|

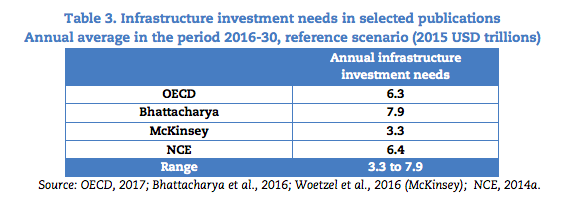

This week we take a look at at a couple of things to consider from an asset allocation perspective. These are extraordinary times and sometimes it pays to think both logically and outside the box. Last week we posited that equities are one asset class that still continue to make sense with the caveat that it is perhaps prudent to buckle up for a rather bumpy journey. And so we end today with the ASX in bear territory (defined as a drawdown of more than 20%). A lot has been happening since we last wrote. The White House has been suggesting that substantial stimulus is in the works and locally the government of the day has all but given up on getting us back to surplus in the near future. Granted the wording was meant to placate some of the more conservative elements of the party, we, however, doubt that Mr Morrison would risk being seen as slow to action given the vagaries of electoral cycles, not after the Hawaii fiasco. His colleague on the other side of the planet found out just how unforgiving an electorate can be when it comes to appearances, Mr Trump also deeming it appropriate to jaunt over for a much-needed break during the latest crisis at hand. It seems rather likely to us that this is a beginning. We will continue to see increasingly aggressive fiscal policies implemented across the Western world and even in emerging markets. From the EU to North America to China and Southeast Asia. We have in fact hoped that this might be the case when we wrote on the issue last year, minus the virus of course. The simple rationale is that it seems rather beyond the pale to have an expansionary monetary policy and a fiscal policy that acts as a counterweight. The thing to watch from an asset allocation perspective, however, will be inflation, something that everyone seems to have forgotten as a remnant of a bygone era. But with continued disruptions to supply chains and fiscal expansion in a highly indebted world, it begs the question of whether this is a rather complacent view. For one thing, we no longer have the monetary tools with which to tackle it (i.e. central bankers would find it incredibly hard to reverse course and raise rates). In this environment, there are bound to be sectoral and asset class dislocations, especially in debt markets. Combine this with the potential for unconventional monetary policy tools and you’re caught between a rock and hard place. The first ones to get hit will be the banks who essentially rely on borrowing short and lending over the long term. Not only does it squeeze their net interest margins but if inflation does kick back in and interest rates continue to be kept low, then it acts as a double whammy. Bonds would be in a similar place, last week we elaborated upon how this particular asset class is increasingly seen as a capital growth story rather than an income play (something that remains puzzling to us). Again, add in inflation and things start to look rather messy. Take the 10-year US Treasuries, for example, which are yielding approximately 0.7% or the German Bunds yielding -0.8%, add in even a 1% CPI and you have an issue. But here is the thing, just as there will be dislocations and volatility, there will also be opportunities for the discerning investor. Take for example the US Ambassador's speech at the Australian Financial Review’s Business Summit where he alludes to the necessity for independence when it comes to the rare earth markets. What this virus has brought to the fore is the sheer reliance of global supply chains on the Chinese market, one aspect of any future fiscal measures will be the strategic development of alternative capabilities. One can be sure that Wesfarmers wasn’t completely out of touch with this new reality in its somewhat premature bid for Lynas. Similarly, infrastructure will also be a key asset class to watch. Whether it be traditional utilities which are, let's face it, regulated monopolies with revenues often indexed to inflation or roadways. This might seem rather unsexy given that there is a seeming lack of growth, but this is a misunderstanding. Companies within the space especially playing in niches such as renewables or even wastewater treatment can have massive runways for growth. Depending on your source, the amount of expenditure needed globally ranges from 3.3tn USD to 7.9tn USD p.a. for the next fifteen years. Another interesting thing about this particular asset class is that it is somewhat insulated from broader macroeconomic variables given their insular and domestic revenue sources. Infrastructure should be seen as the new banks, in much the same way as we have been used to looking at the Big 4 for dividend yield, so too should we look at Infrastructure and if possible look globally (go “glocal”, so to speak). Some of our biggest holdings include China Lesso, China Water Affairs and Transalta. Start-Ups

Here at TAMIM, when we look at an asset class or any investment we think about its differentiation potential. That is, if one were to sell, how would the other behave. Whether it be looking at private debt or global equities (again for those of you unaware, we are firmly of the belief that geographic diversification yields much better performance than sector diversification). For us, Venture Capital offers an interesting prospect. Not only for its arguably non-correlated nature but also the ability for us to have control of and understand the businesses and their commercialisation process at a granular level. Having the patient capital to deploy and insulate management from the whims of public markets can be beneficial in the infancy stages of a business and allow capital to be deployed efficiently. The marginal utility of a dollar invested in a smaller company is much higher and decreases as the business grows. A dollar given to a start-up will be used to hire, whether it be coders at a tech company or sales staff, on advertising to grow top-line or consultants to work on the bottom line. It is also one of the few avenues where you can effectively time the market when it comes to entry and exit strategies. The idea being that if one doesn’t like the multiple they get on the market, one can source alternative exit strategies like M&A or even wait for the right time or right market. For example, with better multiples on the NASDAQ vs. the ASX then one would be incentivised to go to the NASDAQ. Private markets offer an interesting diversification tool that effectively builds a moat. After all, what would Berkshire be without its insurance business? It doesn’t have to be VC, think about your own moat. We’ve always heard about looking at listed businesses and their economic moats as key investment metrics, so ask yourself the question, what is the moat for your portfolio (i.e. it could be a private business or rental property that is cash flow generating and free of debt)?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed