|

The year 2020 is now certain to be remembered as the year China “sneezed” and the rest of the world “caught a virus”. It is official, the coronavirus (Covid-19) is now a global pandemic. So, this week we take a look at what we know about the virus and why we think investors should capitalise on the current volatility, looking to continue buying good quality companies over the next few weeks and months.  Author: Ron Shamgar Author: Ron Shamgar Before we get going, let us start by saying that the developments of the last week have shown this to be a serious health issue. Like any infectious virus, everyone should be taking all reasonable measures to stop the spread of this virus and minimise its impact on the at-risk demographics (not sure that means hoarding toilet paper though). The preventable loss of human life is definitely a tragedy. This article seeks to explore the impact of the coronavirus on the investing world. These are definitely extraordinary times. Up until February 20th the Australian market was going strong and the corporate earnings season was delivering generally good results. Over in the US, the economy has been booming with a resilient consumer, record low unemployment and new monthly jobs created continuing to beat expectations. Generally, the global economy, up until then, was in a sweet spot benefiting from low interest rates and benign inflation. Over in China, efforts by the government to contain the virus seemed to have succeeded and the Chinese people began returning to work and their daily lives. But then Covid-19 began spreading outside of China at a not insignificant rate, with the largest outbreaks in South Korea, Italy, Iran and the US. At that point markets started to panic and an aggressive sell off over the last five trading days of February saw markets drop -12%. The selloff continued into the first week of March with the ASX200 currently down almost -20% (as of March 10th) and at this point it is the quickest market correction on record. If there was ever a definition for a black swan event in financial markets, this is it. So what do we know about this mysterious virus? So far there’s been a lot of uncertainty and misinformation about the virus and the risk it poses. This is partly because we are still learning about it and there is constantly new information coming to light. As of the time of this article, we know the total infected cases to be at about 114,000 globally with 81,000 being from China. Of those, 64,000-odd infected people have recovered or been discharged from hospital to complete their quarantine safely at home. The death toll so far has reached 4,025 with 3,130 of those deaths in China.  Source: worldometers.info Source: worldometers.info The death rate, according to The World Health Organisation (WHO), is currently around 3.5% based on the above figures. In our opinion though, it is likely that this rate is much lower and possibly as low as 1%. We don’t pretend to be virologists, but common sense tells us that when someone dies from the virus, others tend to know about it, and it gets reported. But, it is quite likely that many infected people: a) had the virus but never got sick enough to go get checked out;

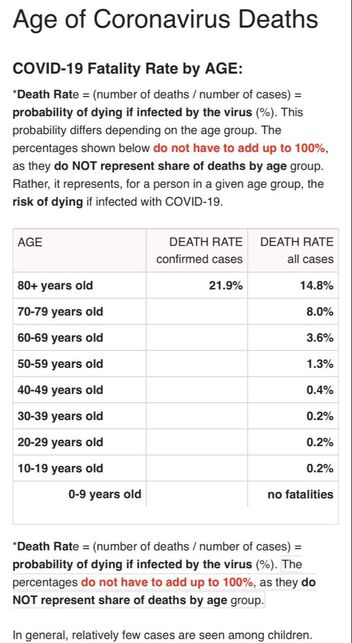

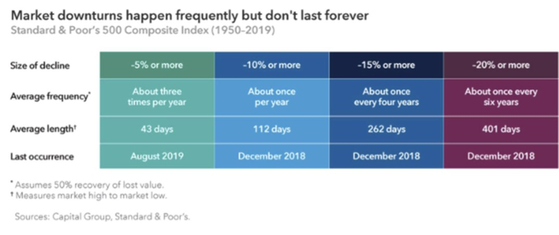

b) got the virus but are yet to show symptoms; or c) got the virus, got sick, but never were able to access medical treatment due to city closures or being in poor communities. This implies that the number of infections globally and probably even in China is likely to be significantly higher, possibly a multiple of the current reported figures. If this is the case, then the mortality rate could be significantly lower than what we know today. This is great news from a death rate perspective but bad news from a slowing the spread perspective as some people may be a little more reckless than they perhaps should be. Furthermore, we know that people with prior respiratory medical conditions and those in the 60 to 80+ age demographic and are the highest risk groups. Indeed, children under the age of 10 have not yet shown any major symptoms when contracting the virus. If we breakdown the current death total into age groups, it appears the mortality rate for people under the age of 60 is below 0.5%. For some broad numbers, it is worth looking at the Worldometers coronavirus pages. Every life on this planet is precious, but unfortunately the older we get the more vulnerable we are to many types of viruses and disease, not just this one. It is important to note once again that we are not here to try and play down the severity of the virus but just put things into perspective. In the United States alone, the seasonal flu infected 45 million people, hospitalised 810,000 and killed 61,000 in 2018. There were 27,000 flu deaths in the US in 2019. Imagine if we didn’t have flu vaccines. So far there have been 550 confirmed cases and 22 deaths in the US due to Covid-19. Yes, this is serious, and it may well escalate but investors should ask themselves whether this is enough justification for the current market panic and general hysteric behaviour? Despite growing fear, it is unlikely that the virus will bring the world to a standstill as it seems to have mild effects on most infected people while having the most impact on the elderly. Not to sound callous but, from a purely economic perspective, the virus will be a disruption of a few weeks for the vast majority of the workforce. The far more deadly 1918 Spanish flu, for example, also failed to bring the world to a standstill and back then the world was not as well equipped to deal with such virus outbreaks as we are today. This even extends to the fact that working remotely has never been more viable (for white collar jobs at least), a two-week company-wide quarantine would have almost no impact on TAMIM’s operation for example. Meetings can be taking online via software like Zoom, laptops can be taken home, phone lines can be redirected to mobiles. When it comes to the markets it should be noted that, given the strong global rally without a correction over the last year (especially in the US), a correction was going to occur at some point. The coronavirus and its short-term effects on the global economy have been the catalyst for this correction. Yes, global supply chains have been disrupted but they are already beginning to come back online. They will recover and they will catch up (this could be the catalyst that prompts companies to diversify beyond primarily Chinese suppliers, there are plenty of developing nations that would happily take a piece of that pie). Given the fear around the virus, people and markets are not currently acting rationally. This is somewhat justifiable based on the number of unknowns. It seems the recent rush on toilet paper at supermarkets across Australia is a good illustration of how irrational people can become when mass fear sets in. Given toilet paper is plentiful and is manufactured locally, this mass hysteria is a classic example of the damage social media, and the news in general, can create with sensationalism. As one lady said, “I’m buying it [toilet paper] because everyone else is doing it”. Unfortunately, investors, professional or not, appear to be no different. There are a lot of people out there panicking and selling because everyone else is doing it. As we go to print, this current market correction has eclipsed the one we had in the 2018 December quarter. Back then investors feared the worst from a US/China trade war. Investor’s fears turned unfounded, and the ensuing twelve months saw one of the best years of market returns in over a decade. Rough time to be sitting in cash. Stocks have risen steadily for most of the last decade, but history also tells us that stock market declines are an inevitable part of investing. The good news is that corrections (defined as a decline of 10% or more) and bear markets (20% or more decline) don’t last forever. Furthermore, no one likes to see their value of their investment take a hit. It is only human nature to seek to avert losses at times like these and to sell. Unfortunately, once investors sell, history has shown that they tend to stay out of the market. But that can cost investors dearly as those who sit on the sidelines risk losing out on periods of meaningful price appreciation that follow market downturns. Trying to time the markets is, generally speaking, a fool’s game. If you don’t want to listen to us, fine but you’ll find that all-time great investors, from Peter Lynch to Warren Buffet, are typically all of the opinion that it is time in the market, and not timing the market, that is important to achieving returns. The chart below shows that missing out on just a few trading days can take a massive toll on investment returns. For example, if an investor missed the thirty best trading days between 2010 and 2019 they would have ended up with 99% lower return than an investor who had stayed fully invested during that time (FYI timing the top is just as hard as timing the bottom).  We are unwavering in our belief that quality companies that are profitable and have strong balance sheets will continue to do well over time. There is no doubt that the world economy will experience a slowdown and possibly a global recession over the next three to six months, but governments around the world will intervene with stimulus packages and other measures to help the most impacted industries. We have generally avoided the travel, tourism, airline and hospitality industries as these will be the most impacted. We believe that consumers will continue to live out their normal daily routines but may seek to stay or work more at home and limit their activities from travel or large gatherings in the short term. We believe that companies that offer solutions and services online will continue to do well. These include payment companies, online retailers, mortgage originators, online consumer lenders, healthcare providers and other software companies. We will look to continue buying these companies as opportunities arise. Indeed, although we are in somewhat unchartered waters when it comes to a global pandemic, we do believe that over time humans show a strong ability to adapt to changes, catastrophes and financial crises. Eventually the panic calms and, when rational behaviour is restored, equity markets will continue to provide the best source of returns over all asset classes. Ultimately this all boils down to one key point. When it comes to both Covid-19 and investing we just need to be sensible. Take appropriate precautions, stay informed, make logical decisions and don’t panic. Investors need to remember that it is in times like these that assets tend to pass from weak to strong hands. Unless Covid-19 has fundamentally changed a business and affected your long-term investment thesis, good companies will recover and will continue to trend upwards. As someone much smarter than us once said, “Be greedy when others are fearful.” Look to hoard equities over the next few weeks and months, not toilet paper! A Message From TAMIM

This is an evolving situation, the 'facts' and figures are changing day by day. One must stay informed and have their opinions and actions evolve accordingly. Stay safe, take appropriate precautions and be sensible.

1 Comment

strong

12/3/2020 06:32:59 pm

Spot on commentary

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed