|

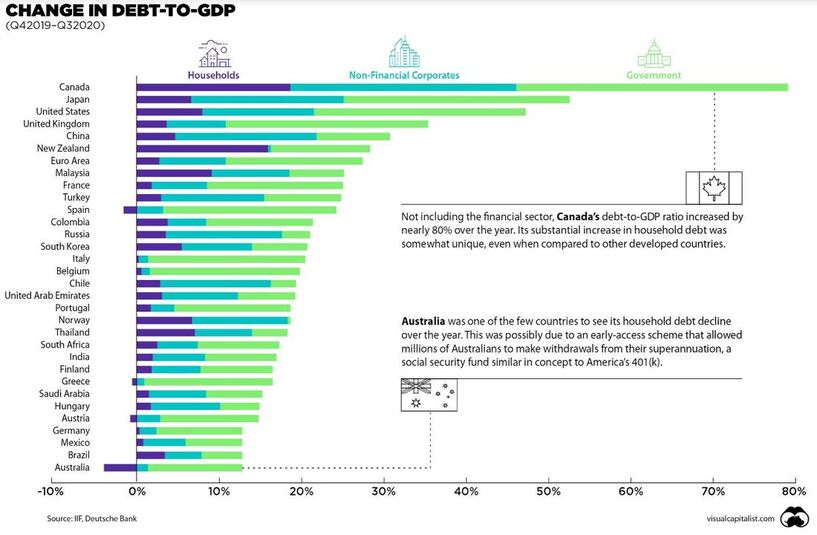

Here we are, February of 2021 and it has been an interesting start to the year. For those of you that have read previous articles, you know I have been one of those outliers that has been predicting inflation and the tremendous risks posed by the bond market for a good 18-months. So, in keeping with that theme, I shall try and grapple with the interesting trading action so far. It started with a sell-off in treasuries, followed promptly by a sell-off in equities and precious metals with inflation jitters coming back into the equation.  Author: Sid Ruttala Author: Sid Ruttala How far we have come within the space of 12 months. Negative rates, negative energy prices to the polar opposite across everything from a resurgent oil price and a decade high in the price of Dr. Copper, a favourite inflation gauge for market participants. Add in a $1.9tn USD stimulus package and we have a seemingly perfect storm lined up. But hang on a minute, how have inflation fears catalysed a sell-off in gold? Isn’t it meant to be a hedge? And why are energy prices so resurgent despite a considerable segment of the planet still in lockdown? Moreover, the yields at the long-end of the curve that’s on everybody’s minds are at a stellar 1.37% on US 10-years, I don’t know about the readership, that doesn’t sound like a particularly attractive prospect to me. This is especially the case when official targets for inflation are around 2% (depending on country), you’re effectively telling me I should lend you money and you will pay back less than what I gave you 10-years from now? So let us try and unpack that for a moment. Do treasury yields actually mean what they used to? Let me give you a couple of simple statistics. 365%. That is the estimate of the global debt-to-GDP ratio to finish 2020. 106%. That was the public debt-to-GDP ratio in the US to end 2019. It is now closer to 130% (and likely to continue to grow disproportionately given the packages and budgetary measures currently under review on the Hill). Think through this for a moment, what does even a 10 basis point increase in yield on the long-end imply in terms of debt servicing? More importantly, is any central bank likely to stomach that increase? We have already seen Christine Lagarde of the ECB make a statement mentioning that they will be closely monitoring yields on the long-end. Stateside, Powell might very well be in a similar situation. This is not the same as the days of Volcker where debt-to-GDP ratios were a more manageable 70-80%. The tax base is not enough across most of the western world to support increases to debt-servicing requirements. The ruling out of yield curve control Stateside will, in my view, go the same direction as Lowe’s ruling out of QE in Australia back at the beginning of last year. Simply put, yields will continue to rise as the market continues to factor in the potential for greater issuance of public debt and a resurgent economy. Where they might get it wrong, and what investors are seemingly ignoring, is a central banker caught between a rock and a hard place. There will be suppression of yields and government debt will be issued on the long-end. A scenario that increases the likelihood of inflation and yield suppression if within a reasonable range. The government will issue, the central bank will buy, thus creating more money supply. Yes, I’ve just said it, debt monetisation. In fact, since the beginning of covid-19 the Federal Reserve has bought close $3.5tn in bonds in 2020 alone, the Bank of England allowed an overdraft of the government account and Australia has seen its central bank buy government securities, though on the shorter end of the curve, to put a lid on the yields.  Why inflation now? It was during the depths of the GFC that central banks embarked upon then unconventional policy in the form of quantitative easing (after a certain amount of time, unconventional becomes conventional). Many doomsayers suggested that this might give rise to runaway inflation. It didn’t. Because they forgot one thing, increasing bank reserves doesn’t necessarily translate into the real economy, it just shows up in asset valuations rather than consumer discretionary spending. However, where things change and the real economy gets impacted directly is direct stimulus measures. Take, for example, the stimulus cheques now under consideration. That is new money supply into the economy. Similarly, infrastructure projects that add to GDP but also contribute actual jobs. This comes along at the same time as increasingly frosty relationships between the major geopolitical powers of the day. I am of the view that technology wasn’t entirely the reason for the deflation of the past, rather the greatest deflationary event of the past two decades was China, which not only enabled cheaper production but stagnant wage growth across most of the western world. Something that, somewhat ironically, was good for the investor, may not have been the case for the average wage earner but, lets face it, we’ve done well out of it. This situation of globalised supply chains led to things like Just-in-Time inventory systems, centralisation of healthcare systems, lowest cost production. All seemingly good things but what it also does is underinvestment in those very things as the costs continue to be driven down. What happens when bottlenecks are introduced out of the blue, tough? A bottleneck like an economic lockdown due to a pandemic perhaps? Re-localisation of supply chains because of a shift in geopolitical priorities/government policy? Last week I wrote about the shortage in semiconductors within the automotive segment. We are seeing similar things in commodities, such as copper, which saw massive underinvestment for close to a decade due to uneconomic prices. But what happens if you add in potential for infrastructure projects, like renewables, while at the same time lacking an existing supply pipeline to deal with the increase? Is it any wonder that the Chinese have been the most aggressive buyers within that particular market? So what am I trying to say? I remain exceptionally bearish on global treasuries and USD overall. What we have seen through much of the year so far are short-term pivots. Precious metals are not selling off because the yields make such an attractive proposition, it is rather investors taking cash off the table after a run-up in the market to move towards re-allocation. If you sell-off your treasuries, the process is first to cash before you make a further allocation (thus putting a short-term upward pressure on the currency). In circular trajectory, once that happens and the yield goes up even slightly, it is the high-growth stocks (precisely those that have done well during Covid) but stand on premium valuations that get sold off (all of a sudden you can use a discount rate). Similarly, a short-term spike in the USD leads to a short-term sell-off in Gold due to the inverse correlation. I remain of the conviction that we will see inflation coming back into the picture but not yet and yields certainly will not be going up in proportion. This is not necessarily a bad thing for the investor. It should only be concerning if said picture gets out of hand. We will continue to see accommodative monetary policy that drives markets but with the caveat that some of the higher-growth names you are used to might not see the same returns. More importantly, as fiscal expansion continues across most of the developed world, we will see every indicator of broad money supply increase and ridiculous valuations across anything that has scarcity value (even Bitcoin, though this author doesn’t quite understand that particular market). What has been interesting to watch is the money flow towards pockets such as the Dow, industrials and emerging/Asian markets.  How to allocate? In every economic expansion cycle over the past two centuries, inflation doesn’t hurt in the initial stages. As governments continue to occupy a greater proportion of GDP, we will see two things happen, household debt will proportionally decrease (i.e. crowding out) and corporate debt remains somewhat manageable (take a large firm such as Berkshire, for example, which issued debt at 105bps in 2020) as you effectively eat away the real value of the debt. We might quite literally have the Roaring Twenties roar back to life. Remember that your portfolio should have three different pockets; the contrarian, income/defensive and a growth pocket. These react in different ways depending on the situation. Your defensives won’t do well in a bull market but that’s how they’re supposed to behave, precious metals fall in this category too (it doesn’t yield anything and it has no intrinsic value but it is an evergreen hedge against uncertainty, not inflation but uncertainty). Your growth will be healthcare and technology with the caveat of long secular growth stories, not the hype of the day, but SECULAR. Think about artificial intelligence, mobility or emerging markets. The third pocket, the contrarian, is the one that is an allocation assuming you have everything wrong (i.e. not contrarian to the market but contrary to your base case). Again for Australian investors, strap your belts, we are the beginning of a bull cycle in commodities. Disclaimer: The Roaring Twenties (a name coined by Fitzgerald) weren’t “roaring” for everyone, with the most common job in the US being farming/agriculture. Harding was exceptionally kind to the investor, much like one recent ex-President, and the economy had deflation as opposed to inflation. In the words of Twain, “History doesn't repeat itself, but it often rhymes.” Conclusion? The music is still playing for now, it might even get louder. Dance while you can. This is definitely worth thinking about at some point but it shouldn’t affect your investing decisions just yet. And now a non-exhaustive list of other things life is too short to worry about:

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed