|

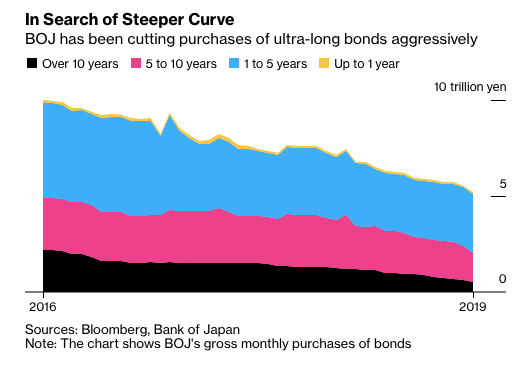

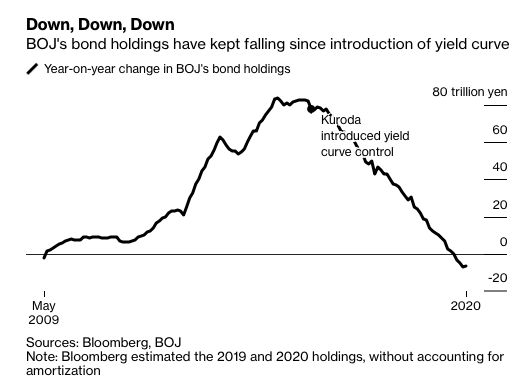

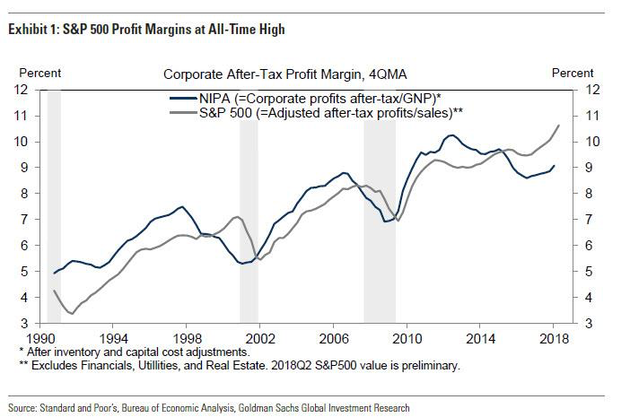

Last week in our article looking at the potential for an escalation in fiscal deficits we made a few calls, first that the S&P 500 would inch higher following more QE from the Federal Reserve and news flow out of China negotiations. This week we would like to follow this up with what we feel are some rather interesting developments in the seemingly bubble-like universe of central banks and their viewpoints. As well as some interesting stories around why we feel like there will be a reversion to the mean in terms of value versus the market all together through next year. Firstly, a story that is overlooked but should definitely be a bigger headline, the recent decisions made by the Bank of Japan. This is an era where their counterparts are going in the opposite direction, with the ECB continuing on its trajectory and bond buying program as well as the Federal Reserve led of course by the New York Fed trying to stabilise the repo markets, we see the opposite direction being taken in Japan. The BOJ has decided three decades on (and perhaps too late) that running up a balance sheet where 50% of government debt is owned by the BOJ and corporate bond buying doesn’t do all that much in terms of helping the real economy. The first major move off the back of this realisation was the introduction of the yield curve to the Japanese market and the notion of artificially steepening it by buying shorter dated (i.e. as opposed to longer dated bonds). For some explanation, think of it like this, the shorter dated bonds should reach expiry in a shorter space of time and should they even reach expiry on the balance sheet it would not be a problem (as we explained before central banks cannot go bankrupt like other banks, what a fun little perk!). Should there be hiccups in the future then they can re-expand it. What they seem to have figured out (rather late mind you) is that strangling the financial system via low interest rates and crowding out the debt markets isn’t all that good for either the functioning of the real economy or the expansion/inflation of credit. They might hold equity markets steady, which in Japan’s case has tracked sideways for over two decades, but it does nothing to actually revitalise the real economy. We actually see this as a positive and the search for bargains should factor in Japan since you might buy companies that have global opportunities and supply chain’s trading at Japanese prices. The ECB has unfortunately not seen fit to do the same and while the Federal Reserve did try in Q4 of 2018 we all saw how that played out. The problem is this, we have a fixation on the monetary side of the equation that asset valuations somehow magically feed through into the real economy. Yes, this is true to a certain extent but only on the downside. Higher equities valuations do not actually increase the propensity to spend. Think of it like this, you own an investment property, your propensity to spend doesn’t go up all that much because somehow you feel that your property is worth a lot more. That does not necessarily translate into income after all. Your propensity to spend increases when there is an increase in real income. As we have been saying constantly, the real caveat is wage growth. On the downside yes, it remains the case that your propensity to spend goes down substantially if you feel that you are worth a lot less than you were a year ago. So the low interest rates and monetary shenanigans are, we feel, a deal with the devil in the sense that there is no way out unless you take the pain. Another interesting outcome/phenomena of the markets and the current complex we have is illustrated in the below chart. This shows a differential between the S&P 500 corporate profit growth and that reported by the Bureau of Economic Analysis (BEA) in the US. Mind you this was an interesting thought process that we came across in an interview by Stephanie Pomboy, an exceptionally interesting woman who started her career working with the likes of George Soros (whether that is good or bad we shall leave that up to you). Basically to sum it up what we see is one reporting a substantially lower number over a consistent period of time while the S&P 500 (i.e. the index) reports higher. NIPA stands for the National Income of Product and Accounts, it is compiled on a quarterly basis by the Bureau of Economic Analysis when it compiles the GDP and underlying numbers of the United States economy. The last time we had this much of a differential, as you will notice, is in the late 1990’s during the dot com bubble. In theory such a differential should not exist, granted corporate profits include a lot more than the S&P 500 and companies do have an incentive to under-report profits for tax purposes. There should not however be an incentive for the opposite to be the case. So, why is the opposite happening now? We would argue that, rather than some blatant gaming of the system by corporates across the spectrum cooking the books, it comes down to what has actually been happening the markets as a result of share buybacks (and GAAP). The S&P 500 relies on earnings per share as the primary metric and so do a lot of analysts. It’s a simple equation. If earnings remain unaffected and you buy back shares thanks to lower interest rates (reducing the volume or number on market) then there will naturally be an increase in earnings per share.

So what does all this mean? As we have previously said, we expect central banks around the world to try and placate the markets in the short-run through lower interest rates and the monetary put on the downside (though we don’t disagree). But the propensity to partake in QE will, we hope, die out (though we think Australia, being one cycle behind the rest of the pack, might go down this route). We do see some gradual change, starting in Japan and their counterparts at the ECB realising that it is perhaps not all that great an idea to strangle the financial system to the point of oblivion or having pension fund managers going down the risk curve to sustain decent nominal yields without excessive risk being taken into the system. We will see the urging in the opposite direction, think Tweeter-in-Chief bullying his “independent” Fed governor into a reversal. We will see the central banks start to go in the opposite direction, at least quietly advising governments that perhaps it is not a good idea to reign in fiscal expenditure at a time of low interest rates (having contradictory impacts on the real economy). Imagine the ECB’s expansionary policy and the Germans trying to get everyone in the Eurozone to reign in deficits, including the Italians, the Spaniards and the rest of the pack. That is a more contradictory policy package than anything we have ever seen. Needless dislocations in asset markets and downward pressure on wages. We in Australia might also need to revisit our fixation with returning to surplus. Again, as we said, if the NSW government could finance its debt at 0.25% then it does not take much to beat that hurdle to make productive investments. In terms of the markets, we will see continued volatility globally. But when the tide does turn, we again reiterate our bearish view on bonds. Once the balance sheets of central banks do start to unravel (granted we have been waiting long enough), we will first see credit spreads widen (no share-buybacks) and debt-book ratios matter a lot more. Hence, we feel that there will be a reversion to the mean in terms of value and we are actually making the call, after ten years of the opposite being the case, now more than ever. In terms of geographies, the US (being an insulated economy) will continue to expand while the biggest opportunities will come across Asia, especially the southeast. The reason we say so now, and this has been said too often, is that despite the volatility given the less developed nature of these markets (capital markets wise) they have the one underlying weapon: a consumer with an expanding capacity and propensity to spend. Even incremental changes made by governments of the region in terms of creating shorter-term financial incentives or expanding the buying power should make substantial differences. Also, they are not encumbered by social security considerations or unfunded pension liabilities (at least on the same level as their western counterparts even if they did, inflation would effectively eat away the real values anyway).

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed