|

Over the past few weeks we have tried to elaborate upon what is turning out to be one of the most interesting and dynamic secular growth stories of the coming decades and perhaps century. And so, we would like to use this article as a conclusion of sorts, namely addressing the why? And more importantly, why now?

Author: Sid Ruttala Author: Sid Ruttala

If you wish to read the preceding articles, you can find them here:

Mobility Part 1: The Investment Thematic of the 20s (Again) Mobility Part 2: We're Gonna Rock Down To Electric Avenue Mobility Part 3: Three Key Considerations for Investing in Autonomous Vehicles Mobility Part 4: Connectivity, Shared Mobility & 2 Stocks to Consider I won't beat around the bush any further, let's get right into it. Why? For those of you somewhat familiar with previous articles, you are probably aware of my fascination with Kuhn and the notion of the paradigm shift. The transformations currently occurring across mobility are, in my view, just such a shift. A once in a generation change and opportunity. The fourfold schematic that we’ve elaborated upon so far is a simplistic and I hope effective way to distinguish the opportunities that are available for the discerning investor. But coming back to the question of why (and it's not complicated), here are a few numbers:

€20 billion

The amount of penalties that automakers face going into 2021 if they don’t meet new stringent CO2 emission targets 9 Countries (and counting) The number of nations currently discussing the total ban on internal combustion engines by 2030 $2.5 trillion The minimum value of the new ecosystem of businesses and services that are emerging within the segment by 2030 $8 - 10 trillion The overall opportunity set over the next 50 years. 62% The percentage of automotives that are used as Robo-Taxis in China (hint as to why this is a game-changer: think about the traditional automobile sales and private ownership). $1.1 trillion The most conservative projection for market revenues generated by mobility services in China 900 billion Total sales of autonomous vehicles (projected to make up 40% of new vehicle sales by 2040).

If the above statistics are not incentive enough for the reluctant investor, have a look at the below video around the Hyperloop and think about the implications for domestic air carriers if such technologies are commercialised.

The point here being that just as the advent of the internet had vast implications in industries ranging from retail to media, the impact of which took anywhere between months and decades to play out, so too will changes in mobility be a thematic. The implications and questions are not limited to whether Tesla is overvalued or not, but what does it cost for me not to have some sort of exposure or at least awareness? You might have exposure to energy, telecommunications or even a supermarket chain, if you think that this thematic wouldn’t impact you, then think again. Taking the supermarket as an example, think for a moment about what it takes to get fresh produce from farm to shelf? For those that aren’t willing to adapt to new technologies and recognise efficiencies within the supply chain, what does their future look like? Think of retailers like Nordstrom or JCPenny. We’re quite sure that most investors in these companies didn’t look to the WWW (World Wide Web) while still in its infancy and see it as a threat to them.

Why Now?

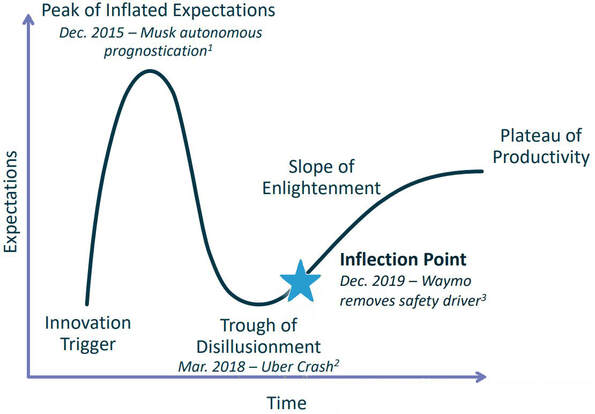

I am not a believer in trying to time the market (I prefer the old-fashioned time in the market), but sometimes it is good to be aware. The best time to have invested in technology stocks would probably have been 2003 after the massive run-up in the dotcom bubble. After the bubble burst, you would’ve bought the capex that had been invested, the R&D and everything that went with it for pennies on the dollar.

1. Business Insider, https://www.businessinsider.com.au/self-driving-cars-at-peak-of-gartners-hype-cycle-2015-8

2. Forbes, https://www.forbes.com/sites/enroute/2018/08/14/autonomous-vehicles-fall-into-the-trough-of-disillusionment-but-thats-good/ 3. Business Insider, https://www.businessinsider.com.au/waymo-says-it-will-start-giving-rides-without-safety-drivers-2019-10

My rule of thumb is always this: let someone else pay for the exploration and I would ideally like to buy at a valuation below whatever has been spent.

The mobility segment is at such an inflection point now (though one wouldn’t recognise it just by looking at the price action of Tesla or Nio Inc.). The more adventurous capital has already been spent (think about the $5bn cap raise just committed by Tesla in the past year). Further up the supply chain, across components like semiconductors, we have seen consistent capital outlay and we are beginning to see the commercialisation. This is helped in no small part by existing regulation (catalysed not only by the EU but by now a Democrat win in the US and across every major developed and developing economy, including China) and policy incentives. The time is now. And if we have another sell-off, get even more aggressive (the adventurous capital is also the most flighty).

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed