|

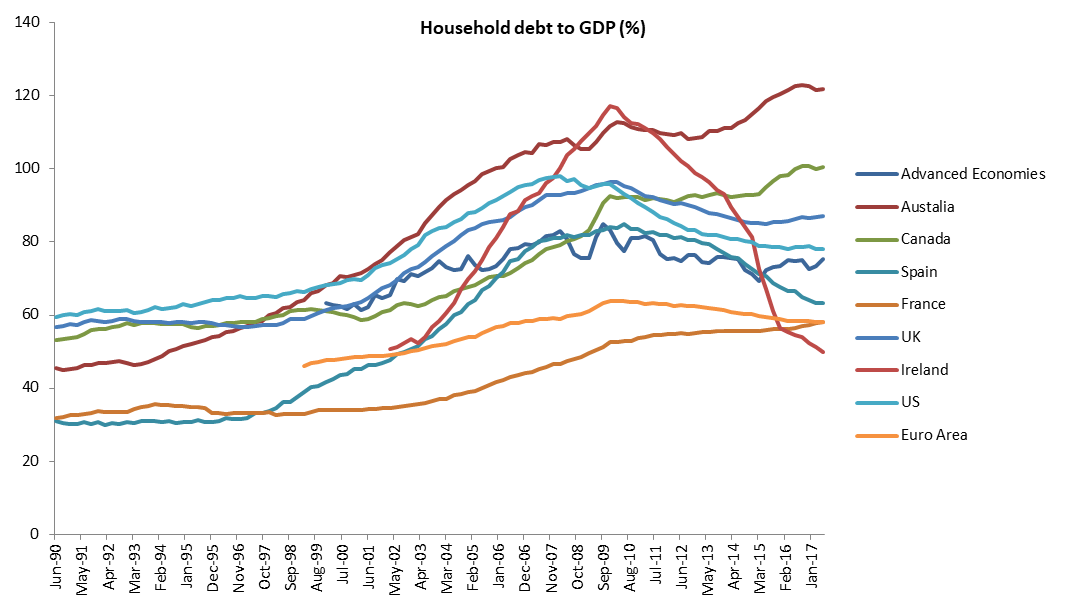

This week we present an article penned by Guy Carson for the April 2018 edition of the Australian Shareholders' Association's Equity magazine. This article was originally published in Equity, Vol. 32 #3, April 2018. For all asset markets whether they be shares, property or bonds, the next thirty years is likely to look very different than the last thirty. The last thirty years has seen asset prices benefit from “financialisation”, with changes made in the 1980s leading to a significant increase in the influence of the financial and most notably banking sector. The trigger that caused the Global Financial Crisis in 2008 may have been subprime mortgages written only a few years earlier but the seed was planted decades before. As Michael Lewis wrote in The Big Short, “There was an umbilical cord running from the belly of the exploded beast back to the financial 1980s. The crisis of 2008 had its roots not just in subprime loans made in 2005 but in ideas that hatched in 1985.” The changes that took place were twofold. Firstly, the 1980s saw a significant amount of deregulation for the financial sector and the beginning of the Basel capital requirements. This decade saw the beginning of a debt supercycle globally which imploded in many developed countries in 2007. Prior to 1980, the global standard for banks was a leverage ratio of 7x, this has changed dramatically since. Just prior to the Global Financial Crisis, leverage in the European Banking system stood at 40x, in the US it stood around 30x and in Australia it stood at over 20x. Australia joined the rest of the world in “gearing up”. Secondly, enabling this “gearing up” was the lowering of interest rates. Globally, interest rates peaked in the 1980s with 10 year US bond yields getting up to almost 16%. The lowering of interest rates over the following 35 year period gradually reduced debt serviceability levels leading to the ability to take on more debt. In Australia the RBA cash rate has fallen from 17.5% in 1990 to just 1.5% now. The result of the two factors above is a financial sector and a global economy significantly more leveraged than any time in history. Over recent decades, debt has risen at the household, corporate and government level. With high debt levels, economies become susceptible to small movements in interest rates. So with small rate rises, cracks start to appear in the financial system. Countries with high household debt levels are particularly vulnerable and Australia sits near the top of the pile. Since the GFC, the US and large parts of Europe (notably Spain, Ireland and the UK) have actually deleveraged at the household level. Australia on the other hand has continued to take on more debt, assisted by record low interest rates. Rate rises have begun globally, most notably by the Federal Reserve in the US. Since September last year, US 10 year bond yields have risen from 2.05% to above 2.80%. As a consequence, volatility has returned to global markets. Two of the casualties to date have been cryptocurrency holders (most notably those who bought in late last year) and those who were short volatility. Numerous exchange traded funds shorting the VIX were launched in recent years and have raised billions of dollars. These vehicles had performed exceptionally well and continued to attract more money, until in one day holders lost over 80% of their capital. Financial leverage is a great thing on the way up but can also be very destructive on the way down.

Events like this are similar to what started to happen in 2007 when suddenly credit markets such as Commercial Mortgage Backed Securities (CMBS) seized up. This ultimately led to the downfall of companies like Centro Property Group. It wasn’t until over a year later that we understood the full implications of what was happening. During the recent ASX reporting season, a few results have stood out to us as having warning signs of future stress. Two companies that we are keeping an eye on are Genworth Mortgage Insurance and Challenger, both of which offered soft results. Genworth is an insurer of high Loan to Value (LVR) mortgages. In recent times, the banking regulator APRA has reversed the long term trends with regards to capital rules and has started to apply more regulation on the banks. One of the effects of this increased regulation is that significantly less high LVR loans are being written. Less high LVR loans means less business for Genworth and sure enough they saw their Gross Written Premium fall 3.4% and their Net Earned Premium fall 18.2% over the last year. At the same time, their loss ratio climbed on the back of rising defaults in Western Australia. A slowing top line with increased claims is a terrible combination for an insurer. Challenger has been a real success story in recent times and has transformed into the largest seller of annuities in the Australian market. Annuities guarantee the underlying investor a fixed payment every year. In order to provide the payment, Challenger takes the capital and invests it in a variety of assets. It is Challenger that takes the underlying risk on those investments. When asset markets perform well, Challenger books the additional profit but when asset prices reverse, Challenger wears the losses. The company reports both statutory and underlying net profit after tax. The underlying strips out the impact of movements in the investment book therefore we suggest investors focus on the statutory. In the last half, investment returns in their infrastructure as well as their equity book reduced profit and given recent movements in bond yields and credit spreads, we would expect at this early stage that the losses in the 2nd half will be more substantial.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed