- Strategy & Process -

The TAMIM Property Fund: Listed Property portfolio invests in listed Australian and global property securities with the aim of generating an income stream and capital growth. The portfolio may also hold unlisted real estate securities if the right opportunity arises.

Investment Strategy

The Listed Property unit class is an active high-conviction strategy that seeks a blend of long-term capital growth and attractive current income by investing in a diversified portfolio of listed property. The portfolio will typically contain 40 – 50 listed real estate securities with a 50/50 split between Australian REITs (A-REITs) and Global REITs (G-REITs). The A-REIT portion will aim to achieve a high level of distributable income by focusing on shares with above average dividend yields while being mindful of sector and company specific risks. The G-REIT portion will be managed in accordance with the sub-manager's existing Growth At a Reasonable Price (GARP) strategy.

The unit class applies a bottom up fundamental research driven Growth at Reasonable Price (GARP) guided strategy on the global segment. It looks for companies that are somewhat undervalued and have solid sustainable growth potential. The GARP method focuses on relative value. The model divides listed real estate into property types - from retail to self-storage - and begins by assessing the relative price of growth. Listed real estate companies that make the first cut have estimated growth rates above their peers, yet trade at a valuation below the property sector average. The unit class is looking for companies where one can buy growth, and thus superior total returns at a discount. The unit class believes a strong approach for both absolute and excess returns in real estate is an active, conviction weighted, and factor-based approach in public REITs. The unit class’ style can be classified as ‘active’ with the sub-manager trading stock positions within the portfolio.

The unit class applies a bottom up fundamental research driven Growth at Reasonable Price (GARP) guided strategy on the global segment. It looks for companies that are somewhat undervalued and have solid sustainable growth potential. The GARP method focuses on relative value. The model divides listed real estate into property types - from retail to self-storage - and begins by assessing the relative price of growth. Listed real estate companies that make the first cut have estimated growth rates above their peers, yet trade at a valuation below the property sector average. The unit class is looking for companies where one can buy growth, and thus superior total returns at a discount. The unit class believes a strong approach for both absolute and excess returns in real estate is an active, conviction weighted, and factor-based approach in public REITs. The unit class’ style can be classified as ‘active’ with the sub-manager trading stock positions within the portfolio.

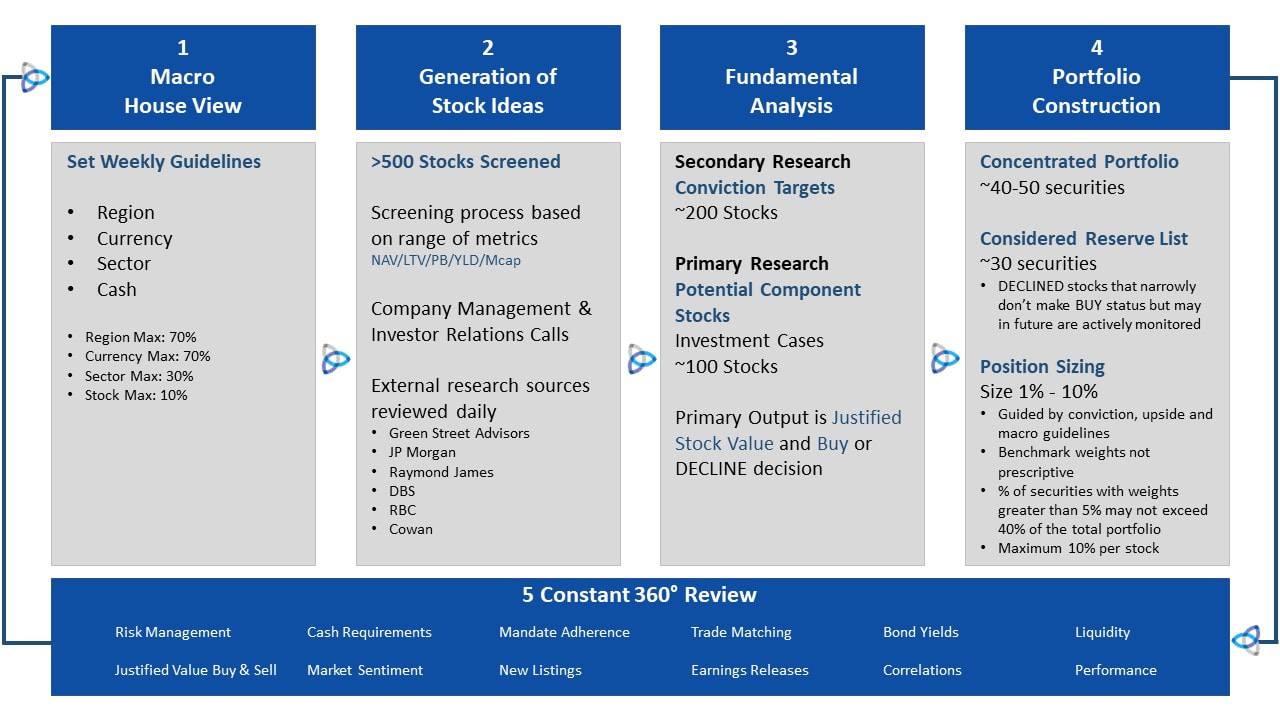

Process:

The unit class’s investment style includes:

Active Management: Exploits difference in the various global REIT markets and industries with carefully considered investment selection and portfolio construction;

High Total Returns: Identifying and investing in REIT’s that are expected to produce high total returns;

Closed-ended funds: Investing in funds with a fixed investment life, to enhance diversification and yield of the portfolio.

The strategy may in certain instances utilise derivatives such as options to obtain a long exposure to a security should this be more efficient than holding the underlying. Derivatives may be used for hedging purposes however they will not be used for leverage purposes.

Active Management: Exploits difference in the various global REIT markets and industries with carefully considered investment selection and portfolio construction;

High Total Returns: Identifying and investing in REIT’s that are expected to produce high total returns;

Closed-ended funds: Investing in funds with a fixed investment life, to enhance diversification and yield of the portfolio.

The strategy may in certain instances utilise derivatives such as options to obtain a long exposure to a security should this be more efficient than holding the underlying. Derivatives may be used for hedging purposes however they will not be used for leverage purposes.