|

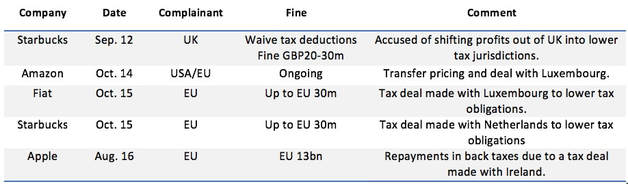

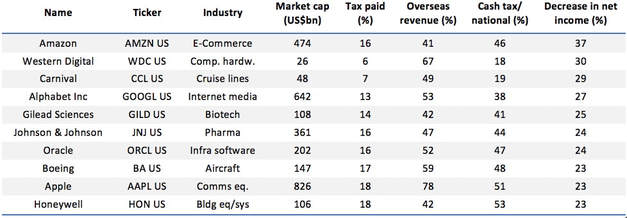

This week Robert Swift and Roger McIntosh, of the TAMIM Global Equity High Conviction IMA, take a look at the tricky subject of creative accounting and how it must be factored into your stock analysis. Quantitative stock selection models such as our VMQ assessment, provide a sound and proven framework for identifying attractive and unattractive stocks. However, quantitative signals that are based on financial statement information can fail to spot creative accounting techniques which may fool the signal and give false comfort. Consequently, we perform complementary ‘fundamental’ research based on Accounting, Strategic and Governance perspectives. These are as equally important as our quantitative signals. Although we dislike the term, some people call it a ‘quantamental’ approach to stock analysis and selection. It’s actually quite hard to use both sets of signals since most portfolio managers believe these two kinds assessment models are from competing philosophies. We believe they are complementary philosophies and wouldn’t invest without analysing both. One currently overlooked aspect of company profitability and its sustainability, is that of corporate taxation. Many companies know that EPS are the driving force behind share price growth and will consequently do all they can to boost that number. This can be done by creative accounting including tax avoidance, and simply by underinvesting in the business by reducing capital expenditure and thus depreciation charges. If a company has been systematically underpaying tax then it is quite likely, now more than ever, that its day of reckoning will come. We have been working with a forensic accounting service, Bucephalus Research in Hong Kong, to identify companies which are creatively avoiding tax (and performing other accounting shenanigans) and are concerned where this tax avoidance alone makes their shares look cheap. We believe in an era of greater scrutiny and cooperation on corporate behaviour, this is a risk to share prices which is underestimated. Our portfolios, we believe, have very limited exposure to companies with earnings boosted by this creative accounting. Where we do have exposure, such as Gilead, we try to ensure that we understand why. Tax is incurred and payable as part of a company’s regular business and can provide a good indication of the real level of cash earnings behind profits. Since cash pays the bills, cash earnings do matter. For most companies, their tax expense is close to their notional and national tax rate, but disparities do exist. This is typically due to the nature of cashflow within different industries. Tax expensed is not the same as tax paid. While there can be many reasons, these differences are typically short term and wash out quite quickly – this is normal and doesn’t bother us. For some companies however, even when adjustments are made to take these additional factors into account, discrepancies persist. These are the companies where investors should question why and how the company is more able to book non-taxable profits. Are other matters being hidden? Is the circumstance sustainable? The OECD, a body which seeks greater global cooperation and conformity, has established a Base Erosion and Profit Shifting (BEPS) programme in 2016. This was established in the wake of different profit shifting scandals, and aims to prevent jurisdiction shopping where companies move to declare profits in places of more favourable tax rates. The BEPS framework will make it harder for companies to maintain this situation and ultimately will lead to higher tax costs for certain businesses and industries. Tax is important for different reasons. Higher tax paid on profits reduces shareholder access to this via dividends. We are seeing some moves across different countries to reduce company tax rates to retain and grow business activity. Companies, particularly international entities, in different industries and regions can relocated cashflow to legitimately pay a different effective tax rate. Analysis of tax paid can also identify anomalies in financial statement information such as whether a company is applying creative accounting techniques to elements that form the input to quantitative valuation signals. It can identify whether a company is utilising debt manipulation techniques to provide a set of accounts that meet credit requirements and investor expectations, but glosses over reality. Robert Medd from Bucephalus recently identified Amazon as a company suspiciously paying little tax. This is in line with a recent article we wrote where we argued that this was just as anti-social as a company which was involved in high carbon emissions, and armaments manufacture. Yet this aspect of company behaviour is, not yet, remarked upon. So, the ESG advocate, who argues for shutting coal mines is quite happy to do so having bought their corporate wardrobe on line via Amazon! We have had a few provocative and animated discussions on this one. We recreate here Robert’s recent work on the USA companies most likely to be at risk of being “called to account”. Recent tax penalties:Companies that may be most affected by BEPS – NB Gilead! Certain companies and industries have greater ability to move cashflow to minimise the impact of tax on ongoing cashflow. The monitoring and enhancement of fundamental characteristics and oversight through company knowledge can help to ensure the strategy avoid investment based on aggressive or even misleading information

What this all means is that any investment process should maintain a robust fundamental oversight on all information that is available. This ensures that any stock is verified as truly attractive with all risks identified. As we state in our presentations – It’s Valuation Momentum Quality (VMQ) + Accounting Strategic Governance (ASG). Sources: ‘Tax matters: Creative accounting and tax laundering’, Robert Medd, Bucephalus Research Partnership, September 2017

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed