|

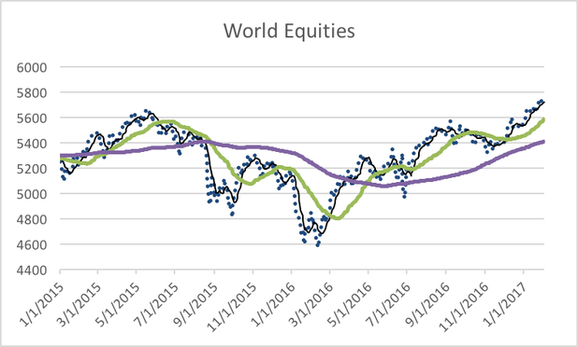

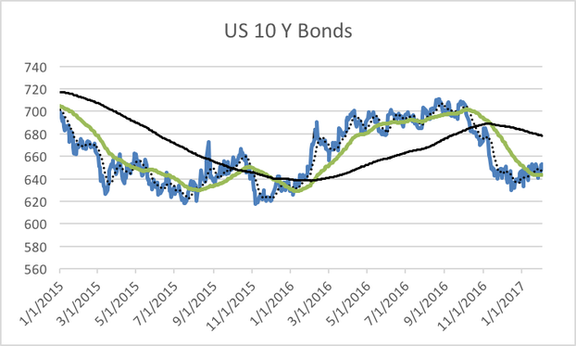

This week Robert Swift takes a look at momentum and what it is telling us about asset allocation. Where should you deploy your capital and how? Will this achieve optimum results in the current economic climate. Asset Allocation: Momentum: Where should your assets be allocated? Robert Swift One of the most important decisions is how to allocate your money across different asset classes – property, bonds, equities, or cash. This is because a combination of these assets will be less volatile than simply holding equities, and the returns, although lower, will be safer and reduce the chances of a nasty surprise to your pension pot. This is probably now consensus thinking and all the major banks, financial planners, and investment management companies produce regular reports giving their views of both HOW you should make the allocation decision and WHERE you should currently be invested. What is our view on the HOW to do it? Does the HOW impact on the WHERE NOW decision? We believe that there a systematic process of asset allocation that actually works. Over the last 20 years or so a number of the investment team have worked for some of the biggest multi asset investment funds in the world which have struggled with this question of how to develop a systematic, repeatable process of allocating between asset classes that added value for clients over time. We have been involved in the formulation, development, and testing of many of these models. A lot of quite sophisticated “fundamental” approaches were tested but none seemed to last the test of time. Perhaps worryingly for some, what did seem to work best (most consistently) was a technical analysis model – simply following a set of rules based on price momentum using 10 day, 50 day and 200 day moving averages of the prices. Only holding above average exposure to those assets that met the criteria and avoiding the others that did not meet the criteria, led to significantly superior results than simply holding a benchmark of all the assets without making any changes. This seems remarkably simple, possibly even stupid, and runs counter to the view that forensic accounting and meticulous predictions of GDP figures add value in making asset exposure timing decisions! Actually, the phenomenon known as momentum has taxed the financial academic world for quite a while and much work has gone to show that price momentum or trend following, adds value not just across asset classes but also within. In other words, even buying equities whose prices are rising, regardless of their valuation, will make you money relative to equities whose prices are falling. Psychologically this “momentum factor” actually makes sense. Human beings like to be with crowds, in popular trends and don’t like the ridicule with being unfashionable, or to be too different. Consequently, there is an opportunity to simply jump on a trend and enjoy the ride. This human fallibility is what makes markets inefficient and active management worthwhile. Think. If momentum exists as a way to make money, which it does, then it can’t be the case that ALL information in the market is instantly discounted so that the relative prices have instantly adjusted to their correct level. If prices instantly adjusted, as efficient market proponents argue, then there would be no momentum. Prices would move instantly and not over a period of time. It is this slow upward and downward movement that allow us to get set and make money. We use a stock selection model which also incorporates momentum or trend following. In a way acknowledging the impact of price momentum is the ultimate acknowledgement that other people may know more than you. If valuation is acceptable then better to go with what other investors see as attractive? It is rather ironic in a business where people attempt to develop very sophisticated models that closely fit with financial theory that it is often very simple things that work! This simple price momentum, had it been followed in 2008/9 financial crisis would have avoided much of the damage to portfolios that people incurred by switching out of the falling assets (equities, commodities) and in to the rising assets (bonds). In a business where there is so much information being thrown at you, it is important to be able to separate what’s relevant and what is simply a distraction. We have never found predicting GDP is productive for asset class forecasts. Plenty of firms do but we think they’re wasting their time. WHERE NOW? So what is the price momentum model telling us now? Over 2016 the model gradually sold out of all form of bonds – both government and corporate – final sales being in September 2016. These have been gradually replaced by increasing exposure to equities – firstly US equities – then a gradual spreading throughout most of world equities. This purely price momentum model also fits in with our fundamental view. Following the 2008 financial crisis a large proportion of money was switched out of equities into bonds. Relative to history over the last 5-6 years there has been an over-allocation to bonds over equities. The Bank Credit Analyst a well-respected research group recently released a report where they argued that the world economy was in a synchronised growth stage and this was leading to a general improvement in company earnings. Furthermore we are started to see growth in company capital expenditure which is a sign of more confidence amongst companies after years of below average expenditure on capex. M&A is also starting to picking up – which is something we discussed a few weeks ago.

So with positive technical indicators and encouraging fundamentals we could eventually see more decisive switching out of bonds in to equities. Equities – overweight with a bias towards Value Bonds – underweight especially net debtor countries such as Australia, Turkey, Spain

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed