|

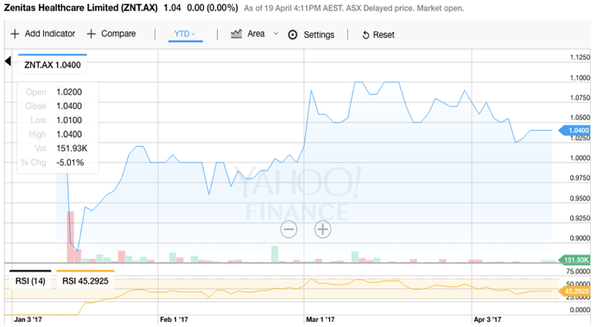

We take a look at accessing IPO's and Capital raisings. Small investors tend to be locked out of these raisings. In most instances, this is not an issue as the quality of the capital raisings tend to be poor. However, in the case of a strong IPO, you can benefit from a relationship with an investment manager who provides access to these IPO's and Capital raisings. Summary:Gaining access to the best IPOs and Capital Raisings appears to remain the preserve of institutional and high net worth individuals at present. Whilst this plays to our advantage at TAMIM Asset Management we would like to see the market playing field level over time to allow fairer access to retail investors. However, in the meantime we continue to take advantage of opportunities to access the highest quality IPOs and Capital Raisings within the ASX smaller companies universe. In this article we discuss the ins and outs of gaining access to stock. Not all IPOs and Capital Raisings are created equal... IPOs and Capital Raisings are a sensitive subject for many retail investors who often view them as “closed doors” for smaller investors. And of course the more a door appears closed, the more it is natural for human psychology to want it to be opened. However, we believe this way of thinking warrants caution since not all IPOs and Capital Raisings are created equal. In our opinion the vast majority should be avoided due to their lack of track record and evidence of sustainable moats, and their often unproven business models. We have previously written about our high quality shopping list, and we find the majority of IPO and Capital Raising opportunities fail to meet our criteria of a high quality investment. We recently saw a cautionary tale when it comes to IPOs, as covered on The Lazy Dog blog. STOCK EXAMPLE: Zenitas (ASX:ZNT) is a good example of a recent Capital Raising which ticks all our high quality boxes. ZNT now operates from 54 locations throughout Australia, employing 700+ health professionals, providing services across allied health, home care and primary care; making it a significant player in the community healthcare in the Australian market. Community healthcare is expected to benefit from supportive government policy, as community-based health services represent a cost effective solution compared to high cost hospital care. We like ZNT as it is in a sector supported by strong tailwinds and encouraging thematics, it is priced on an undemanding multiple, has multiple and credible pathways to grow, and is run by an experienced management team. That said, the business still has work to do prove itself to the market, and to build out its model. As it does, there is ample room for the share price to re-rate. Once you have identified the right ones – how to gain access?  We have generally found that competition is intense for stock if an IPO or Capital Raising does indeed tick all our high quality boxes. In small Capital Raisings that are in high demand, it is often the case that the stock available is bid for multiple times over by institutional and sophisticated investors, before retail investors are even offered an opportunity. As a result, it can be very challenging for retail investors to pick up stock in these cases. Conversely, it is often easier for retail investors to pick up stock in the lower quality IPOs we are aiming to avoid. At this point it is worth mentioning that the IPO market largely remains under the control of the larger brokers who still generate very high fees for handling IPOs. So the main route to IPO or Capital Raising stock supply is through the broking community. For smaller investors this means leveraging existing broker relationships, and showing yourself as a potential longer term client for that broker rather than an “IPO flipper”. If an IPO is in hot demand brokers will be very focused on the clients they believe will help build their business longer term rather than short term focused traders. This is one of the areas where it is a major advantage to be invested through a long term focused smaller companies investment manager since these funds tend to move to the front of the queue for the reasons mentioned. STOCK EXAMPLE: In the above mentioned example of Zenitas (ASX:ZNT), there was no public float or ability for retail investors to participate. And even sophisticated investors had their bids substantially scaled. However, we were able to use our existing relationship with the company through our long term shareholding in BGD Corporation to secure a strong allocation. What is being done about it by the ASX? The short answer is the ASX are doing nothing about this. They recently released a consultation paper on listing rules reform, which made it clear they don’t intend to address the fair participation in IPO issue at all. This effectively means the IPO (and Capital Raising) markets will remain the preserve of bankers, brokers and high net wealth individuals, at least in the short term. Alternative strategy to gain access to IPOs: Onmarket Bookbuilds It is positive to see the emergence of onmarket bookbuilds, a relatively new business model which aims to provide IPO access to retail investors. At present, this type of business is generally the secondary IPO broker behind a traditional primary broker so is generally only contributing a relatively small portion of the IPO fund raisings it in involved in. However, the key point is that this business is providing IPO access to retail investors who were previously locked out of the market, which is a clear step in the right direction. We hope these bookbuilding models succeed in building their business longer term as their success will lead to greater access to the higher quality IPOs which remain largely inaccessible for retail investors at present. And hopefully other alternative access points for retail investors will emerge in the coming years. Conclusion:We rarely participate in IPOs and generally only participate in the highest quality Capital Raising opportunities. However, fair access to stock is a debate which will rage on. We believe a move towards fairer access to stock for retail investors is likely longer term despite the ASX’s recent lack of reform action.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed