|

This week (and over the coming few weeks) I would like to visit upon a passion of mine, that is the understanding of investment and capital markets within the broader context of history and the political economy. Firstly, I must admit the inspiration for this particular piece came from perhaps one of my all-time favourite intellectuals and money managers, though I consider the latter aspect of his life to be quite secondary to the former. Ray Dalio’s most recent study into the big cycles of the past 500 years was not only stimulating but puts a great amount of context to the world we live in, or at the very least makes the investment framework rather more nuanced.  Author Sid Ruttala Author Sid Ruttala Too often, as investors we can grow limited in our views and when we see outliers, as we elaborated upon last week, we don’t know quite how to make sense of them. But perhaps history can, at the very least, give us some clues (if not answers). After all, as the quote from the book of Ecclesiastes goes: “The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.” We are by no means suggesting that we dispense with the idea of progress or advancement but only that history can teach us a great many lessons on causal relationships and what the future might hold. Understanding central bank policy after the GFC might have been a lot easier if we were to look to the 1929-1930 period where similar policies effectively had broader ramifications upon both income inequality and the political economy.  Where to begin? Dalio’s study of debt and credit cycles led him to an interesting observation, that the period of a long-term debt cycle lasts for 50-100 years. The case studies used include that of various powers including that of the American Empire (i.e. their hegemony after the fall of the Berlin Wall), China, India, Roman and the British Empires. The common theme throughout these histories has been the collective quest to grapple with the distribution of resources. As a student of history (a rather amateurish one at that) much of what is elaborated upon is striking. The current environment of rising populism and the rise of a second super-power to dominate the hegemony of the existing one isn’t so exceptional. We had a similar trajectory following the Great Depression and the fall of the Weimar Republic. In that case we saw the end of the modern day Rome in the form of the British Empire and the rising power of Germany. The post WWII world order has been what our generation is ingrained with as standard. The fall of the Berlin Wall was, in a sense, acting as a validation for the superiority of our new institutional framework. So with this in context lets begin to unravel our collective histories to see what the likely outcomes might be. For a ten minute read, this might be a tad ambitious, so please forgive in advance the broad strokes. The What? Let us go back to basics. Too often when we sit amongst the day-to-day of market shenanigans, we forget the simplest things. The markets as we know them are simply tools or mechanisms within which individuals come together to allocate resources. The fundamental quest, and this is the reason why the Chinese were such prolific builders of a state apparatus long before anybody else, is to allocate and distribute resources that are scarce in a “rational” manner. Ever wondered why, despite the abundance of resources, the Polynesian peoples were never able to make advancements out of tribal level societies? And no it was not that they had lesser intellectual capacity, but the one precursor to statehood (and why individuals would forgo and sacrifice their rights to the state) is resource scarcity and the problem of actually sharing those resources efficiently. This is perhaps also the reason why the great and prolific empire builders throughout history ended up being the Europeans and the Chinese state (though they were inward looking through much of history). What was common to them was a lack of arable land and the need to create a mechanism to distribute resources. This is probably the reason why the other great economic power of its day never built a centralised state apparatus despite having massive economic surpluses, here I refer to India. So if the raison d'être of the state is the scarcity and distribution of resources, it is plausible to see why capitalism as we know it was brought forward in societies with scarcity and why as those societies grew richer, like the Dutch and British, there was eventually instability. Since its foundations are contingent upon the ability to distribute resources, the moment this ceases to be the case is the moment of reckoning and eventual decline. In present day America, it is not a fight between left and right but rather the haves and have nots. The very policies that brought forth the innovations and advancements to society are ones that are becoming the bane of her existence. Despite the libertarian in me, I would have to admit that if there was no scarcity of resources, there would be no market and, given that the state’s primary function is to allocate resources, the two are interdependent.  The State & Investment Ever since I was a child, there was one question I could not quite grapple with or understand and maybe I still can’t. And that is, just what is money? The Chinese were the first to invent paper money as we know it (though Carthage may have issued promissory notes). Despite the Romans and their advancements, for the entirety of its history Rome used coinage; gold, silver, bronze and copper in different compositions. If there was ever a question of having or “printing more” to finance the state, inflation would typically be in the form of debasing the actual coinage, after all they could not simply print more gold. In other words the treasury had to maintain adequate supply of actual commodities at all times. This was perhaps the reason why the Roman Senate took such offence to the amount of silver going to India as a result of the demand for Indian silk by Roman women. I would say this is perhaps the first instance in recorded history of a discontent with trade imbalances within the context of the political sphere (happy to be corrected if any of our readership knows better). China, on the other hand, has always had issues with accessing precious metals and were thus the first civilization to issue paper currency during the time of Tang. Coins were, up till then, strung together on a rope and merchants (as you can imagine) found it cumbersome to carry copper around for large transactions. Slips of paper were used instead with coins backing them and guaranteed by the state. So in essence, money is again a mere mechanism, just as the markets. Except in this case it makes the issuer liable. In the words of JP Morgan, “Gold is money, and everything else is credit”. But if this were the case then ever since Nixon, who suspended the convertibility of the USD to gold, fiat currency has been backed by nothing. At best it is a call option on the state, however what concerns me about this is that, unlike having a contract with a private individual (which we rely upon the state to enforce), an individual relies on the goodwill of political actors. The power dynamic is a little off if you think about it too much. The entire system is reliant on trust. This is how the US Dollar, as the effective global reserve currency, allows the US government to finance its deficits (if it were any other government issuing trillions in deficit spending with a foul-mouthed and decidedly unstately Head of State things might have been rather different) for an indefinite period of time. Also why the continued current account deficits do not decrease spending power of the American private sector as a whole. The problem for Dalio and one of the thematics is that this trust is inevitably dismantled. The mistake he made was to think that when Nixon first made the move to suspend dollar convertibility, it would inevitably be bad for the markets. Ironically immediately following that announcement, markets went in the opposite direction. Why might this be the case? Think about the best bet against debasement of currency. It is precisely real assets and gold. Not cash. It might seem a little ridiculous to believe but governments debasing their own currencies does not give people an incentive to move towards that asset or hold it. Fortunately, given the USD’s centrality to the post-WWII financial and institutional system, it didn’t hurt as much as many expected it to. Again, the situation relies on the trust factor. The USD was still too essential for the global financial system to have a credible alternative. However, here is the caveat, how long will this remain the case as the state department continued through much of last year to impose unilateral sanctions against the deplorables and deficits continue to blow out to previously inconceivable levels. But will this continue to be the case. How is it that we got to this point though? This is something we will explore in depth next week. Note: Ray Dalio's 'Principled Perspectives' can be found on LinkedIn (see here for the latest) An important note for the charts above:

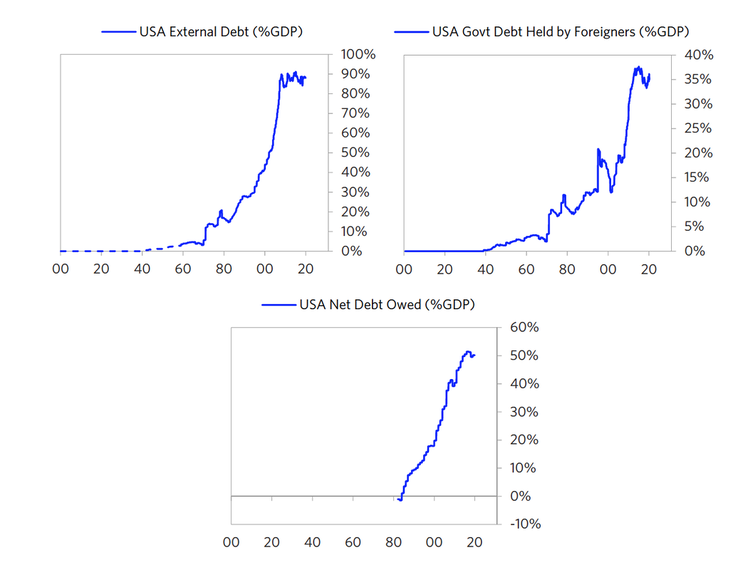

When the debt is predominantly denominated in foreign currency this will lead to a inflationary deleveraging during a debt crisis whereas, if the debt is predominantly denominated in the countries own currency, it will lead to a deflationary deleveraging. With the USD index falling 9% in recent times due to excessive QE and interest rate cuts, it poses interesting questions with 35% of the US’s debt held in foreign currency (we will talk more about this in the next part of this article series). Australia’s household debt is the second highest in the world currently sitting at 120% of GDP, this can be credited to the banks increased lending to the household sector through mortgages (read about Basel II in regards to RWA’s to find out more about this) which has inherently inflated the property markets. When debt levels grow at a faster pace than income we will see the household sector struggle to keep up with repayments which will inevitably lead to the swing of the cycle in our very own credit markets. Is Australia currently in a debt crisis? Often in the best of times the worst loans are made. As with general market cycles the debt cycle shares many characteristics. When the credit markets are wide open lenders are eager to lend and perceive the current environment as riskless and lend to burrowers at cheaper rates with looser covenants within the loans Howard Marks refers to this as “the race to the bottom” on the flip side when the bubble has burst lenders are not eager to lend and the doors become shut. Its during these times that the best loans are made as people become very fearful which leads to higher yields on the loans created with better covenants within them.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed