|

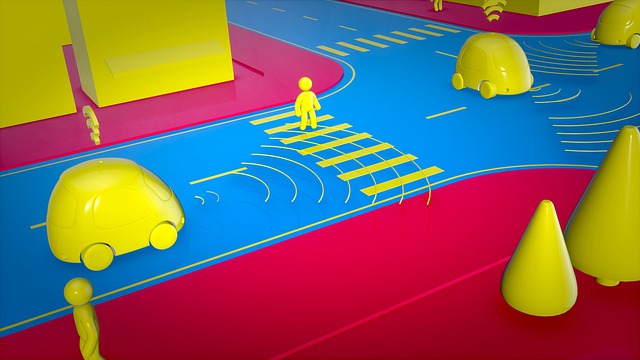

This week we visit our second category within the mobility thematic, that is autonomy. A topic that is arguably more important than the general electrification of transport, we arrive at three key considerations for those wishing to take advantage of the thematic.  Think for a moment about the impact of this autonomy theme, not only within the automobile segment but the broader economy. The questions that spring to my mind include the impact on automotive sales, especially in densely populated geographies such as China? The economic impact in nations such as India where driving as a profession makes up the primary income source for over 150m people? On the flip side, the ultimate nirvana of fully autonomous vehicles (connected) should also reduce road accidents and fatalities. This is one topic that has clear benefits and will potentially lead to large dislocations in the overall economy. Autonomy and shared mobility, which we refer to as ACES (Automated, Connected and Shared Vehicles), has already had a tremendous impact upon the border economy. Just think of the more well-known Uber and Lyft IPO’s and, in emerging markets, companies such as Ola. The way I try to contextualise this trend is to think about the evolution from the simple mobile phone to the smartphone, trends that are mutually reinforcing. Where the hardware (in this case the Electric Vehicle) is evolved into the fully autonomous vehicle (in this case software that enables connectivity in the same way as the iOS or Android systems make up the vast majority of the underlying interface that enables the features of the smartphone). As of today, the market for automotive software has been silently growing at about 7% annual CAGR with the market expected to grow to over $469bn USD by 2030 (Source: McKinsey). This is the first thing that the discerning investor should be aware off, the overall automotive market (characterised by end-user sales) is, in contrast, expected to grow at 3% p.a. over the next decade (assuming current trends are not changed). Simply put, the best opportunities do not necessarily lie in access to final producers or downstream so to speak, but rather in the components that make it up. As if that were not enough, it is more than likely that we will see the same creative destruction trends that we saw in other markets. Think about it in the same way that Apple revolutionised the smartphone market and now the market share of Nokia today.  Within automotive software, as is the case with any new industries, there is significant divergence and segment-level variation. We have yet to see a centralised software or a player take the lead within the space. My view is that, unlike the automotive industry in general, the software itself might just be a winner takes all market (with the caveat being that it will be hard to judge who the leader might be), just as Google took close to the entirety of the search market and Windows (Apple’s iOS nonwithstanding) with the PC market. This is a place where the watch and wait approach might be best with a diversified pool of bets in the portfolio. Some listed companies within the space include, Keysight Technologies Inc (KEYS.NYSE), Thermo Fisher Scientific (TMO.NYSE), Materialise (MTLS.NYSE) and Silicon Laboratories Inc (SLAB.NASDAQ). Existing incumbents such as Microsoft, SAP, Autodesk, Dessault and Oracle are also making headways in building out divisions. Aside from software, we will continue to see advances made with regards to sensors. One can reasonably expect to reach double digit growth in this market as incumbents scramble to perfect the segment. These include shared mobility players and the more traditional auto manufacturers. Looking more in-depth, the backbone for the technologies can be categorised into two segments, ECUs (Electronic Control Units) and DCUs (Domain Control Units), which underpin VxV (Vehicle to Vehicle communication). The relevant leaders within these segments currently include Nvidia (NVDA.NASDAQ) and QualComm (QCOM.NASDAQ). We expect that high-voltage harnesses within ECU to increase whilst the converse is true for lower voltage (i.e. EV vehicles). That said, major players have already made certain headways including Volkswagen, which plans to adopt a unified automotive architecture, and BMW, introducing a central communication services and service-oriented architecture (SOA) providing a certain level of scalability. To date, the issues remain the security of the underlying software, the efficiency and efficacy of VxV communication and circuit level complexity. Rather than going into detail that might very well bore, think of it like the problems associated with making an iOS system communicate with Windows. The alternative could be open source and a centralised system with regulators effectively operating as the middle-man. For the more impatient investors, the companies that currently dominate the DCU market are Visteon (VC.NASDAQ), Continental AG (CON.ETR), Bosch (a private company other than their Indian operations) and Aptiv PLC (APTV.NYSE). The upcoming contenders include Chinese player, Huawei (not publicly listed), Desay (part of Huizhou Desay SV Automotive Co Ltd, 002920.SHE), Shenzhen Hangsheng Electronics (HSAE is also not public) and Neusoft (600718.SHA). What is perhaps interesting about the incumbent players vs. the upcoming players is the geographic segmentation and it adds a secondary consideration for the discerning investor. The first group are domiciled in the EU and US whilst the second are all domiciled in China. This is where we must consider geo-politics, as the Huawei situation has undoubtedly shown with regards to 5G, there will be lines drawn that makes the supply chain and investing a little more complex (and perhaps more profitable for the same discerning investors) since companies are not necessarily competing on a global landscape but within particular spheres of influence. If regulatory responses were to go toward preferential treatment for certain players, this will almost certainly create scenarios of greater economic profit than would otherwise be the case in a truly competitive environment (in economics this is termed economic rent-seeking). It might very well be the case that it would be better to diversify portfolios across not only market-leading companies but also geographies with the added advantage that risk is mitigated somewhat by ensuring a base-level of profitability (i.e. even if the company is not necessarily best-of-breed globally, they may be profitable purely based on jurisdiction). To conclude, recognise the following: 1) There is a developing and evolving ecosystem of companies within the broader AV thematic; 2) The industry is still in its infancy and, if the past is anything to go by, then the winners are not so easily discernible, hence it is best to diversify at this stage;

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed