|

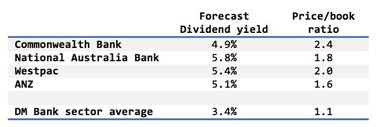

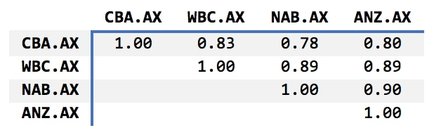

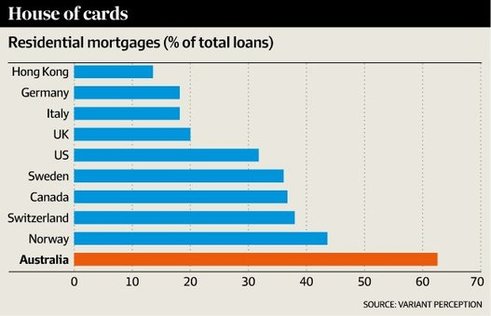

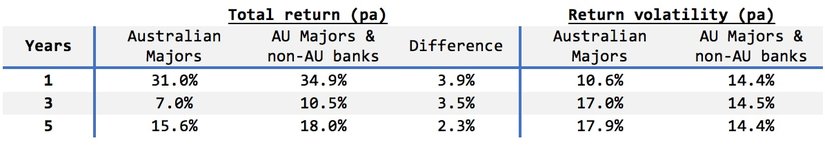

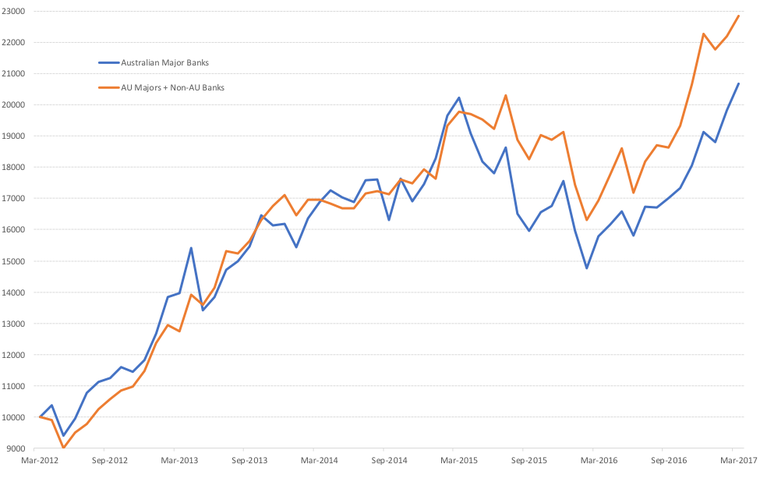

Robert Swift and Roger McIntosh compare local and international banks. Does it make sense to own the behemoths that dominate the Australian market? Are you unknowingly doubling down on exposure to the Australian property market? Australian vs. Global banks – Which should I own? Robert Swift & Roger McIntosh For Australian investors, the banking sector, particularly the four major banks, form a significant part of their investment strategy and exposure to Australian economic activity. However, only investing in Australian banks even with the franked dividend income, is definitely a suboptimal approach to investing. Let’s compare Australian banks with global competitors in terms of valuation, capital sufficiency, and business positioning or resilience. Australian banks have high dividend yields and low variability of EPS growth compared to global competitors. This would usually make them attractive. Although we like dividends as proof of cash flow, it appears to us that Australian banks are overdistributing earnings as dividends, and not sufficiently acknowledging the risk in their loan books. In other words, their EPS resilience is somewhat masked by ‘highly managed’ bad debt recognition. In terms of capital sufficiency, the Australian banks are average. It appears to be a form of financial arbitrage to us that the Australian banks pay out franked dividends and then raise capital in the markets to meet regulatory capital ratios. If management wanted to avoid this ‘distribute capital and then raise capital’ merry go round they would cut the ordinary dividends and wouldn’t need to raise capital since the capital buffers would be built by retained earnings. However, there would be an outcry from investors desperate for dividend income. When companies are hooked on dividend amounts which they shouldn’t be paying, it strikes us as risky. Price/book ratios may be a better guide to valuation given the latitude which all banks have in their EPS reports? In the table below we show the Australian banks look expensive on this measure compared to other developed market banks. Australian banks tend to copy and follow each other’s business strategies and this is clearly shown in the very high correlation of the bank’s total returns with each, not offering investors a reasonable level of asset diversification. They rushed into expensive wealth management platforms and ‘fund management’ (multi-manager offerings) and all now appear to be exiting simultaneously? They all rushed into mortgage lending in NSW, Victoria and Queensland and are now being told by APRA, their regulator, to ‘cool it’. Further, to increased limits around mortgage lending, the regulator has now indicated they are reviewing further changes to the risk weightings the banks use (for details on this, please see The Lazy Dog blog post). None have cracked Asia; none have cracked investment banking as have the USA majors. You can see the result of this ‘tack and cover’ strategy in the table below. This compares the price behaviour of the Australian banks to each other where a figure near 1 means they are al the same and a figure of -1 means they are all different. Correlation figures of 0.8 or higher show very close similarity in asset returns. Investing in Australian banks is essentially investing in one big bank. This is not ideal for your portfolio. Correlation of monthly total returns for 5 years ending 31/3/2017 Investing in non-Australian banks, particularly those with broad, global operations, offers a much broader and diverse source of business activity and economic exposure which in turn provides broader net cashflow and alternative revenue sources. The analysis suggests that the market is aware that the largest source of revenue for Australian banks arises from net interest income, primarily domestic loans and credit to personal and business customers. They are all the same and their fortunes will wax and wane together. No diversification here at all. Own the Australian banks and you own their residential property exposure and your own home as well. Potentially a large part of your wealth and income is focused on one asset class – Australian residential property. Benefits of diversifying are clearly demonstrated in an analysis of the differences in return and risk outcomes of a strategy that holds equal exposure to the four major Australian banks and an equal-weighted portfolio of the four majors and the banks held in our High Conviction Strategy. Currently, these are JPMorgan Chase (US), Sumitomo Mitsui Financial Group (JP), BNP Paribas (FR) and Bank of Montreal (CA). These banks provide a great combination of exposure to global banking and to different types of regional economic activity. They are far more diversified with their loan books. AUD annualised gross total return and volatility for periods ending 31/3/2017 There is definitely a benefit in terms of higher returns and reduced variability of returns by adding exposure to non-Australian banks. This can also be seen in the growth in $10,000 invested in each strategy over the last 5 years. Australian banks are not badly managed. They are not bad businesses. They pay seemingly attractive dividends. They are however very similar to each other and are currently over exposed to Australian residential loan risk. They are possibly paying out too much in equity dividends. A small increase in loan loss provisioning could wipe out in share price terms, the extra tax credits from their dividends. Consequently, there are meaningful benefits by investing outside Australia and its banks.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed