|

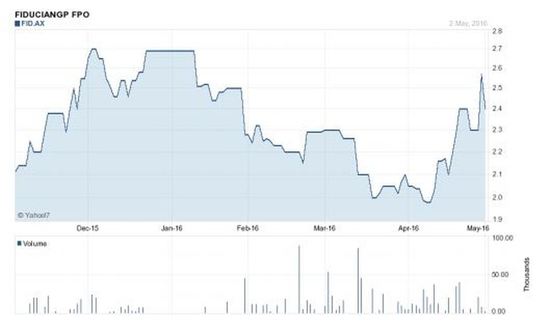

This week TAMIM launches the TAMIM Australian Equity Small Cap Individually Managed Account. This week we start the first in a 3 series set of articles highlighting the advantages of incorporating Small Company shares in your portfolio. The fund underlying the TAMIM Australian Small Cap portfolio has returned over 37% in the 12 months to 31 May 2016. If you would like to discuss this IMA with one of our directors please contact us at ima@tamim.com.au. This opportunity is strictly limited to $100m to protect the portfolio investment style and philosophy. Low Liquidity - Friend or Foe? Smaller companies generally trade with lower liquidity than larger companies reflecting their smaller market following and large founder stakes. Contrary to popular opinion we view lower liquidity as core to the smaller company investment opportunity since smaller companies only trade at low liquidity levels when they are under-researched and undiscovered, and their valuations generally reflect this. This creates significant opportunities for investors who are prepared to find the high quality smaller companies trading at a significant discount to intrinsic fair value. THE IMPACT OF LOW LIQUIDITYSmaller companies are generally perceived to be higher risk investments than larger companies, largely due to the higher liquidity risk prevalent amongst smaller companies. These smaller companies often remain tightly held by a founding family and/or lack the institutional interest and ownership required to generate a sufficient level of stock liquidity. The market is generally biased against higher liquidity risk because no one wants to be stuck in a poor investment they can’t sell. However, as with most aspects of investing, we believe the reality is far from this simple. We view low liquidity as a double edged sword which can also create opportunity. The market believes what the market believes. We have learnt to respect the market but at the same time understand that the market is not always right. Quite the contrary, the market can be incredibly inefficient, particularly at the smaller company end of the market where investors tend to be less informed. The effect of the market’s perception that higher liquidity risk makes smaller companies riskier than larger companies, is that many retail and institutional investors either stay away from illiquid stocks altogether, or are only happy to buy an illiquid stock at a much lower price than they would pay for an equivalent liquid stock. As a result, many smaller illiquid companies trade at much larger discounts to their intrinsic value to reflect this perceived risk. In many cases, the discount can be extreme. "Lack of market liquidity can sometimes be of benefit to small-cap investors who already own shares. If large numbers of buyers suddenly seek to buy a less liquid stock, this can drive up the price further than in the case of a more liquid market.” - Investopedia. We would go so far as to say that low liquidity is core to successful smaller companies investing. Our objective is to find undiscovered gems and to buy them when they are under-valued and illiquid, and before they are properly researched and understood by the market. Once they become liquid, these stocks will generally trade at significantly higher levels. The journey from illiquidity to liquidity is synonymous with the journey from undervalued to fair value and thus should be celebrated by experienced smaller companies investors. EXAMPLE – FIDUCIAN GROUP LIMITED (ASX: FID) Fiducian, a leading fund manager and financial planning operator, is one of our core holdings. We view the company as one of the highest quality micro caps on the ASX due to its excellent management team, clear growth strategy, strong competitive advantages and enviable track record of recent earnings growth. Fiducian’s earnings are expected to continue growing at double digit rates over the medium term and yet the stock is currently trading at only 11x FY16 underlying earnings and on a 5% fully franked dividend yield. This may seem strikingly cheap to large cap investors but this reflects the smaller company investment opportunity. Recent trading in Fiducian provides an interesting insight into smaller company liquidity. As the chart below shows, the stock fell from $2.70 in January to $1.98 at the end of April. At $1.98, the stock was trading at only 9x FY16 earnings and on a fully franked yield of over 6% despite the company’s high quality business model, strong first half result and excellent growth prospects. While the volatile equity markets of early 2016 no doubt impacted sentiment towards Fiducian, the share price fall was accentuated by the stock’s low liquidity. If this was a large cap reporting excellent results it is very unlikely the stock would have fallen so dramatically. In our minds this spelt opportunity so we bought more Fiducian stock into weakness at around the $2 mark. We viewed the selloff as a great opportunity to top up our shareholding in a high quality business on a very low valuation. Low liquidity once again presented a compelling opportunity which aligned with our disciplined value investing style and we were able to take advantage. ConclusionThe reality is that liquidity risk can either play to your advantage or disadvantage as an investor. We believe many investors are missing a trick by viewing all smaller companies as riskier than larger companies. The fact that so many people view liquidity risk as a disadvantage provides an explanation as to why smaller companies often trade at such low valuations and therefore are attractive investment propositions.

In our opinion, the key to using liquidity risk to your advantage is to ensure you are investing in under-valued, high quality smaller companies where you have an information advantage. This is clearly easier to do in the smaller companies universe than amongst large caps where you may be competing with 20+ highly intelligent analysts who have followed the stocks for many years. When investing in smaller companies there may be no analysts at all following the stock so it is a far less competitive investment environment. However, successful smaller company investing does require a disciplined filtering process since there are numerous listed smaller companies which will never reach profitability or a credible business model. We focus only on high quality companies which for us means having a diversified customer base, strong competitive advantages, a sensible growth strategy, a strong track record of earnings growth and good visibility around future earnings growth, and importantly, capable management who we are confident can execute on their growth initiatives. While illiquidity can offer great value buying opportunities, we do not want to be holding an illiquid company forever. Therefore, it is important that the investment has a clear pathway to growing earnings or growing its market capitalisation in order to attract a broader range of investor interest in the company. Fiducian is a great example of the type of company we will invest in, and one that we expect will attract greater broker and investor interest as it grows. We are confident that applying a disciplined value investing strategy to this select universe of smaller companies will lead to significant long term outperformance. We will continue to use smaller company illiquidity to our clients’ advantage.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed