|

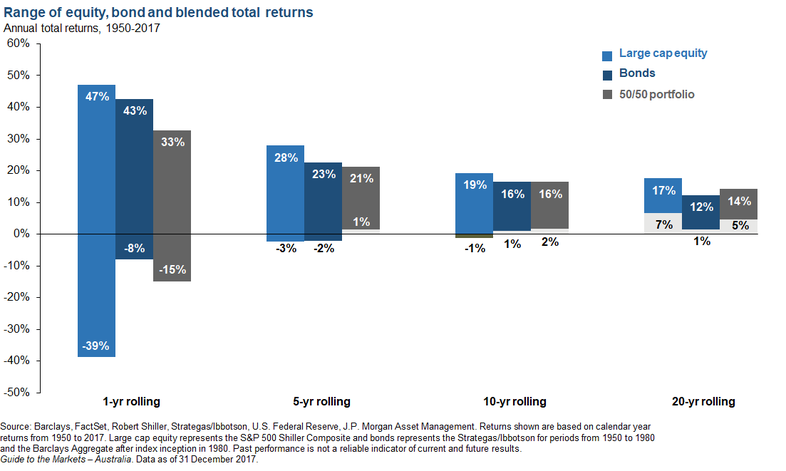

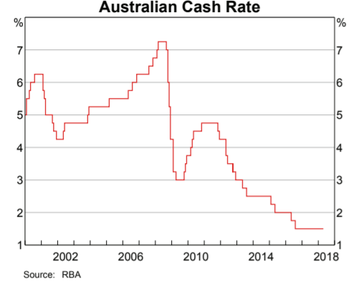

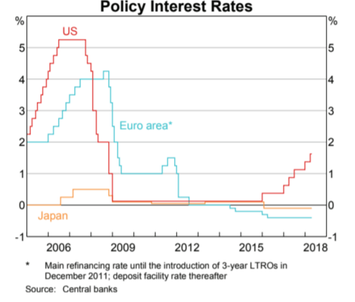

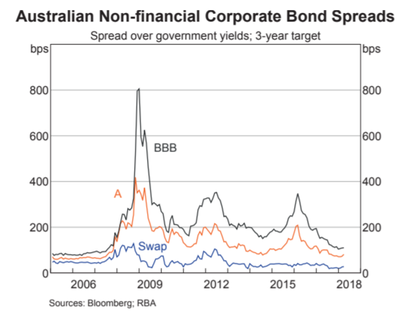

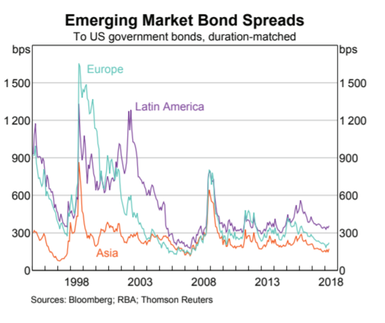

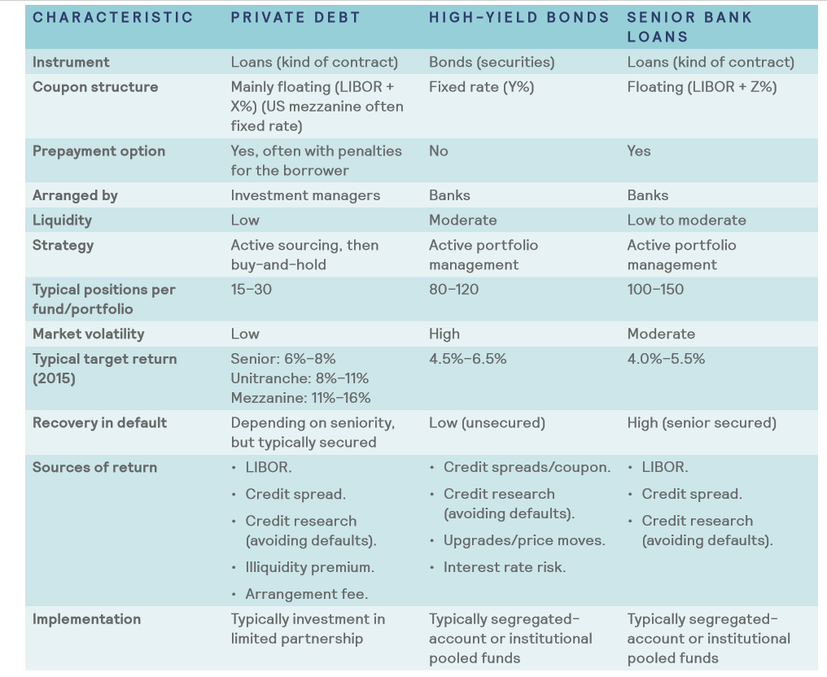

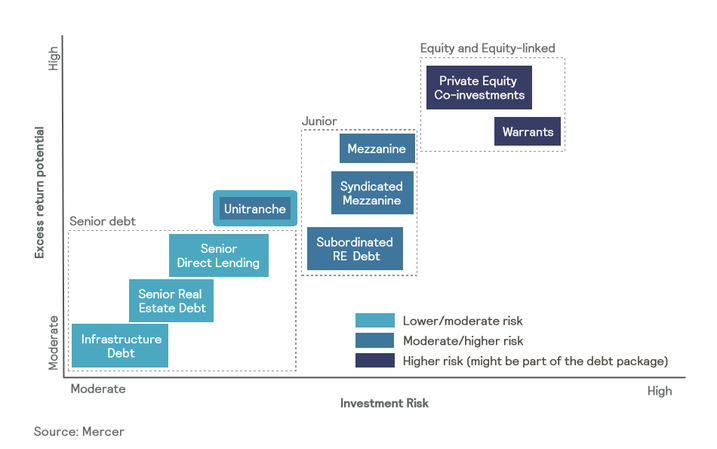

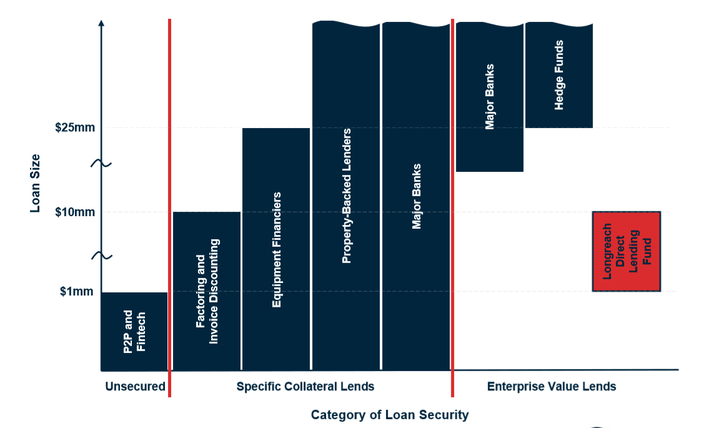

TAMIM Director Darren Katz takes a look at the fixed income space. In today's low interest environment our traditional views on asset allocation and how to achieve diversification are being tested. We take a look at private debt, once the preserve of the ultra wealthy and big institutions, fortunately we are now able to access this unique asset class. We have all been educated that our portfolios need to be diversified to help us to reduce investment risk. The typical diversification mechanism for equity portfolios is to include fixed income into the mix and the old adage has been that you should have the same weighting to fixed income as your age. So if you are 65 years old you should have 65% of your portfolio in fixed income securities. As can be seen in the diagram above, the combination of equity and bonds into a 50/50 portfolio helps to reduce the variability of returns. Importantly, from 5 year rolling periods onwards it helps our portfolios to stay in positive territory. This strategy was all well and good 20 years ago but today we have two issues, namely that we are all living longer and interest rates are as low as they have been in a long time as you can see below. In Australia, which is at odds with what we are seeing in the US, interest rates will remain lower for longer due to the heavily indebted nature of Australian households. Australia currently has the second highest level of household debt in the world. The RBA realises that they will not be able to move rates up due to the risk to the already fragile Australian consumer. Given the view that over the long term we would like to have fixed income assets or their equivalent in our investment portfolios as they serve to reduce risk but the interest rates are too low, especially if we take inflation into account. How do we go about achieving this? At some point in the economic cycle it will make sense to us to be invested into government bonds again but for now we are concerned with a normalising global interest rate environment. We would also like to add corporate bonds to our portfolios but spreads between corporate and government bonds have compressed and you are not going to be well rewarded for the risk you are assuming by owning these debt instruments. The same applies to emerging market debt: The final issue is that banks have stepped back from certain segments of the lending market. This is because they are being forced to provision more for riskier loans. The debacle around the Royal Commission also means that any type of lending that will further harm their already damaged public image will no longer be undertaken. This all means one obvious area of the lending market becomes very appealing. The private debt or direct lending sector. So what is private debt? Private debt is similar to a loan in that it’s capital provided (as an investment) to an entity in exchange for interest (and possibly other payments) and the return of the original principal at a defined point in the future. The debt is typically secured and has various protections/covenants in place. The debt is also not widely held (hence private), and is customised to the borrower’s requirements, thus rendering it illiquid. Private debt investments have existed for a number of years, but were, for a long time, the preserve of a minority of investors, of which banks and the ultra wealthy were the most significant. Today, private debt is an asset class increasingly considered by a broad range of investors. Private debt can encompass corporate debt, real estate debt, infrastructure debt and some opportunistic credit strategies. For each form of debt, exposure can be via senior loans or subordinated/mezzanine loans. Issuers may be investment grade, but on the whole, the private debt market is sub-investment grade (we don't view this as an issue as lenders are typically able to take significant security against the loans) and similar in some regards to the syndicated/bank loan and high-yield markets, though typically with higher yields, additional return sources, and different market dynamics. Private debt offers several advantages over high yield (including floating rate, lower mark-to-market volatility) or senior bank loans (including higher returns, prepayment protection) and also often stronger covenants and better information/monitoring rights. This comes, however, at the price of lower liquidity, access via closed-ended funds, and the need for more resource-intensive implementation and monitoring processes. Globally the category is growing rapidly with compound growth of 33% since 2006 to stand at a level of approximately US$153bn in 2017. This figure is likely to be understated due to the difficulty in collecting accurate data around the amount of private lending done. A lot of the private debt deals are exactly as their name suggests private. While we view the asset class primarily from a return perspective it does tend to be defensive with lower volatility than most assets classes. There is a risk premium paid for the illiquid nature of the asset as well as the complexity of structuring the deals and, in Australia, it is largely under invested due to the difficulty in finding appropriately skilled teams to execute the strategy. The opportunity set in this space is huge with the banks concentrating largely on their residential mortgage lending. Private debt can be classified into a number of different subcategories. The three most common methods are by seniority in the capital structure (senior, subordinated, unitranche), the type of lending transaction (corporate, infrastructure, or real estate), and geography (North America, Europe, Asia/emerging markets). This allows the defining of expected target returns; although exceptions might apply for specialist/niche strategies. Private lending can be quite broad and covers different segments when looked at from a loan security perspective. As seen in the diagram above the categories are as follows: Unsecured - consumer or business loans which are generally smaller in size and where the lending is done against no security. This category tends to dominated by the banks historically but is now being disrupted by the peer to peer lending platforms. Factoring or Invoices - debtor finance is where a business sells its accounts receivable (invoices) to a third party (called a factor) at a discount. Security is against the cash flow of the invoice. Equipment Finance - loans made to businesses generally to allow for the purchase of equipment. Loans are normally secured against the assets purchased. Property backed lending - business or consumer loans backed against property. This is generally used for residential property purchases and is the domain of the big banks. More private loans are being made with property as security for other uses of the funding. This category can also included developement loans which are utilised for the purchase and developement of land into various real estate assets. While backed by property security these loans can carry a heavier level of risk due to the developement nature of the asset. Enterprise value lending - loans made against businesses or the cash flows of businesses. Occasionally these loans can also be secured by property as well or even personal guarantees from the owners of the business requiring the loan. Loans can vary from short term to relatively long and interest rates can be floating or fixed. Loan sizes can also vary from extremely small to significantly large. Returns will obviously increase with the risk levels taken but can also include origination fees and early repayment penalties. Risks of Investing in Private Debt As with any investment, there are risks associated with private debt. Private debt involves a range of risks that can vary widely depending on the category, the structure of a particular loan, and the asset manager’s experience in selecting less-risky deals. Credit risk is important considering that most private debt categories are below investment grade, although the risk of a credit event can be lower than yield spreads would suggest. Default and loss rates can vary widely depending on the category and deal structure. Some risks, such as illiquidity, may be less important to buy-and-hold investors. Private debt’s complexity and diversity can be off-putting and thorough due diligence in understanding specific risks in relation to investment objectives is recommended. In conclusion...

In an environment of low yields, extended equity bull markets, and where many assets (across equity and fixed income markets) remain volatile, less attractive and sensitive to market sentiment, we believe it is important to consider an allocation into a well constructed portfolio of private debt.

1 Comment

Mike Davis

29/6/2018 09:56:44 am

Hi Darren, good article and nice breakdown of the structure of the Private Debt market. Our experience at Causeway has definitely proved a number of your points in regard to returns achievable and the sectoral opportunities in the space. Cheers Mike

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed