|

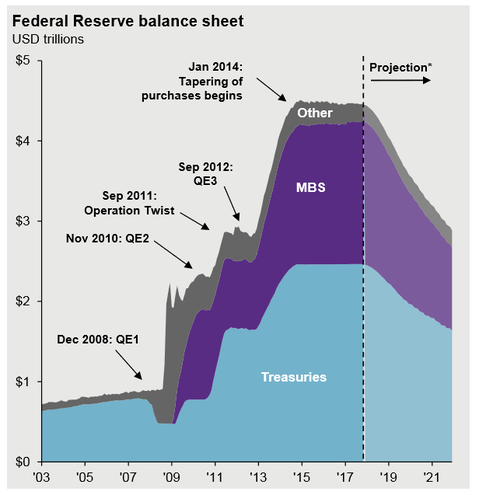

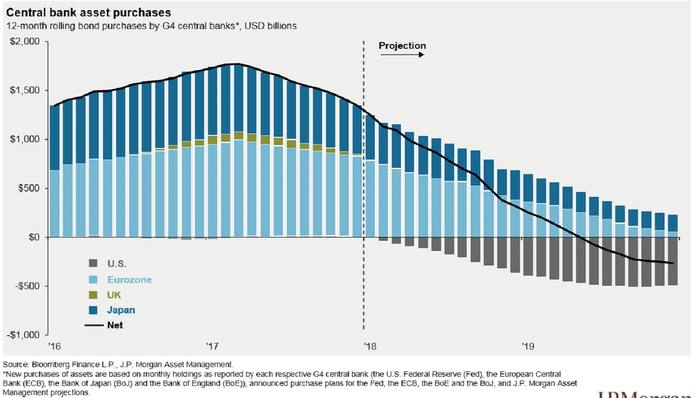

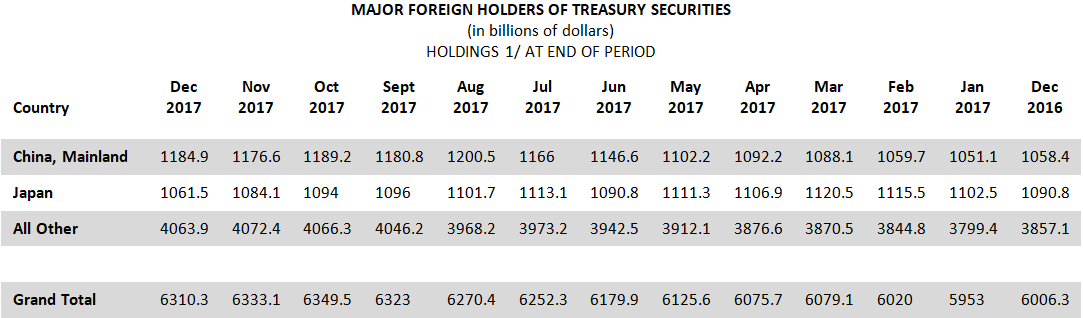

This week Darren Katz, TAMIM joint managing director, takes a look at what he believes to be one of the most troubling issues on the financial horizon. An issue that could have far reaching and grave consequences for the global economy, this is not something to ignore. February has been a stark reminder to those who had forgotten what volatility was, January on the other hand was a much quieter month. Global equities continued their strong run in the first month of the new year, led by Asia and the USA. Australian equity markets disappointed in the context of the continued global equity melt up. So what happened in February? The beast - inflation - reared its (ugly?) head in the form of possible wage inflation. This triggered a sharp rise in the US 10 year bond rate, towards 3%, and a sharp increase in volatility. Interestingly, or perhaps painfully, the sharp increase in volatility was triggered by leveraged selling into equity markets driven primarily by inverse VIX (volatility) ETF’s. Imagine that… Investment banks selling leveraged exposure to volatility which was at or near multi period lows. I guess we just don’t learn, when you are offered a deal that is too good to be true and you can’t explain what it is to your mother, then RUN! So does that mean we should hide under the bed for the rest of 2018? Definitely not, the economic environment is strong globally and this is still a good environment to be invested. We should however take some time out to understand the storm clouds that are forming on the horizon. This refers to the massive amount of US debt and the impact this will have on the global economy in 2019 and beyond. Let us take a good look at what is happening with US interest rates and more specifically the 10 year US bond rate. The yield of a bond, as you would no doubt remember, moves inversely to the price of the bond. So when yields go up, that means the price of the bond is going down. The yield/price of a bond is determined through the economic forces of supply and demand. Supply relates to the issuance of additional US government debt in the form of bonds. Demand relates to the need from buyers to purchase this government debt. Supply The supply of US debt is about to explode. US Debt levels currently exceed $20.7 trillion and that does not include, state, local or agency debt. It also does not include the unfunded liabilities of social security and medicare. In 2017 the US Federal deficit was $667bn and this is estimated to be up to $877bn for 2018. For those of you who are interested in these numbers please check out this site for all the figures. In February congress passed bills mandating the spend of $300bn on military and domestic programs over the next two years. Additionally, the Trump tax cuts will cost the nation $1.5tn over a 10 year period. Not to mention the mooted $1.5tn infrastructure spend. All this spending needs to be paid for and this will come from debt issuance to assist the shortfall in revenue collection from taxes. This year the US Treasury expects to issue $955bn of debt instruments and over $1tn per year in 2019 and 2020. This represents an 84% increase over 2017 when it borrowed $519bn. While this all sounds ugly, it still does not include the off balance sheet items such as social security and medicare. Rising interest rates will have a curious effect on this ever increasing debt mountain. The days of zero interest rates where the cost of servicing this debt was, rather conveniently, low or non existent are now over in the US. With the Fed predicting short rates at 2.25% by year end, the cost of financing the debt will increase significantly. Low rates were not the Feds only gift to Treasury, the Fed also purchased significant amounts of US debt. In 2007 the Fed balance sheet was $858bn rising to $4.5tn in 2017. This massive balance sheet expansion is now ending and actually reversing. Demand So onto the demand side of the discussion. As discussed above, over the last decade the Fed purchase of US Treasury securities (and mortgages) was significant. That is all about to end, as of October the Fed committed to actively reducing its balance sheet by selling treasuries and mortgages. In January 2018 it reduced its balance sheet by $18bn and it has committed to reducing by a further $420bn in 2018 and $600bn in 2019, this $1bn that the Fed needs to sell back to the market will cost the deficit an additional $20-$25bn per year in lost interest revenue. So to get the arithmetic straight, in 2018 the deficit will be $1.1tn, assuming an optimistic off budget deficit of $400bn and the Fed bond sales of $420bn, that means the Treasury is going to need to find buyers for close to $2tn of US Government debt in 2018. It is not clear that US investors, US pension plans and certainly the poorly funded state and local pensions will be able to purchase the additional government debt. China will continue to buy US Government debt but you can be sure that over time they will want to reduce their exposure. The once reliable OPEC buying is now less reliable as the US purchases seven million fewer barrels of oil a day resulting in less OPEC dollars to fund US debt purchases. US Government debt levels held by foreign purchasers increased from $1tn in 2001 to $6tn in 2013 but has largely moved sideways since that time. Should you wish to see this data in more depth, it can be found here.

Our final analysis of the supply and demand imbalance is simple the US debt addiction means that US interest rates will have to go up. Possible solutions to the addiction could be:

Our investment position remains the same for 2018, remain invested as the economic fundamentals are still strong. Do make sure that your equity exposure is more liquid and make sure your portfolios are diversified. Do not look for your diversification in US bonds.

1 Comment

Robert Bouwer

22/2/2018 09:06:32 pm

It all seems crazy! Is this really normal and manageable?

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed