|

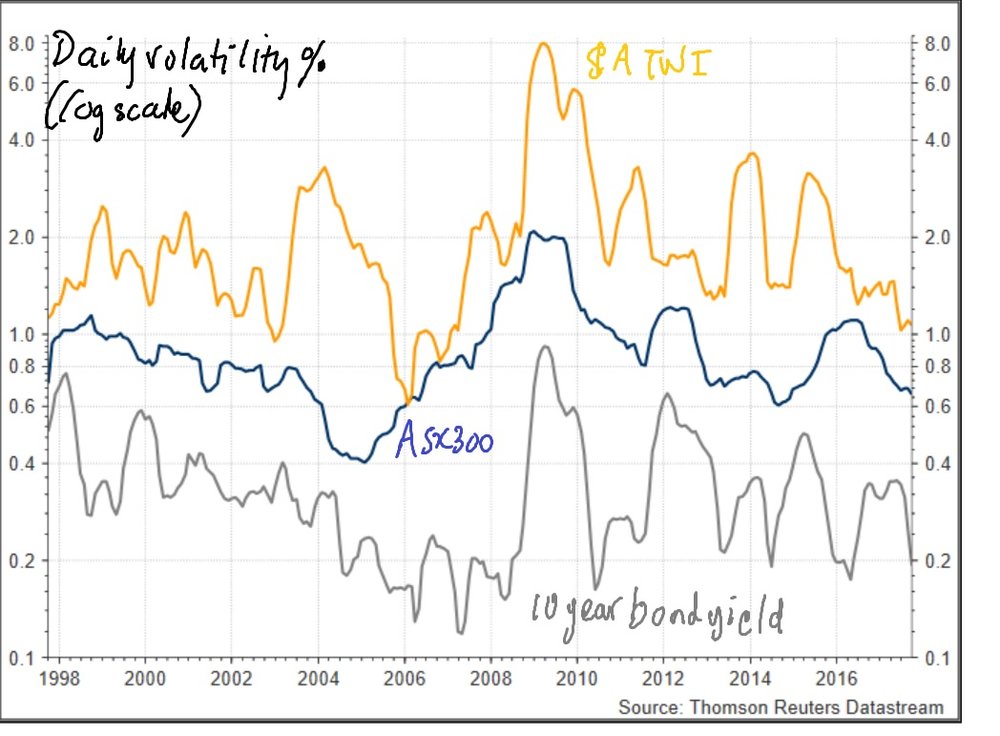

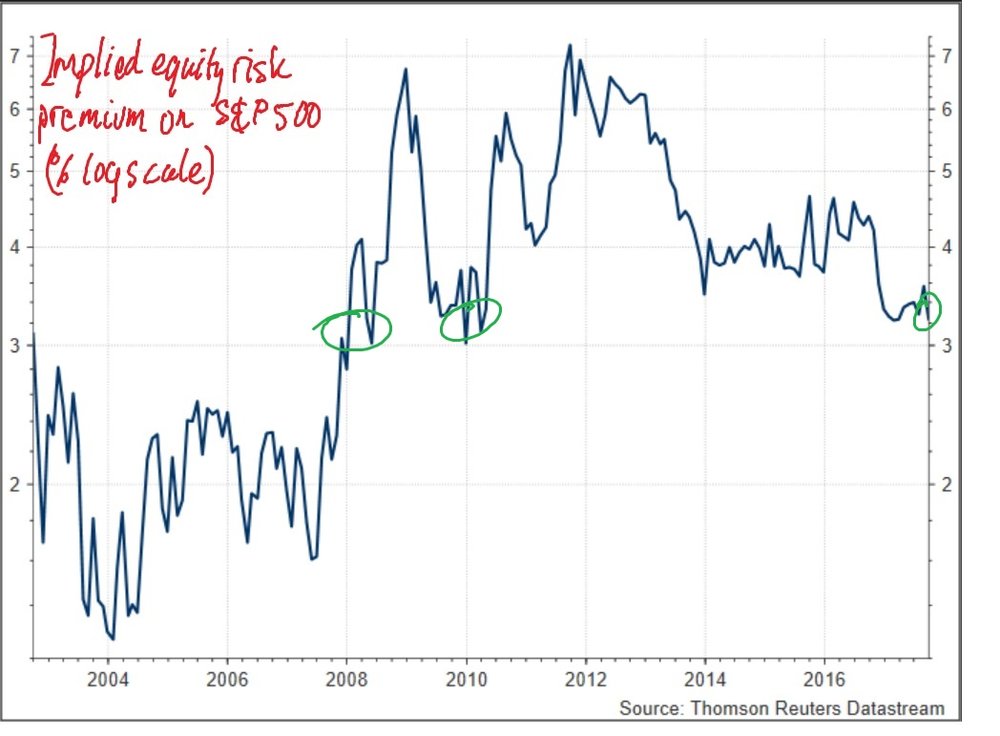

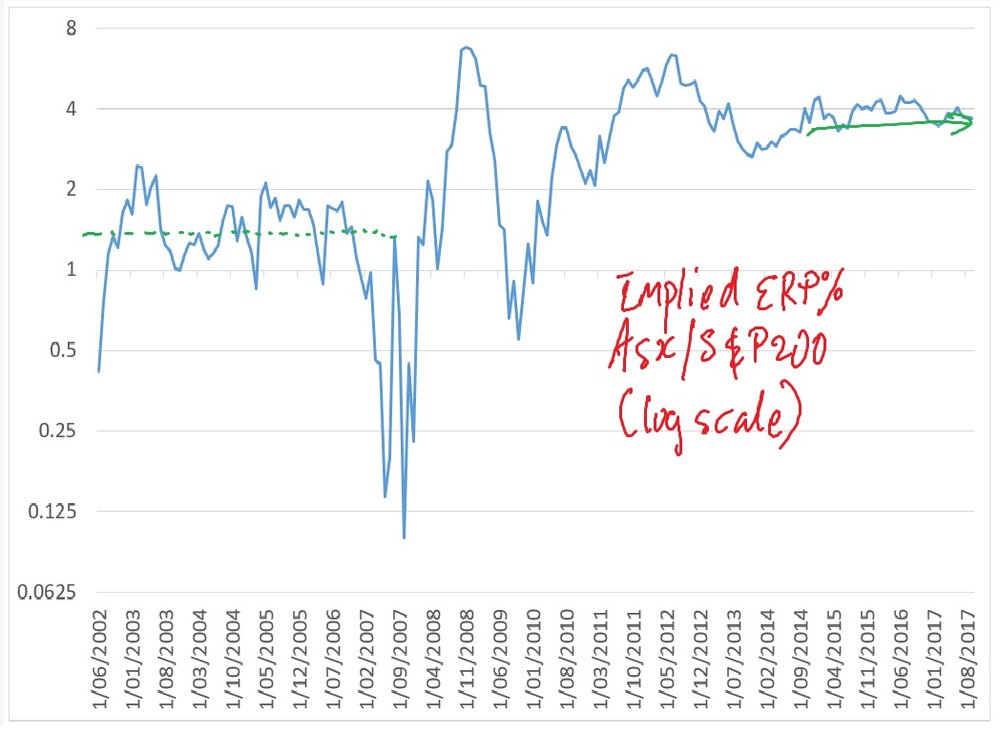

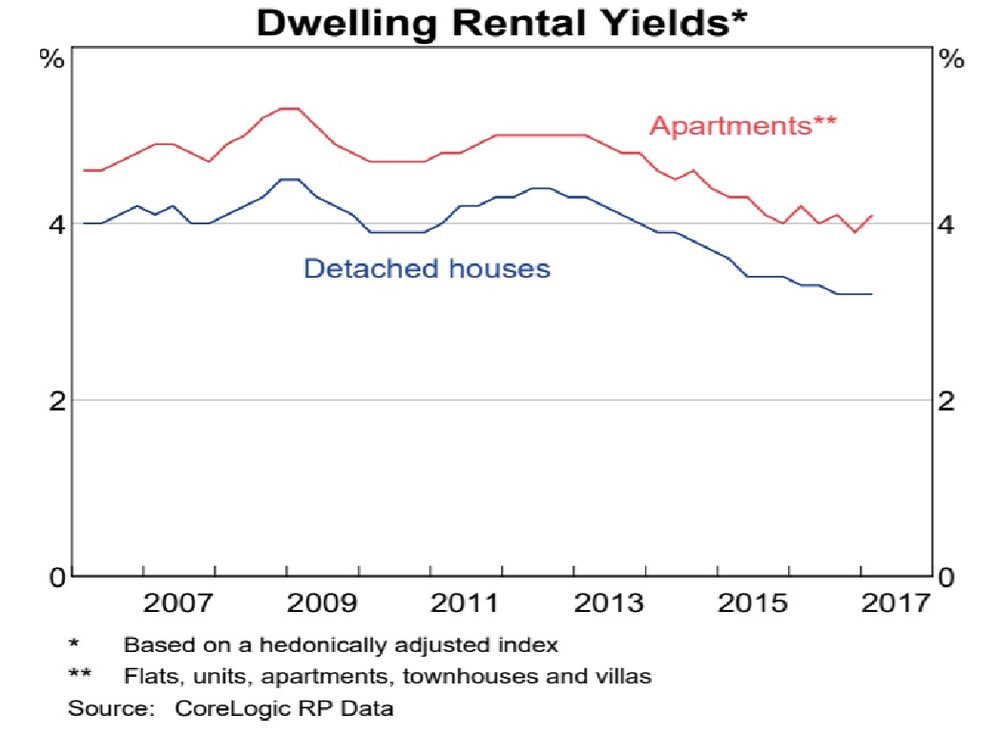

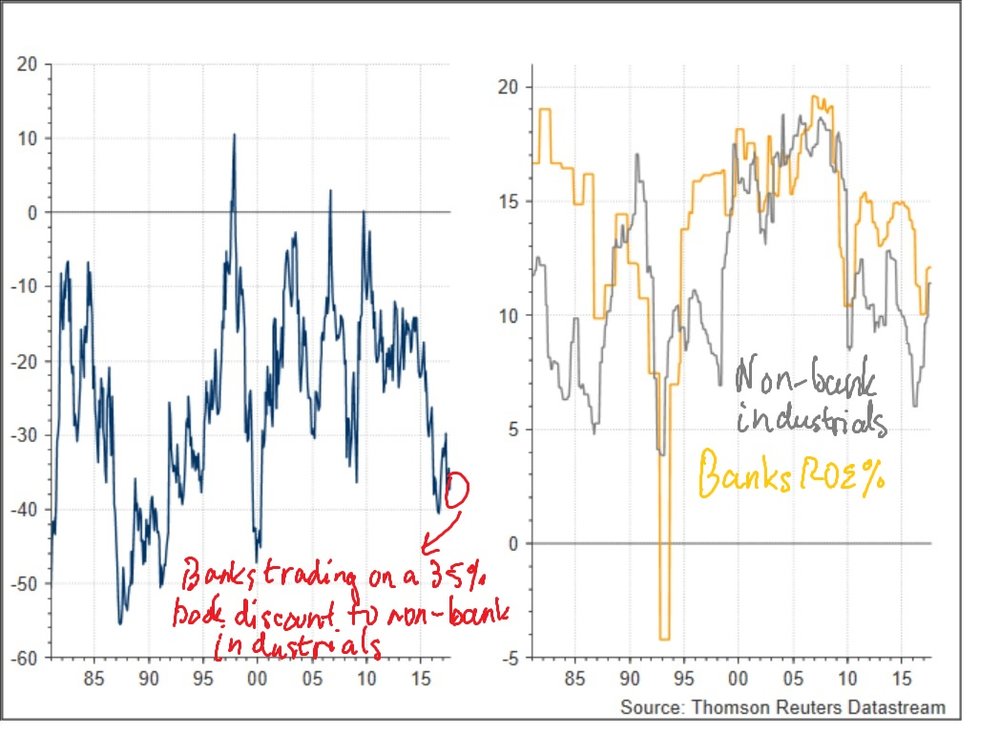

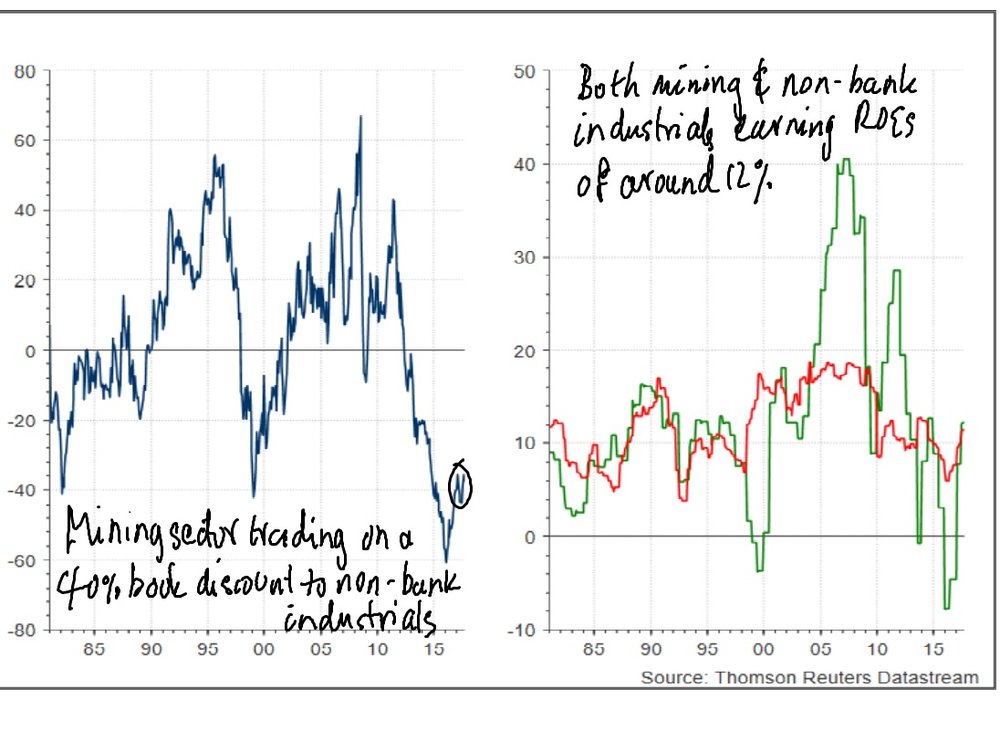

This week we present an article by friend of TAMIM Sam Ferraro as he examines the subdued volatility the Australian market has been experiencing. Market volatility conditions have remained subdued for some time. Daily return volatility of the Australian dollar Trade Weighted Index has dropped to its lowest level in a decade despite the recent appreciation of the Australian dollar against the US dollar. Volatility in the 10 year CGS yield has exhibited a regular cycle since the financial crisis, but the the peaks and troughs have tended to trend down. While stock market volatility is close to a decade low (see chart). Although not shown here, global macro volatility is not as benign in Australia. Although return volatility of the S&P500 is anchored to its lowest level in four decades, volatility of the US dollar has been rising and volatility of US Treasury 10 year yields is high by historical standards. So the persistently low level of stock market volatility in Australia probably reflects an exposure to a global volatility shock, while subdued volatility conditions in the TWI and Australian bond yields may have arisen thanks to domestic developments. The benign stock market volatility in the United States has coincided with a drop in the expected risk premium (ERP) to its lowest level since 2010 (see chart). Even at current levels, the ERP remains higher than the levels that prevailed during the credit boom. The implied volatility of index puts on the S&P500 also are low by the standards of the past decade (not shown here). Evidente has previously suggested that if the ERP in the United States continues to trend down, it would be expected to precipitate a revival in animal spirits and business investment, and ultimately sew the seeds of the demise of the profit boom. The Australian experience differs from that of the United States. Although stock market volatility conditions are subdued, the implied ERP has been broadly unchanged over the past five years (see chart). The ERP divergence between the United States and Australia might have contributed to the multiple expansion of the S&P500 to close to historical highs, while the ASX200 continues to trade in line with historical norms. Evidente believes that a renewed drop in the ERP is necessary to revive animal spirits in the corporate sector and kick-start growth of capital investment. One of the key macro risks in Australia remains the historically low rental yields in residential property. The gross yields on apartments and detached houses have dropped to 4% and around 3% respectively. Evidente has previously suggested that when net rental yields and the lift in lending rates for investors are taken into account, the economics for new property investors are becoming more tenuous. Investors appear to be alive to the risks associated with historically low rental yields, with the Australian bank sector currently trading on a 35% book discount to non-bank industrials (see left panel below). This represents the largest discount since 2000 and comparable in size to the discount that prevailed in the late 1980s and early 1990s. The size of the discount might also reflect negative sentiment surrounding what many consider to be bad bank behaviour. Higher capital requirements have probably played little role since the sector continues to post higher profitability - in terms of return on equity - than non bank industrials (see right panel below). Investors also seem to be alive to the risks associated with high and rising corporate debt in China, particularly in the construction sector. The metals & mining sector is trading on a book discount to non-bank industrials of around 35%, which remains low by historical standards (see left panel below). The size of the discount persists despite the fact that the profitability of the metals & mining sector has recovered from its recent trough and is now comparable to non-bank industrials (see right panel below). Against this backdrop, Evidente has re-balanced its thematic, high conviction model portfolio, which under-performed marginally in the September quarter and out-performed marginally in the twelve months to 30 September. Given the size of the sector discounts, the model portfolio retains an overweight in banks, and metals & miners, funded from an underweight in non-bank industrials. Despite some of the macro tail risks discussed in this post, Evidente believes that the risk-reward for these two sectors remains attractive for now. Evidente is an independent financial consulting firm managed by Sam Ferraro that delivers innovative financial advice to wholesale investors, including active long only funds, hedge funds, pension funds, and sovereign wealth funds, in Australia and globally. Drawing on academic research in asset pricing, behavioural finance and portfolio construction, Evidente provides wholesale investors with commercial solutions to stock selection and asset allocation decisions across equities and other asset classes.

Sam writes as a freelance journalist for The Age, Sydney Morning Herald and Australian Financial Review, was a member of the advisory board of API Capital, teaches business finance and international finance courses to undergraduates at RMIT, and most importantly Sam is a well respected source of information and friend of TAMIM.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed