|

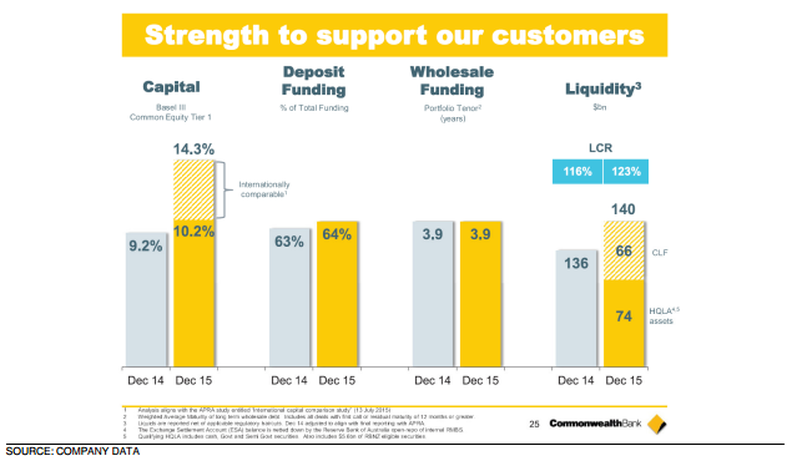

Markets are always made up of at least 2 opposing views. This is what makes markets what they are. Trying to come to a price through the discovery of existing and new information and factoring all of this into future cash flow projections is what makes financial markets. That is why the team at TAMIM is passionate about what we do, we love the intellectual pursuit of finding out information that perhaps the market has not yet figured out. We use this knowledge in putting portfolios together. Because we know that different investment methodologies will work in different market environments, we work with a number of managers across a number of investment styles and asset classes, this allows us to always have a solution for the current investment environment. European banks are in free-fall. The Stoxx 600 Bank index is down 42.5% from its high on the 20th of July 2015 to the low on 11 February 2016. This is largely driven by concerns over the ability of Central Banks to support markets globally. Mario Draghi’s policy of more and more quantitative easing is not working. Europe’s banking system is fundamentally weak. There is not enough capital supporting the mountain of debt on the banks’ balance sheets. In addition to this the ongoing weakness in oil prices causing worry about banks exposure to oil and gas corporates and the weakness in emerging market debt emanating from China continues to make the situation worse. On the surface, Australia’s banks are much stronger. But our love affair with residential property has resulted in housing dominating the asset side of banks’ balance sheets (as we all know, house prices never fall!). On the liability side of the balance sheet, it is believed that banks have a large reliance on offshore borrowing which to be fair is partially offset by a large and stable domestic funding base. The liquidity pressures on the global banking system mean that the cost of financing these liabilities will rise. The ASX Financials ex A-REITs index has fallen 24.9% since its peak on the 20th of March 2015 to the low on 12 February 2016. Is there more weakness to come. It is interesting to note that there is divergence in this index with CBA down 27.1% at is low (it has since recovered) while for example ANZ is down 41.3% from its high. Given the above global and local movements there has been a lot of commentary on the banks recently so TAMIM has done its research and has the following Bull and Bear summary of the issues for you to consider. The Bear View

The Bull View

Should you own, buy or even sell the banks. The case can be made for all 3 situations and we believe the answer will largely be impacted by your circumstances and especially your time frame of investment. The recent correction in banks has vividly illustrated the risks of running portfolio's that have a high level of concentration to 1 sector. In this case, the banks. It is even more important to be aware of this concentration risk when holding the banks because as Australians we are also highly leveraged in most cases to the property market. As always, consider both side of the argument, safe investing from the team at TAMIM.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed