|

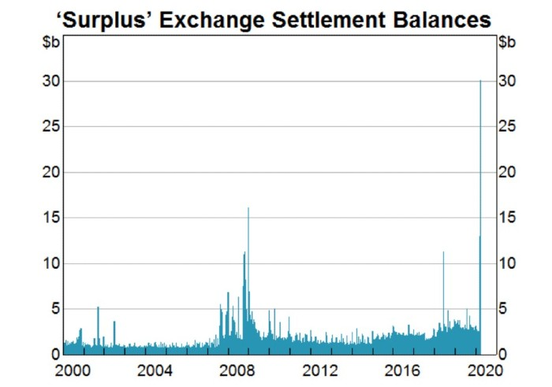

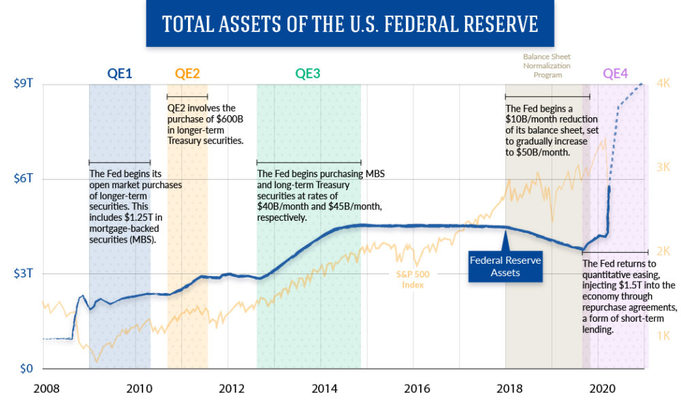

We seem to be saying it all the time but what a way to start the week, from the potential for a vaccine by Moderna which prompted a solid rally across risk assets to some rather optimistic rhetoric coming from the rainmaker-in-chief, the Fed chairman, Jerome Powell. We’ve also seen stimulus across both the fiscal and monetary side of the equations to a tune that is, to us at least, rather unprecedented in recent history. So where does this leave us? Is it time to be buying equities in the hopes of a v-shaped or w-shaped or u-shaped or any-other-shaped recovery that the pundits are calling or are we better off waiting? Rather than take a normative stance, we would like to take an opportunity to disentangle some of the facts from the noise, something that is much easier said than done.  Are we going to be cured/vaccinated? Firstly, the big news prompting the latest rally was the early-stage trial by Moderna that showed a strong immune response in eight healthy volunteers. This is not the only vaccine in the pipeline by the way, rather the first to be tested on humans. The other leading contenders to develope one include, but are not limited to, Pfizer and its German partner BioNTech, Chinese company CanSino and the University of Oxford in conjunction with AstraZeneca. That is not to say only one of the companies has to come up with a single vaccine or that it should be limited to that particular product. In fact, the best outcome may be the development of multiple vaccines that are then able to be distributed and commercialised on a global scale. A situation rather complicated by the political and logistical challenges involved. As the recent scandal between Macron and Sanofi has shown, this is going to be much more politically sensitive than one might expect. For those of you unaware, in this particular instance, the C-suite at Sanofi, headquartered in France, saw fit to release an announcement suggesting that since the majority of the funding for their R&D came from the US, then it follows that the US would have priority above all others in gaining early access and distribution rights. The French President, as you can imagine, didn’t take to this particular thought process and ‘’invited” the CEO for a meeting. Oh, to be a fly on the wall when that particular interaction takes place. So that brings us to a much more fundamental issue. Not only the development of a vaccine but also its commercialisation and distribution on an equitable basis. If Sanofi chose to take a stance that nations that back their R&D program have priority, then where does that leave poorer nations? Are we to believe that we will make a pecking order with regards to something as crucial and vital to the global economy? But that is still a ways away, we haven’t even reached the proper development of a vaccine as yet. The next stage of the process, even for Moderna, would be to increase the sample size with particular attention paid to how people with pre-existing health conditions might react. Something which, even optimistically, is at least three months off. After this optimistically short three month period, one would assume that it then needs to be produced in an economically scalable manner, something even the Trump administration with the liberal use of the DPA (Defense Production Act) couldn’t speed up to a fast enough pace. Our baseline scenario would be it taking at least six to twelve months after the development of the vaccine for it to be available to the general public. So, we are still eighteen or so months out, even optimistically, from things starting to turn “normal” again. Even then, the world would still need to be locked down somewhat seeing as many of the emerging economies, whether you’re talking South East Asia, Africa or Latin America, would still need to gain access to the vaccine and make it readily available to their people. This is something that would require significant help from global institutions such as the World Bank. Ultimately, it is too early to be able to make a call on if or when we will see a vaccine, if it will be in time or the impact it will have on markets. So, does this mean that the bounce is fake? In actuality? Again, too soon to tell. Assuming that central banks and governments around the world don't change the rules of the game on us all? No, within the current context there is a very good chance it is very real. From what we can see, the market sentiment is such that it is looking for a way to get back in the green. For one thing, low-interest rates globally, QE infinity and stimulus measures that weren’t seen even during the depths of the GFC are creating an environment where investors are being coaxed, and in a worst case scenario bullied, into risk assets. We’ve previously talked about the Federal Reserve's buying up of high-yield ETF’s through the creation of a special purpose vehicle. This suggests a global consensus amongst policy makers that markets must be held up at all costs. This scenario is markedly different from the past in the sense that there is a much more collectivised action by the fiscal and monetary arms; the Federal Reserve effectively underwrites the US Treasury and vice versa. In Australia, we haven’t got to that point but are slowly creeping towards that ultimate nirvana. After all, the RBA actively manages the yield on Australian sovereigns through open-market transactions to keep it below 0.25%.Though taking credit risk onto the balance sheet is a different game all-together, in Australia the RMBS (Residential Mortgage Backed Securities) buying is typically done by the AOFM (Australian Office of Financial Management) and not the RBA directly. However, ask yourself the question, if the Federal Reserve buys corporate debt, is it then undertaking the same function as a regular bank? Granted, there are intermediaries but that’s only a matter of optics. If a central bank undertakes the same functions as that of a regular bank and takes on credit risk, it becomes that ultimate too big to fail monopoly. For those of you that are history buffs, this isn’t new, go back and read about the First and Second Banks of the United States... So why does this matter? Put simply, it amplifies the disconnect between the actual economy and asset valuations. So, while the underlying economic metrics might look rather grim, if you take out some of the tail-risks by putting a floor on price action then it follows suit that markets will consistently seek any modicum of good news to track higher. To put it bluntly, one is no longer taking equities risk to get equities returns, rather the public purse effectively takes the risk and us investors happily walk away with the return. The Opportunities? When? We’ve previously mentioned that in normal cycles, the markets effectively front runs the business cycle (i.e. turn south before the real economy does and vice versa). However, in events such as these (exogenous events) it is the other way around. One would be required to see marked differences in the underlying economic indicators before gaining conviction in the markets. This does not however mean that we should sit in cash. In fact, it might be more logical to go in the opposite direction. Since we cannot pick the bottom (we might’ve been in it already or it might be yet to come), we can sequence in on a reasonable basis and buy companies at reasonable enough valuations with the expectation that there is a floor under the price action (through monetary shenanigans) and the potential to be in the markets when the economy does take a turn for the better. The two-word summary? Average in.  What? Going through this entire scenario has created opportunities and sped up certain long-term trends in areas like big data, technology, infrastructure (benefiting through fiscal stimulus) and health care. In the short-term, holdings in companies such as Kogan (currently held) and Baby Bunting (not held) have paid off but, over the long run, we have certainly seen companies such Data3 (previously held), Dicker Data (previously held), Megaport (currently held) and other companies within the network infrastructure space benefit. We shall continue to see this as a long-term trend. For those of us that look to dividends for income, looking at data companies in the same manner as REITS might not be such an irrational move these days. Not only do they have solid dividend yields but they can, more importantly, maintain double digit earnings and hence dividend growth over a sustained period of time. This is something we don’t see the financials in this country (or many of the property trusts) being able to continue to do. Or if you wish to go for actual infrastructure warehouses, take a look at EQUINIX (EQIX.NASDAQ, not held) as opposed to NextDC (currently held) seeing as it actually pays a dividend. In terms of infrastructure, the companies that one might think of immediately are things like Transurban or Sydney Airport (both currently held) but we need to get more creative. For example, one of the biggest holdings in our global equities portfolio has been China Lesso, a manufacturer of PVC pipes. Alternatively, think about Australian companies that could benefit from fiscal measures on a global scale, Fluence Corporation (not held) is one that has been increasingly popping up on our radar lately. Try and look for companies that have long tailwinds even if they aren’t as cheap as you might wish (they might never get there if central banks keep putting up a back-stop and pumping liquidity). Perhaps more importantly, look for low-levels of debt. This might seem a little counter-intuitive in a low interest rate environment but it has more to do with management discipline than it does incentives. Companies that run lean also tend to run rather mean. As we’ve always ranted, a high ROIC (return on invested capital) is the best long-term indicator of a great business.

2 Comments

22/5/2020 09:52:59 am

I often skip long winded commentary but your latest offering reflected my own thinking and we even hold much the same stocks. Focus on dividends however should be moderated when the possible loss of Seniors Health Card is considered. Capital gains can be halved and used as offsets to losses. Dividends cannot.Capital gains on NXT could be partly harvested without alarming tax worries. It always comes down to an individuals circumstances and not a blanket recommendation.

Reply

25/5/2020 10:10:55 pm

Thanks for your newsletter - very informative. You might like to look at https://www.wired.com/story/coronavirus-covid-19-antibody-treatment/ for a good explanation of antibody treatments for COVID-19. Also look at the Distributed Bio website. This company, founded by Dr Jake Glanville, and its spin-off, Centivax, have developed an antibody treatment that is currently being tested on animals and trials on humans could start within a few weeks. If these are successful a treatment could be available around September - a real game-changer with enormous potential impact on economic recoveries and share markets.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed