|

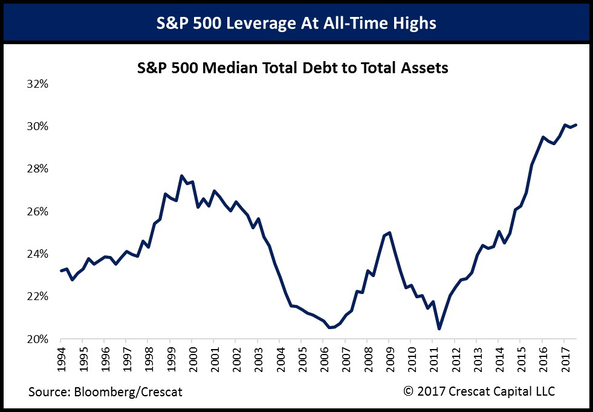

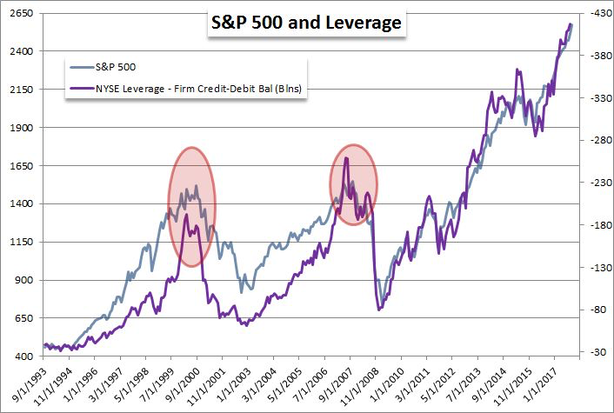

Last week we wrote about asset allocation for the coming year (2020) on a holistic basis. This week we would like to build on that topic and examine the context that surrounds equities headed into the new decade. Context that puts Australian investors in a uniquely advantageous position. The first part of this, and possibly the most important, being central bank policy and the second being the potential for a gradual move towards a trade deal between the two largest economies in the world. Central Bank Policy Perhaps one of the clearest outcomes of recent monetary policy is the premium valuations we have been seeing across equities, with the possible exception of the Eurozone (where this has shown up in bond valuations). This is prevalent not only in the developed world but also across emerging markets, with the RBI (Reserve Bank of India) and PBOC (People's Bank of China) being the forerunners in this instance. Domestically, this has been seen most recently in the RBA’s lowering of interest rates with further scope for two more cuts through Q1 of next year. At this point there is a possibility of unconventional (maybe less so now) tools coming into play. One thing we are seeing more and more is that, from their traditional mandates of inflation targeting, monetary policy is being used for purposes beyond such a remit and edging towards GDP targeting in the absence of clear fiscal policy. More concerning has been the increasing tendency of markets globally to acclimate to at least a perception of a central bank put. Past actions from central banks have tipped investor sentiment to be bullish on risk assets with the expectation now that any sell-off will undoubtedly be mitigated by monetary intervention. This is perhaps a self-fulfilling prophecy in that, as we have previously elaborated, asset valuations have a greater impact on the real economy on the downside than on the upside (i.e. the correlation is only significant in the event of a sell-off where GDP growth might be impacted when there is a market sell-off but the same is not true on the upside). This makes it increasingly unlikely that monetary policy will revert back to any semblance of historical normality in the near future (we are referring to the next five years). From an investment standpoint, this creates an interesting environment for equities investors. For one, we can be certain that that there is intrinsic motivation on the part of the Fed to at the very least to maintain a certain level in terms of valuations, that much was made abundantly clear during the Q4 2018 sell-off. That being said, in that particular instance the fundamental issue was credit spreads but in this environment of corporate balance sheets blowing out (in terms of leverage), the outcome remains the same. A goal of ensuring that credit spreads stay within a certain benchmark is effectively the same as an underlying impetus or put for equity markets. Running through the numbers, one notices that a trend has been appearing; the outperformers on a rolling 24-month period, in terms of overall returns, have been the ones with a higher debt to book ratio. On an intuitive basis, this should make sense. If the cost of capital is increasingly zero bound, then hypothetically the metric to take into consideration is a return on equity which increases in a positive correlation to leverage. While we are by no means suggesting that it makes sense now to invest in effective zombies with lazy or dangerous balance sheets, one can easily see why it does not make sense to stay away from equities for the foreseeable future. At the very least it could easily be argued that valuations would track sideways for an extended period of time, in essence public risk and private profit is the argument of the day.

Another outcome of these unconventional policy tools is also the long-term attractiveness of precious metals which at the very least act as a hedge in the continued lowering of rates. What will be interesting is Gold’s ability to break through the US $1500 resistance level and its ability to stay there, at which point it will have its day in the sun. Trade War We have written previously about the likely conclusion of the trade war and the fact that any initial deal would be the first in a series that would be limited, at least in the initial stages, to public stage-shows. In the lead up to elections and a previously unseen level of animosity between the stakeholders in the political spectrum of the United States, especially in the lead up to the 2020 elections, it is unlikely that anything substantive is likely to be reached. As we have previously mentioned this is a game of individuals rather than rational statecraft. One of the clearest outcomes that we foresee is the gradual disentanglement of the supply chains between the two great nations of the US and China. This will mean necessary repercussions showing up in the EBITDA margins of both the S&P and the Chinese corporates. However, one of the often overlooked issues is that of currency. The United States’ recent propensity to introduce tariffs is curtailed by its almost immediate impact upon the valuation on the USD/CNY pair, where the currency fluctuations are immediately absorbed by a relative currency devaluation. However, as we have previously suggested, the US government is perhaps a little late to the game when it comes to accusations of currency manipulation against the Chinese state since they have left this behind and are in fact incentivised to maintain currency to the upside at this stage (at least within a band or range). For the Chinese government it is a question of maintaining a certain level of credit growth in the domestic economy which, somewhat ironically, relies on the USD (given its status as the global reserve currency). What will be increasingly prominent over the coming years, in our humble opinion, will be the propensity of Chinese corporates to take increasingly large stakes in firms in South East and Central Asia in the search for the next growth markets. Unlike their Western counterparts, the move towards the de-industrialisation process will be undertaken in a much more schematic and coordinated manner. This will be key if they wish to overcome the middle-income trap. Essentially meaning that, as wage growth catches up in the domestic market, they will look to move up the value chain (as Japan did in the 70s & 80s) and increasingly look to outsource lower-value add and labor intensive processes towards countries such as, to name just a couple, Vietnam or Thailand . This is also, we believe, one of the key premises behind the OBOR policies. So what does this mean for Australian Investors? For one thing, we believe that this puts Australian investors in a uniquely advantageous position. The nature of AUD and its reliance on commodity prices makes Australian companies with exposures to China and South East Asia an interesting play. The currency also helps and acts as a natural hedge for international exposure that should allow us to gain access to growth markets across South East Asia that will take advantage of the recalibration of supply chains in the region. We are talking about companies like semiconductor manufacturers in Taiwan or Australian companies with US market exposures that are not in any way affected due to trade tantrums.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed