|

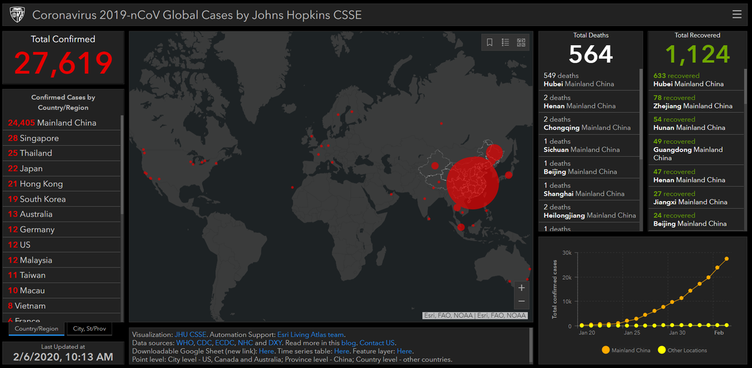

For the first newsletter of 2020 we put forward five key predictions for the calendar year ahead. Each of these will definitely impact the investing world and will have an effect on the Australian economy either directly or indirectly. It is always worth considering what lies ahead. This week we would like to begin where we ended last year, revisiting a favourite exercise of ours: making predictions. However, a slight adjustment is in order since we would like to do so at the beginning of the year as opposed to the end. So unfortunately, given that we don’t have a little thing called retrospect, they might not be as exact. So here we go… Prediction 1 – The coronavirus will be forgotten by July Given the rhetoric that we have all have been seeing in the media over the past month or so this might seem rather optimistic but let us make a case for it. The novel coronavirus (2019-nCoV) surfaced in Wuhan, China in late 2019, resulting in borderline draconian measures being put in place by Beijing to stop its spread. The affected provinces were quarantined and effectively shut off from the rest of the mainland (it has since spread to most provinces to varying degrees). While many people have drawn comparisons between the current crisis and the SARS outbreak of 2002-2003, there are significant differences, both good and bad. Check out the interactive map from Johns Hopkins CSSE (screenshot below) to see the spread. On the positive side, the fatality rate of this coronavirus is considerably lower than SARS which, at its worst, had a fatality rate of around 8.6%. 2019-nCoV, on the other hand, is somewhere closer to 3.5%. Though to what extent these numbers can be trusted given the history of the Chinese state in being particularly creative when it comes to statistics we leave for the readers to judge. Nevertheless, based on current news flow, there does seem to be a lot more openness in terms of disclosure than in previous crises. On the negative side however, 2019-nCoV could be a lot more contagious than SARS which at its height impacted about 8000 people and killed 800. What will be particularly telling will be to see what is referred to as the R-Naught figure which refers to the contagiousness of the disease itself. For example, if a virus has an R-Naught of 3 it means that every person that has the disease affects three other people in the community and so and so forth. So if the figures that come through are on an exponential basis, then it becomes a bigger problem. Till now the draconian measures implemented by the Chinese government, including mobilising the army to cordon off areas, have meant that the impact area has been largely contained. What is also concerning about this particular strain is the incubation period which means that once infected it takes up to two weeks to actually show symptoms, this also happens to be why the Australian government saw fit to use Christmas Island. Coming back to the impact on global markets, at the risk of sounding rather callous given the human cost, we would suggest that it is being blown out of proportion (the common cold being rooted in a coronavirus itself). The closest thing that we find analogous is probably the flu season which impacts between 9 and 45 million people in the US alone and kills between 12 000 to 60 000 people every year without a substantive impact upon GDP. Granted, the markets are prepared for it but, given what we know of this particular problem, it hardly warrants a 9% sell-off in the Chinese indices or a 150 basis point sell-off in the ASX. Think about it like a plane crash, the actual underlying impact is rather small but it is an outlier event when compared to the thousands of car-crashes that occur every day whose death toll is substantially higher. It will make an impact in very particular niches given Wuhan’s role in automotive manufacturing or if it spreads more aggressively into other more central provinces but, if contained, it’s impact on top-line growth should be negligible, maybe 20-30 basis points. If it gets bigger sectoral dislocations could occur; for example airlines, oil prices (due to travel restrictions) and tourism. Overall it should not impact global growth all that much, especially if the Chinese government decides to intervene directly and stimulate to meet their target of doubling the economy between 2010 and 2020. Prediction 2 - A new round of QE will take place As we suggested last year, the Fed’s intervention in the Repo markets in September is for all intents and purposes QE (even if they refused to name it such). What we see by these actions, and after Q4 of 2018, is their unwillingness to let market corrections take place. Despite the rhetoric that Powell chooses to use about not being in the business of propping up markets, we see a deep-seated aversion to anything that might rock the boat, USS Economy. The thing to watch in this instance is not necessarily the Fed Funds Rate but rather the balance sheet. We think the odds of trimming it to be extremely low. Rather, they are more likely to let bonds go to expiry since central banks, by their very nature, can go into negative equity and still be functioning. In essence we are emphasising the notion of the Central Bank Put which, for better or worse, is going to mean that the Federal Reserve will let the markets run hot in the absence of inflationary pressures. That said, we are by no means suggesting that valuations at this particular point in time are reasonable on a historic basis. Indeed, one needs only look at sectors like semiconductors which are extremely procyclical by nature to realize that the current status-quo is well into bubble-like territory (i.e. valuations are no longer being driven by fundamentals). A perfect example of this would be securities like AMD (see below) or even the FAANG stocks to a certain extent, which as of January 2020 have a market capitalization of 4.1 Trillion USD. Nevertheless, we fundamentally believe that in the absence of any changes to current, seemingly consensus, monetary policy stance around the world, we are unlikely to stop a continued melt-up in the coming twelve months. This comes with the caveat that current valuations also have the flipside of being priced for perfection and, as a result, any negative news is likely to see a disproportionate response in terms of price movements. In other words, volatility will be back again this year and if severe enough on the downside, which is almost certainly going to happen in the lead up to 2020 elections, the Federal Reserve will be forced to intervene directly and with the certainty that they won't have the opportunity to even disguise it as was the case in September.  Prediction 3 - RBA cuts rates to 0.25% So Wednesday came and went with the RBA holding rates steady at 0.75% as was expected by the market given better than expected employment figures. However, we do not, unfortunately perhaps, see this holding steady throughout the year. RBA Governor Lowe has already made veiled comments targeted at Canberra about the extent of firepower left on the monetary side of the equation. Perhaps he might be right on this front, since monetary policy can only go so far in impacting the underlying economy. In other words more needs to be done on the fiscal side of the equation, whether it be a more flexible approach to the obsession with getting back to surplus or spending on things like infrastructure. However and perhaps unfortunately, we are cynical that this might be the case given the political equations of our time. In the absence of any substantial movements on the political front, any perceived weakness in the underlying economy, including a cooling off in the property market, will be met with more rate cuts and, given the headwinds we seem to be facing in the form of health (the coronavirus, granted blown out of proportion) and environmental/rural (bushfires) crises, we can expect that there will be hurdles along the way. Undoubtedly these hurdles will be met with rate cuts going towards the zero-bound. Maybe even our very own QE dare we say? Again, despite the gloominess that all this might suggest, it is not necessarily all negative for equity markets depending of course on sectoral allocations. Infrastructure, utilities and the like are likely to be beneficiaries to this given their highly leveraged nature. Any government expenditure on longer-term projects going forward should also bode well for these sectors despite the regulatory mess that they seem to be facing in terms of policy clarity. In addition, finding companies with clear catalysts in terms of earnings growth should also allow us to be disproportionately rewarded by the market. Prediction 4 - Trump wins re-election against either Joe Biden or Bernie Sanders Funnily enough the sign James Carville famously hung in Bill Clinton's Little Rock campaign headquarters in order to keep the campaign on message in 1992 is still rather relevant today. It read:

It is point number two we would like to focus on here. Let the circus begin. At the time of this writing, the Iowa caucuses are in progress and New Hampshire is soon to follow with approximately USD 40m spent on the campaigns already. The lead contenders as of the 5th of February are Pete Buttigieg closely followed by Bernie Sanders, Elizabeth Warren and Joe Biden. The caucuses, while remnants of the past and probably outdated in their function, are still fundamental to the American political process. For those of you who are not well-versed in the essential difference between a caucus and a primary, a caucus requires the registered party members to physically go to a meeting at a designated place to nominate their nominees whereas a primary is conducted in a similar manner to an election where the voter goes to polls to cast their ballot. The caucuses are often determined by the loudest and most active party, clearly benefiting candidates like Sanders over more establishment candidates such as Joe Biden. That said, only six states still use the Caucus format to select their nominees with the rest being primaries. Iowa being a swing state has always been exceptionally adept at choosing the winning candidate and thus is seen as essential to the nominating process, though many have questioned the priority this particular state takes. Nevertheless, it is still a rather good representation of the mid-west which was essential for Trump to take the White House during the 2016 elections, Iowa going to Trump 51% vs. Clinton’s 41%. One thing is for sure, the top three candidates during the initial primaries will have the momentum behind them in a rather crowded field to go on to national primaries including the all important California and New York. Currently, we would bet that Bernie Sanders and Elizabeth Warren will come out in the lead in early stages but Joe Biden will close the gap following deals with drop-outs or those that don’t have the requisite numbers. Bernie Sanders would appear to be the clear favourite within the party, especially with younger voters, with Joe Biden being seen as the man most likely to be able to beat Trump. Elizabeth Warren would, we assume, still be on the ticket as a running mate for either of those candidates. All in all and returning to Carville's second point, whoever the candidate might be, we find it exceptionally hard to believe that a contender could dislodge a sitting President with the economy going so well, even if he doesn’t actually understand how it works. Despite what your opinions about the man himself are, the dynamics of the previous elections mostly remain standing. While Joe Biden as a nominee would have the baggage in the form of his son Hunter and the Ukraine fiasco (depending on which way you lean, the Ukraine situation is baggage for Trump too), Bernie Sanders might be too progressive for most of moderate America unfortunately. Just as last time, we see an electoral college win for the Tweeter-in-Chief and another loss when it comes to the popular vote.  Source: goldprice.org Source: goldprice.org Prediction 5 - Gold will break above 1700 USD but equities continue to melt-up As mentioned a number of times last year, we are firm believers in the notion that gold should be looked upon as a hedge to a broader portfolio rather than a growth play. That said, we continue to believe that it has a long trajectory in terms of upward momentum. While we did not see it as particularly attractive then, this year the trends are indicating otherwise. For one, the key will be a sustained break above 1500 USD and a resistance at that level. We are increasingly seeing a bullish pattern developing in combination with the other relevant factor: the USD. Again, as previously mentioned, the precious metal has an inverse correlation with the USD both for historic and practical reasons. As the Fed continues to lower rates and undertake unconventional policy tools we might see this correlation break. The USD might still have upward momentum given its reserve currency to the world status and weaknesses in the Euro as well as emerging markets but recent trends, including various moves by central banks around the world including the PBOC (China), RBI (India) and Russia, are suggesting that there is going to be increased demand. We predict that by the end of the year gold will reach 1700 USD. Though the one downside could once again be the coronavirus since Chinese and Lunar New Years have historically created demand for gold since it is a common gift during these events.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed