|

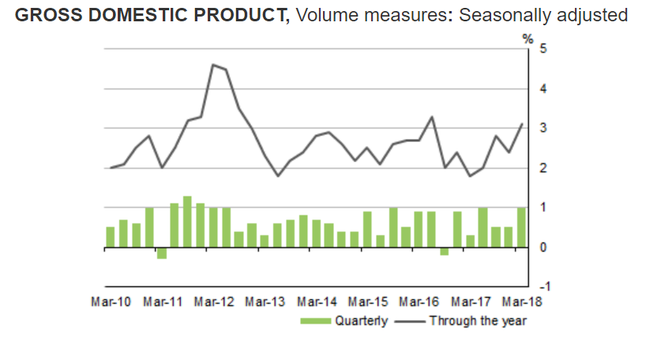

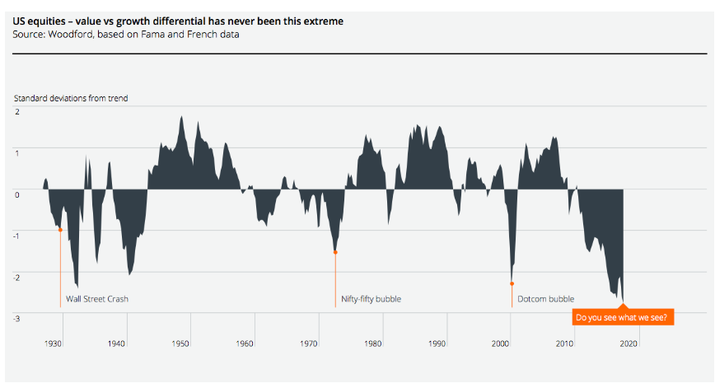

TAMIM Managing Director, Darren Katz takes a look at the month that was May from both a local and global perspective. Australia extended its amazing run of positive growth quarters with an increase in GDP of 1% from an upwardly revised 0.5% in the December 2017 quarter. The growth during the quarter was largely driven by increases in the export of mining commodities. This marks the 27th year without a recession in Australia. The annual growth rate of GDP moved up to 3.1% from December's 2.4% according to the Australian Bureau of Statistics (ABS). In addition to the contribution from strong exports, a jump in business investment helped although household consumption does remain a worry. According to Bruce Hockman, the Chief Economist for the ABS, growth in exports accounted for half of the growth in GDP. Production of coal, iron ore and liquified natural gas (LNP finally coming online) showed strong increases. Private investment was particularly strong in the non-mining sector with strong investment in machinery and equipment. Household consumption was a paltry 0.3% and the household savings ratio fell to 2.1% which was its lowest rate since 2007 although the rate of decline has moderated over the last year. Employment in Australia has grown strongly over the past year but this has slowed recently. Due to a strong increase in the participation rate, the actual unemployment rate has not altered. The big issue facing our economy is wages growth remains low at 2.1% and this does not seem to be reversing. While some level of growth would be welcomed as it would help the savings ratio and help reduce household debt, the counter argument to this, is that this would be inflationary. The Australian market represented by the ASX 300 was up 1.19% in May 2018. Year to date it is up a measly 1.5%, driven largely by healthcare stocks (up 23% for the year) with CSL in particular up 33.45%. Telecoms (-19.6%), utilities (-7.3%) and financials (-6.7%) are all down for the year. While the Royal Commission moves forward the pressure on the banks will continue. There will be a time to buy the banks but this is not quite it. While CBA is on a 6.2% dividend yield before franking, it is still down 27.7% from its peak back in March 2015. Over the last 12 months IT, energy and materials have been the sectors to be invested in. Residential house prices have slowed in Sydney and Melbourne. Interestingly APRA’s supervisory measures and tougher credit standards on lending have slowed credit growth and contained the risks in the household balance sheet. We would expect lending standards to tighten further with the Royal Commission. Interest rates on outstanding mortgages continue to decline. The RBA kept rates steady at 1.5% at the recent June meeting with a hike not being priced in until late 2019. According to the statement by Governor Philip Lowe, the global economy has strengthened over the past year with developed economies displaying above growth trends and low rates of unemployment. Risks to the growth of the Chinese economy are being focused on by authorities help keep growth at solid levels. Inflation remains at low levels globally despite what we read in the the sensationalist headlines of the past few months although some labour market tightness may see a slight pick up over the shorter term. Global markets Italy has a new Prime Minister, Guiseppe Conte, who leads a coalition government of the Movement Five Star (M5S) and League. This has created significant movement and volatility in Italian debt (it has gone from being the best to the worst performer over the course of the month) and equity markets as a result of the populist nature of both of these parties. Some of the parties more radical proposals of the past such as a referendum on the Euro were dropped in the lead up to the elections as a result of the economic recovery in Italy. The new government will focus on tax reform, a socialist minimum income for Italy's poorest households as well as a tougher stance on immigration and a revival of infrastructure projects. The new government will however cause feathers to be ruffled in Brussels which ultimately will have no lasting impact on markets. Overall momentum in the European economy has moderated, labour markets have remained strong with unemployment at 8.5%. Manufacturing PMI declined for the 5th straight month but still equates to 2% growth rate. Core inflation of 1.1% is still well below the ECB’s target of 2% which will keep the bank in an accommodative stance for a while to come. The ongoing US trade wars and the disastrous G7 meeting last week will take a back seat to this weeks #TrumpKimSummit, we will wait to see what comes of this. I am pretty sure there will be fireworks but ultimately there will be a deal. We have seen US short term money market conditions ease recently and longer yields have retreated slightly. The PMI in the US showed the economy accelerating into the second quarter while consumer confidence is still close to February's 17 year high. The first quarter saw record profits, with the S&P 500 earnings per share growth of 24% year-over-year and revenue growth over 8% year-over-year. Profit margins improved to a new record of 11%, with over three quarters of companies beating earnings expectations. U.S. corporates are well on track to meet the consensus 20% earnings growth for this calendar year. The key risk of a more aggressive Fed abated in May, a quarter point hike is almost a certainty this month and we are likely to get at least one further hike during the balance of 2018. Despite the technology stock melt down in February and March most of the FAANGS are back at highs and a concern is whether the prices of these technology companies are sustainable. As can be seen in the chart above the price of Facebook is up over 700% in the last 5 years. Across the sector the gains have been spectacular and semiconductor businesses have been enjoying supersized gains as well. While we are not calling an end to the cycle our preference at a global level is with the more value oriented companies which have under-performed in the past three years. It is time for the trend to reverse and for value to move back to the forefront once again. Across portfolios we favour value over growth in both Australian small caps and global equities. We favour private lending solutions to gain exposure to fixed income as opposed to government or corporate bonds. Finally we continue to be highly selective when looking at property assets but find assets are still being highly contested. We will remain patient. As we stated at the start of the year, it is important to keep portfolios well diversified to help reduce risk levels.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed