|

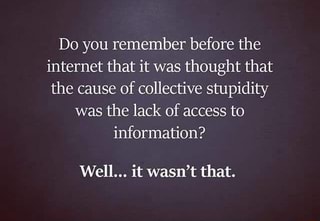

Heading into reporting season we take a look at a few simple things to keep in mind if one truly wishes to capitalise on the increased news flow that comes with reporting season.  Watching the markets day in day out can often be overwhelming to say the least. Information is abundant these days, perhaps so abundant that it is all too easy to be sidetracked by the noise. So this week we would like to take a step back and consider formulating a broad-based framework with which to understand the announcements and how they might impact our portfolio’s going forward. In particular, we posit that going into the new decade with the ASX hitting new highs, it pays to be a little more discerning of the factors that might impact the movements in equities. For one, though equities have had a stellar start to the year, the newsflow related to global economic growth, the drought, viruses and the bushfire season has meant that it is proving to be a rather bumpy ride.  1 - Its Growth, Old Chap (at a reasonable price...) One of the more curious facts of the ASX both today and historically has been dividends. In particular the relatively high proportion of earnings of Australian listed companies that are paid out in dividends as opposed to capital reinvestment or buybacks. The incentives for this are multi-faceted ranging from tax structure to investor composition (this might warrant a more in-depth article in and of itself). Suffice it to say that in this regard Australia is an outlier on par with only perhaps Canada. But going forward this may no longer be the best way to continue investing in equities. It may be a rather controversial suggestion but in a low interest rate environment where the opportunity cost of cash is quite high (given the minimal return we receive), it might do us more justice for a company to reinvest and get a better return on equity. We’ve also seen enough shenanigans with poorly performing management often placating shareholders with juicy dividends. In the long run, this might not necessarily be in everyone’s best interests. A classic case in point, and one which we’ve been talking about for too long, being Telstra. Maybe if they had invested in upgrading their infrastructure and keeping up with technology instead of paying out fat dividends, they wouldn’t be in the less than desirable position they are today. In addition, looking for yield in a historically high valuation environment is a rather tricky game. Unless an investor has true conviction that the market has the wrong view that might warrant a rethink or rerate in the future, then it is exceptionally easy to fall into value traps. We are by no means suggesting that it is okay to pay unreasonable prices for anything in the hope for pure momentum plays. What we are suggesting is that in a low interest rate environment, where although the overall index has been growing at high double-digit pace for the past twelve months, it might make more sense to buy securities at reasonable prices with earnings growth being the key catalyst and driver (compounded by the expansion of the PE multiple). This should be taken in conjunction with return on invested capital (ROIC) and Return on Equity, especially when the cost of debt keeps falling and is likely to go further south. In essence and put simply, watch for releases that show clear signs of earnings growth or delivering higher incremental ROIC, especially when the cost of capital keeps going lower. 2 - Sector & Thematic Dislocations One of the most frustrating aspects of newsflow for us is broad-based thematic generalisations. Examples are things like the Amazon effect and the death of retail or a property downturn. Granted, a broken clock is right twice a day, but it pays to be able to filter the noise. A recent case of this is JB-Hi-Fi (JBH.ASX) (we, unfortunately, do not own) which has released exceptional results despite the doom and gloom associated with brick and mortar retail. In fact, some of our best performing securities have been stocks like City Chic (CCX.ASX) or Baby Bunting (BBN.ASX) which have done exceptionally for us. The point here is that thematic sell-offs often create opportunities for the discerning investor. The key is to identify dislocations that might not fit the bill. For example, in this instance in the case of City Chic, ask questions about their online presence or who their target segments are and whether they are likely to keep growing earnings despite market sentiment. Another interesting theme has been in the nascent space of ESG (Environmental, Social & Corporate Governance). Here, this author believes, we will perhaps see some opportunities of a lifetime. Whatever side of this debate you fall on when it comes to topics ranging from climate change to the entire concept of companies having a social dimension to them, it remains a fact that this particular trend will have a significant impact upon the broader investing world. You only need to look to BlackRock divesting totally from coal in its active management business or CBA refusing to finance any new projects in the space to see this. The outright impact will be the increased cost of capital in the space, pushing up valuations in the renewables space and related infrastructure. The fact that Apple’s (APPL.NASDAQ) market cap today is worth more than the entire energy sector of the United States speaks volumes; everyone uses energy, not everyone has an iPhone. Again, going back to the notion of being discerning through the noise, think about the fact that some of these firms might trade at attractive valuations and might even look to use some of the existing infrastructure and cash flow to diversify into alternative segments of the sector or new businesses entirely. (Come on Telstra, take the hint). Think BP’s (British Petroleum) effort to rebrand itself Beyond Petroleum in 2000. Today, BP is well on its way to building out its circular economy and renewables/alternative energy divisions. Closer to home, Caltex has a biofuels division. This second point is simple, through reporting season look through the so-called unloved sectors for outliers that don’t quite fit the broader narrative. 3 - If You Decide to Sell, Move!

Selling the dogs in a portfolio is perhaps one of the hardest things to do. Whether due to anchoring or just plain ego, those pesky psychological bias’ will always get in the way at some point. We all have the underperformers in the portfolio that we are not quite sure about or, worse yet, that we just don’t want to admit we got wrong. Reporting season can be great to give us that final push and crystallise our thoughts. If you can admit to yourself when you have got it wrong, take solace in the fact that, in the words of Peter Lynch, “in this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.” Most importantly, if you have decided that you were wrong, then move fast. It is often one of the biggest mistakes to wait for the right price to sell (there isn’t one). Not only can you lose further while waiting for a stock to recover to the price you are comfortable selling at, but the opportunity cost of not selling is putting the same capital to work on your winners or those that you have conviction in.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed