these concerns that exemptions were made to certain countries including India and China. Longer term we might very-well see a de-dollarisation of the oil markets. This process is very much in its infancy, since you would either need a currency that is in wide enough circulation (which the Yuan is not) and markets liquid enough to enable the transactions to take place. Unless we move towards a Bretton Woods 2.0 whereby the Chinese government wishes to make the Yuan convertible to Gold or dial back capital controls, both of which seem unlikely. All this makes us feel bearish about the prospects for oil going forward into 2019 and longer term.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed