|

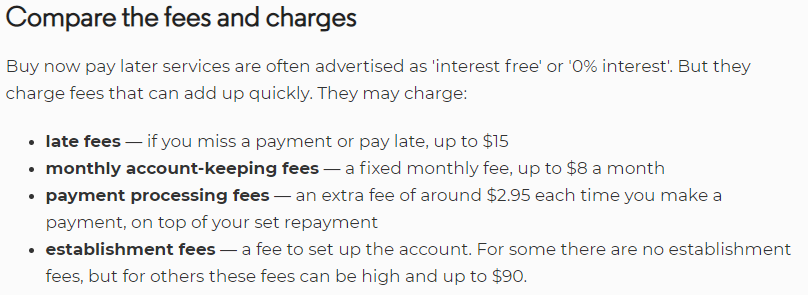

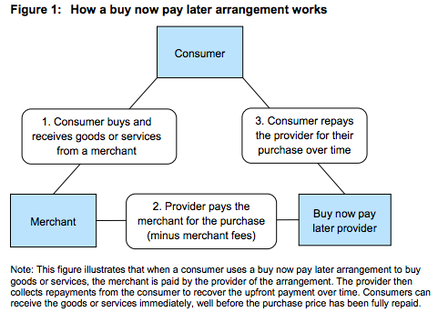

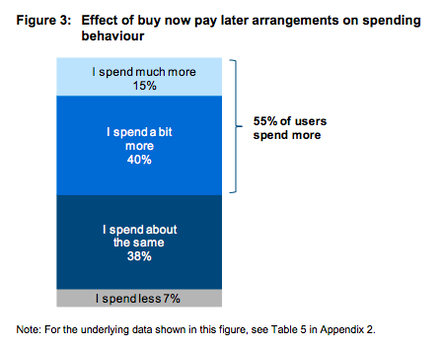

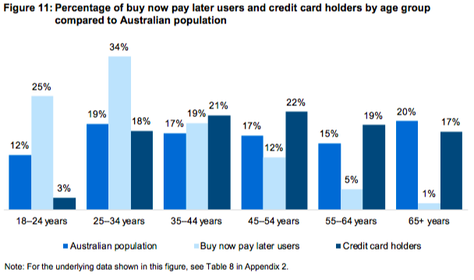

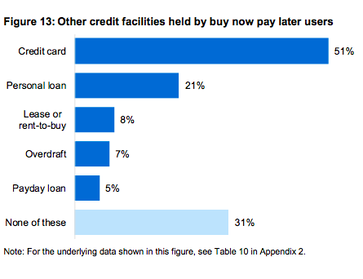

This week we visit perhaps one of the most prominent thematics in the market, that is the Buy Now Pay Later (BNPL) space. In particular and given the outsized returns of the market darlings, including APT, we would like to ask ourselves the question, where to next? Is the optimism warranted? Or is it perhaps the outcome of a rather irrational market?  Author: Sid Ruttala Author: Sid Ruttala The answer lies somewhere in the middle of these two extremes. As it perhaps always does, just enough so that we can be right when the reality shows up in either direction. Context Let us begin with the basics and understand what “Buy Now Pay Later” actually means and how it differentiates itself from the traditional credit card system. The moneysmart.gov.au page on the subject gives a succinct summary of how it works and some of the things to be aware of before using BNPL services as a consumer: Source: moneysmart.gov.au And here is ASIC's explanation of how it works: Here we have to say that this is an understandably cautious perspective, only to be expected from government bodies. If one isn't cognizant of the fees and the like then there is probably trouble on the horizon. As with any loan or line of credit, if you can't afford to service it then it's probably not wise to set off down that path. Like any financial product or service, it is important to do the research and understand what you are getting yourself into. For one thing though, immediately on face value, BNPL can offer significantly better terms for consumers given that the fee burden is shared with the retailer. Retailers take on the additional burden for the certainty (one would imagine) of revenue and the prospect of getting more customers who would otherwise be turned off at the prospect of fronting large upfront payments for purchases. Moreover, as shown in the figure below, over 55% of users choose to spend more than would otherwise be the case as a result of using one of the BNPL providers. It essentially turns the BNPL provider into a hybrid credit card. In an era of low-wage growth and increased online purchases, this creates an inherently attractive business case for players within the space. However, there is a caveat and one that the market has seen fit to ignore or put on the back-burner. That is the risk profile of the actual user base. There are no credit checks and the actual product would be exceptionally attractive to the debt-burdened customer. Not to mention that, given its infancy, the regulatory oversight is also still in its infancy. Remember the scandal around how minors were able to spend and buy alcohol online on Afterpay back in 2018? Or how the account registered to ‘Mickey Mouse’ was able to spend close to $250 on wine and other goods? Source: ASIC Report 600: Review of buy now pay later arrangements, November 2018 Apart from this, the space is also capital intensive seeing as there is a requirement for the companies to pay the retailers upfront from company cash whilst receiving the relevant cashflow sequenced over a period of time. There is also the additional problem of time-lag since they are effectively lending long without the advantage of knowing their customers. For example, how does one manage bad debt provisions without having the certainty of running a credit score on the customer base? This is also perhaps the reason why the initial Covid-related sell-off impacted the market darlings, such as APT and ZIP, so drastically. That is, what was going to happen to these companies when all the supposedly young people with little or no credit history (let alone good ones) they are ‘lending’ to lose their jobs in the economic shutdown and can’t pay the installments on the $350 sneakers they so desperately needed right away? Luckily the recovery came swiftly when there was a realisation that consumption would not be impacted as much as anticipated and the move towards online retailing was only accelerated. So this brings us to our first point, the sector is inherently pro-cyclical. So why hasn’t the recent pandemic impacted their bottom-lines as much as it should? The answer to that is self-explanatory (so we won’t labour the point). Think about the user-profile of most of these companies and what policies such as early access to super, fiscal stimulus both in Australia and globally (especially in the US) mean for their spending in the short-run. Competitive Environment

Though Afterpay has been the standout in recent years, it's often forgotten that the sector itself is quite a lot older. Some names include GE Money (now Latitude), FlexiGroup (the self-proclaimed “Australia’s original Fintech”), Zip Co., Sezzle, Splitit, and OpenPay. The key differentiator has been the ability of market leaders to go digital and to commercialise quickly. The advantage for Afterpay and Zip is their platform, which is truly digital and user-friendly. It works with its target-market (i.e. Millenials) rather well (Zip’s pocketbook is especially interesting when competing with APT). And although the only company in the sector currently making money is FXL (which we own at TAMIM), it is also true that the name of the game at this stage is market share. The market has been disproportionately rewarding those that have the ability and willingness to go global and do so quickly. That being said, the logic behind Zip’s 1.5bn AUD increase in market cap for a $400m acquisition that sees it scale in the US is a little beyond us. The market is pricing in and salivating over the prospect of some these companies driving growth in key markets (US and Europe) where the sector is still in its nascent stages. This is the same reason why Sezzle, a company headquartered in Minneapolis chose to list on the ASX as opposed to the US markets. We are by no means being cynical of the ASX, but one cannot imagine that the company thought an Australian listing was more reasonable because the ASX is such a huge and liquid market compared to the NYSE or NASDAQ. We have a theme and the market is rewarding that theme with a multiple that they cannot get elsewhere. The same reason that you would choose to list in Canada if you were a marijuana stock when that was the rage. The valuations and multiples are what they are because it is the latest theme the market wants to grasp and the retail punters are happy being there. Most of the sector continues to burn cash. APT at a rate of 40m AUD p.a., though at last call it had close to 405m in cash and it is the price one pays for gaining market share quickly. What we would be interested to watch will be how the bigger giants, both in technology and financial services, react to the new kids trying to play on their turf. Latitude, for example, is owned by Deutsche (along with PE firms like KKR), Tencent made headlines taking a strategic stake in APT. The Big 4, we’re sure, will come up with offerings to compete along with global credit card providers Visa and MasterCard. The end result we expect is a lot more cash-burn to come and M&A activity before we see some semblance of stability. So, going back to the question, where to next? The market has the right idea about the potential for the sector especially in a world where online is likely to dominate consumer demand now and well into the future. Income inequality is likely to be exacerbated and we wouldn’t get our hopes up for wage growth any time soon. Thus creating the perfect environment for future potential. But when the markets push up valuations to the tune of billions in the space a couple of weeks, there is a certain part of us that feels rather uncomfortable. If one were to play within the space despite this, there are some slightly less risky bets, such as FXL and OpenPay, which have a different risk profile. OpenPay being more of a SaaS provider than purely BNPL and FXL having a more diversified revenue stream. Don’t get us wrong, APT is something we used to own (so was Zip), but at these valuations? No, thank you. When my mother or friends decide that they don’t think its a great idea anymore, that’s when I think I will consider buying. But until then, I shall let the punters have the deck. Before making further decisions the reasonable investor would hope to see how they react and what proportion of their revenue base would get depressed in the absence of fiscal responses or a true credit crunch. As with any disruptive or "new" product like this, at some point there will be pressure applied to to whole segment and we will start to sort the wheat from the chaff. Watch this space when JobKeeper and the like get scaled back...

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed