|

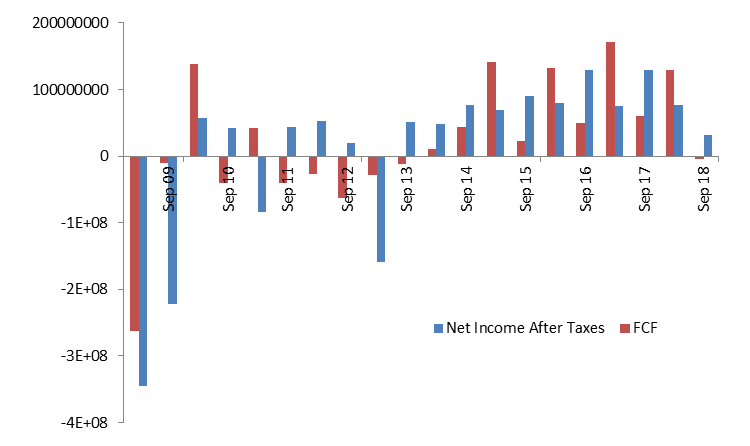

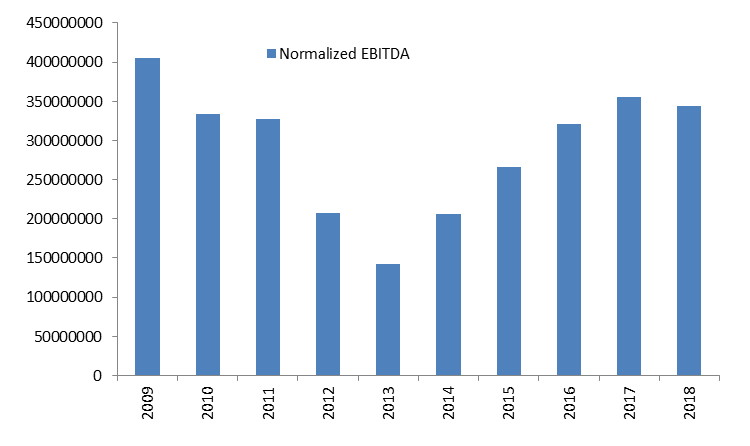

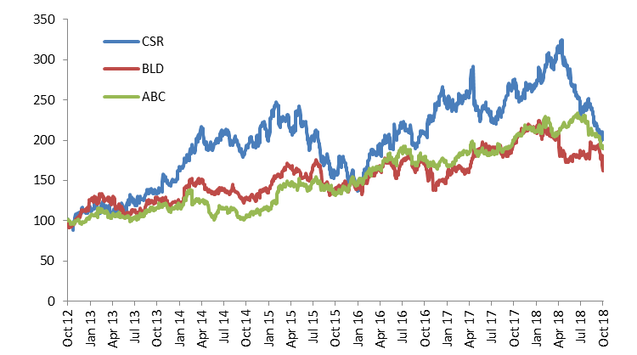

In light of the recent CSR results Guy Carson, of Quick Brown Fox Asset Management, revisits one of his favourite topics from the past eighteen months. Don’t look now but the CSR share price is down 38% since May this year and it is signalling tough times ahead for the economy. The reasons behind the fall were there to see in its result last week. Group EBIT fell 32% with the fall driven by the Aluminium division as well as a lack of property settlements. The good news from the result was that building products and the troubled Viridian glass division were up 1% but the signs are not promising. EBIT from Viridian rose from $2.2m to $7.1m. This is a solid rise off a low base but it hardly justifies the $1.2bn CSR paid for the business over a decade ago. The increase from Viridian offset a fall in the EBIT from building products from $120.3m to $116.5m. After solid growth in earnings from 2013 through to 2017, it appears this cycle has peaked and CSR’s earnings are starting to head south. Source: Thomson Reuters, Company Filings In response to softer demand within their building products division the company has announced it will be “mothballing” one of its kilns in New South Wales. Whilst doing this the company has tried to reassure investors that the long term will be fine given high population growth. The market isn’t convinced and is clearly more worried about the future than the management. The problem for the company is that Australia’s largest ever building boom is coming to an end. This was a building boom kick-started by the beginning of the RBAs easing cycle in 2011. Shareholders in building materials companies benefited as construction started to boom. Then this year that run came to an end. The reason the boom is coming to an end is twofold:

The result is a slowdown in credit growth and a fall in demand for housing. We have seen the impact of that in the recent results from the bank with top line growth anaemic. Banks have relied on lower impairments to hold up profitability. This is an unsustainable situation if house prices keep falling. Tighter credit means that demand for property is faltering (and hence prices are falling). The result is that supply is now starting to react and Australia’s largest ever residential building boom is ending. Residential building booms tend not to end well. We have written extensively in the past about a 2007 paper written by US Economist Edward E. Leemer called “Housing IS the Business Cycle”. In this paper, Leemer looked at all the recessions in the United States since World War 2 and found that 8 out of the 10 were “preceded by substantial problems in housing and consumer durables.” This leads him to conclude that “Housing is the most important sector in our economic recessions, and any attempt to control the business cycle needs to focus especially on residential investment.” The only two US recessions that are exceptions to the above were the end of the Korean War in 1953, caused by a decline in defense spending, and the 2001 “Tech Wreck”. As the paper was written in 2007, we can now improve the success ratio to 9 out of the last 11 recessions following the 2008 recession, something that Leemer warned about. The key reason Leemer gives for housing being so important to the economy is that “house prices are very inflexible downward, and when demand softens as it has in 2005 and 2006, we get very little price adjustment but a huge volume drop. For GDP and for employment, it’s the volume that matters." In other words, a housing cycle will typically see a drop in transaction volumes and building activity that will lead to job losses and ultimately a downturn in the economy. In Australia, Construction (along with Healthcare) was the two key drivers of the record jobs gains last year. Construction employment is now at its highest level in a century (9.6% of labour force) and residential construction accounts for c. 75% of all construction jobs (source: RBA). The implications of a stagnating or falling residential market are therefore serious. The chart below shows the rise of construction jobs over recent times. One thing to note is the last time Australia had a recession, the number of construction jobs fell by 17%. CSR's result last week shows we are just at the tipping point. Building materials companies are starting to see a slowdown, developers will likely follow suit. The problems don’t stop there due to a large multiplier effect associated with the property market and we are already seeing the signs of this contagion. Retailers are already facing tough conditions with soft updates recently from Nick Scali, Lovisa and Flight Centre. New car sales recently fell for the 7th month in a row and is weighing on the price of AP Eagers and Automative Holdings. In the online space, Domain has issued a profit downgrade and has dragged the REA Group share price down with it. The banks are all trading at or around 5 year lows with significant downside if those dividends are cut. For us, now is not a time to be aggressive. Our average cash level has risen over the last few years and we have initiated a small short position on the index. Whilst some managers have been quoting Warren Buffett and proclaiming the October selloff as a significant opportunity, we are not convinced. We still see significant pockets of overvaluation that aren’t fixed by a 10% pullback coupled with a housing market that could bring down the economy.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed