|

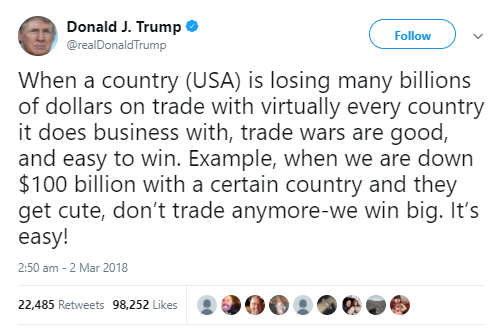

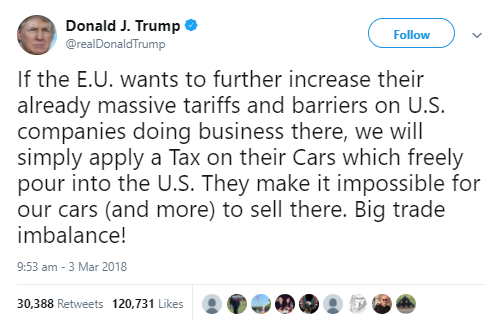

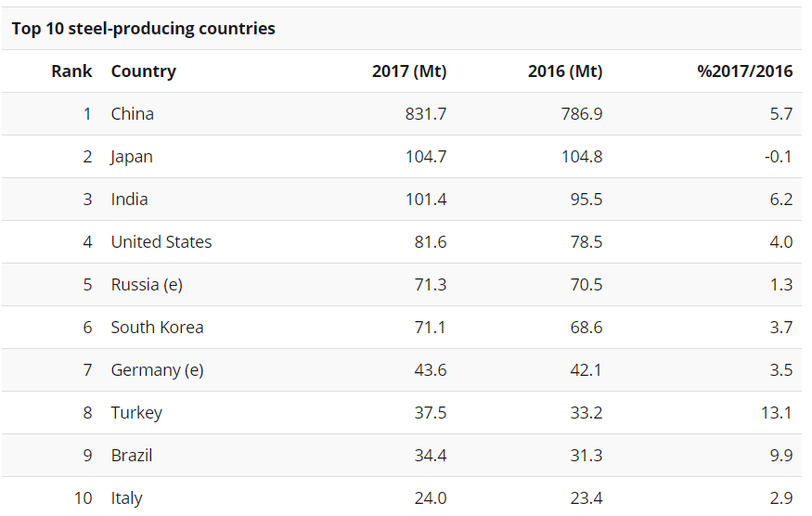

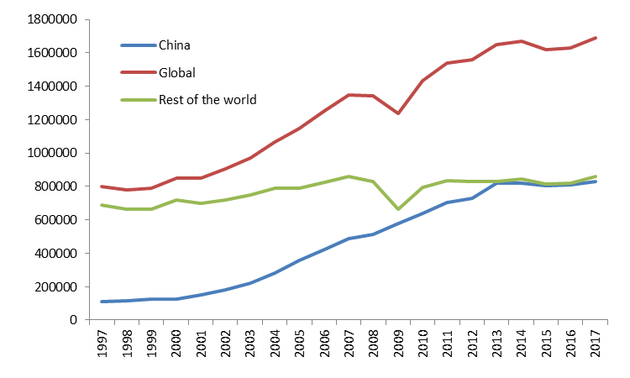

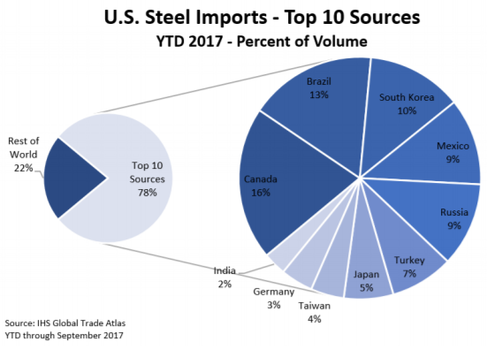

In the wake of Donald Trump's recent twitter activity concerning tariffs, Guy Carson has penned his thoughts on the subject. Guy looks at the logic (or lack thereof) of the decision and its potential impacts. The recent announcement by Donald Trump for Tariffs across both Steel and Aluminium markets has caused some concern across global markets. Whilst the President has declared via Twitter that “trade wars are good, and easy to win”, most economists would disagree. Not that Tariff increases are unique to Trump, the Obama administration put certain tariffs on certain steel products from China as well as solar panels. However this is the first time we are set for them to come in on a one-size fits all approach. There are very few winners from the suggested tariffs with really only those companies in the steel and aluminium industries in the US benefiting. Producers of these materials in the US will face an easier competitive environment and will see their profit margins rise on the back of higher prices. Higher steel production will be likely and its important to note that US steel production has never recovered to its pre GFC levels (the country produced 81.6 million tonnes last year, well down from the peak production of 98.5 millions in 2006). So employment would increase on a very marginal basis. Whilst times would be good for the producers, manufacturing companies in the US would see the price of their steel and alumium increase and hence have to pass on those costs to customers. The cost of construction will go up as will the costs of goods such as cars and household appliances. So the American consumer will be a loser from the introduction of tariffs. The cost of living will increase and hence inflation will rise, there will be no offsetting wage increases as the inflation has come purely via higher raw material costs, this creates a stagflationary environment. The Federal Reserve will likely push ahead with rate rises to keep inflation under control. So the US steel and alumium industries will receive a boost but that will most likely be outweighed by a hit to the US consumer. Overall though if the tariffs are contained to just steel and Aluminium, the impact will be small. The question though becomes one of retaliation and what impacts a trade war might have on a global basis. To that end, the European Union has indicated they will respond in kind to US tariffs. To which, President Trump replied (again via twitter) that the US will “apply a tax on their cars”. To understand what impact a global trade war might have we can look at the make up of the steel market globally. The below table looks at the top 10 steel producing countries last year. One of these countries stands out head and shoulders above the rest and that is China. China produced a staggering 831.7m tonnes of steel last year, almost 8x the production amount of Japan (the 2nd largest producer). Whilst China consumes the most steel it also exports a significant amount as well. In 2017, China exported 73.3m tonnes (more than Russia produces), prior that in 2016, China exported 106.6m tonnes (more than any other country in the world produced). The fact that China exports so much steel shows the significant overcapacity that exists within its steel sector. In a rational world, China would simply cut back on its production. However, production continues to grow and the Chinese steel producers are happy to flood global markets with cheap steel with very little regard for profitability. The below chart is it shows the dramatic rise in Chinese steel production over the course of this century. China has gone from 8.6% of global steel production in 2001 to 49.2% in 2017. Virtually all growth in steel production globally over the last 20 years has come from China but that growth has been significant enough to increase the demand for the raw materials such as Iron Ore and Metallurgical Coal. Hence, when one talks about the price of these commodities, one has to keep in mind that the rise in Iron Ore from below $20 pre 2002 has been all about China. This is also true for most other hard commodities such as base metals where China represents 50-60% of global demand. So whilst a popular thematic in recent times has been that “coordinated global growth” will lead to a rise in commodity prices, for us all that really matters is China. Now, the interesting thing from the introduction of a one size fits all tariff for US steel imports is that at a cursary glance China doesn’t appear to be impacted. The below chart shows the top sources of US steel imports and China does not appear in the top 10 and therefore would represent less than 2% of imports. The most impacted by this policy are Canada, Brazil, South Korea, Mexico and Russia. The European Union is also impacted through Turkey and Germany. This raises the question of where Chinese Steel exports actually go. The answer can be found in the chart below and its predominately Asia. Notably, the largest export destination is South Korea who just happens to be the largest importer into the US. We can’t say for sure but it seems likely some steel will be making its way into the US. So there is a potential of impact through that. It’s not hard to see though that China as the biggest producer and exporter of steel globally has the most to lose in a trade war. If their customers (other countries) start to levy tariffs and taxes on their products and look inwards for more production at a higher cost, then China will have a choice to make. They would either have to cut production or boost construction spending yet again through infrastructure spending. This choice would have dramatic implications for Australian Iron Ore Producers as a cut in steel production would likely mean significantly lower prices whilst stimulus would mean just more of the same.

For years, people have questioned when China will address the overcapacity in its steel sector. Every time it has seemed imminent (2012, 2015) they have kicked the can down the road via stimulus packages and monetary easing. One day the country will likely cut steel production, we’re not sure if today is that day but a trade war will make the current situation more difficult.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed