|

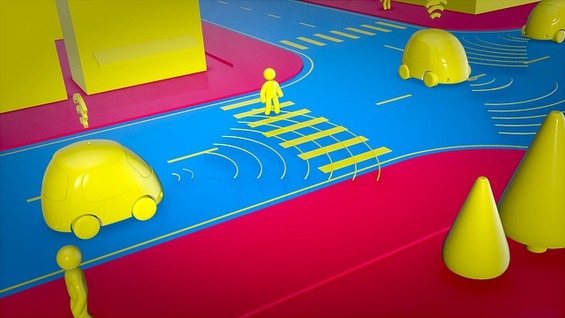

This week we begin an exploration of one of the most prescient topics in the world of investing and economics, that is the future of mobility. We’re all familiar with the recent success of Tesla which has baffled many of the more conservative investors and has come to be a painful trade for the shorters over the last few years. Closer to home, we’ve seen some interesting aspects of this in less familiar names like Novanix (NVX.ASX) and adjacent categories such as Connexion Telematics (CXZ.ASX). We begin what is going to be a series of articles with an overview of sorts. A disclaimer before proceeding any further though, I am personally an investor in (and overweight) commodities such as copper with the thesis being that the growth in one particular segment of this market (i.e. Electric Vehicles) will put upward pressure directly on the demand for that particular commodity.  Author: Sid Ruttala Author: Sid Ruttala Overview Pre-crisis, 2019/2020 has seen significant advancements across mobility. Whether it be autonomous driving, connectivity, electrification or shared mobility. EV (Electric Vehicle) sales were hitting an all-time highs with 2020 continuing the trend, major IPO’s across ride-hailing apps such as Uber and Lyft have showcased the immense potential for the space. What has become apparent is that the transport sector is set to face challenges and opportunities that are on par if not greater than the revolution brought about by Ford over a century ago. To put it succinctly and categorise it easily for this series, there are four key elements to the revolution taking place, the first is the obvious electrification of transport and automobiles in general, the second is autonomous driving, third connectivity and fourth shared mobility. The changes don’t stop there, for each of those general categories there will be changes in adjacent supply chains, infrastructure requirements including the building up of required networks (i.e. charging stations), a rethinking and shifting of supply chains including essential commodities, software that enables connectivity and autonomy as well as disruptions to the existing automobile industries. In fact, for better or worse most major automobile manufacturers have put the EV market at the top of their priority lists, including General Motors, Toyota and Volkswagen. What has perhaps been disadvantageous for them to date has been legacy issues that require them to effectively subsidise entry into these new markets through the sale of more traditional fossil fuels related automobiles. While de-risking the potential somewhat, this makes them vulnerable to new entrants such as Tesla who are not quite so encumbered. In fact using the current valuation as a metric (and assuming the market has it right), it would suggest that Tesla will not just continue to grow sales but emerge with a close to 30% market share by the year 2030. This is something that has never been achieved in the automobile industry to date and suggests that investors are betting that this industry will face enough disruption and be prone to the same dynamic as Google in the search market for example (i.e. winner effectively takes all).  As though the flux wasn’t enough, several other macro and political changes have taken place that ensures that the investor is always on his or her toes. For one thing, reality checks such as the discussion around the safety of Autonomous Vehicles (AV’s) have been made necessary as we edge closer to them being a reality (for the ethics philosophers amongst you, should the car save the pedestrian or the passenger?). Congestion and public-transportation woes have also ensured that incumbents have had to dial down their ambitions at least in terms of their own timelines. One thing is for sure though, with the global regulatory environment changing and expectations of energy efficiency as well as reduction in greenhouse gas emissions being put at the fore, there is a tailwind for players in the space all together. Further up the supply chain, it isn’t enough that electrification takes place but also the process of energy production becomes more carbon-neutral (this places mobility within the context of border policy outcomes). The trade war and the fight to keep ahead of the innovation curve has also ensured that players within the space are protected and a scramble for supply chains is taking place, for those of you unaware, the Chinese equivalent to Tesla is Nio. We would posit that much of the recent copper price action is a result of relentless demand for that particular commodity in China. Similarly, the 21st Century scramble for Africa, which contains some of the most pivotal resources to enable the industries to scale. Over 60% of the world's cobalt production, for example, comes out of the Democratic Republic of Congo. In the States, both the current Trump administration and the Democrats have stated that a recalibration of supply chains is warranted with additional support being provided for vital industries including lithium, rare earths and R&D more broadly. For the discerning investor this creates immense opportunities but also risks. Think about the ongoing scandal dogging electric truck company Nikola (NKLA.NASDAQ), whose share price sky-rocketed 500% upon announcement of a deal with GM only to be brought back down to earth after damning allegations from short-seller Hynderberg Research. Whatever the truth about those allegations, it is important to avoid hype and look to take advantage on a reasonable risk-reward basis, easier said than done. We have the feeling that the price action around Hyliion (HYLN.NYSE) was at least partially a result of investors having FOMO after watching Nikola. However, using the Nikola story and its partnership with GM as an example brings us to the second point about the EV market and more broadly the industries associated with mobility in general, that is the creation of a true mobility ecosystem. Where traditionally it was OEM’s (Original Equipment Manufacturers) working with tier-one suppliers (think of the vast Keiretsu network of suppliers across Southeast Asia for Mitsubishi or Toyota), we are seeing the emergence of a broader ecosystem. The easiest way to think about this trend for the Australian investor is to think about the mining lifecycle from exploration to production. Through this whole process different companies are involved. BHP Billiton would be more adept at producing and would preferably buy a SolGold after the resource has been found and gain economies of scale than spend valuable resources making the next big discovery, the different risks associated with each step would ascertain different rewards. Going back to our four-tier categorisation of the mobility market overall, there are and will continue to be different components and companies that will be crucial. From the rare-earths suppliers to the battery manufacturers to the software providers for connectivity to the final product whether it be ride-sharing or automobile manufacturers. This is one of the most promising investment thematics for the next decade. Similar to the 1920s explosion in automobile production, there will be winners and losers though; of the roughly two hundred American auto makers in existence in 1920, only 40-odd survived to 1930 (Vintage Cars 1886 to 1930, Georgano, 2000). Over the coming weeks we aim to delve deeper into each of the four categories above and further explore each to get a feel for the potential winners, losers and “in-betweeners.” With of course importance being placed on what we as investors should be looking for.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed