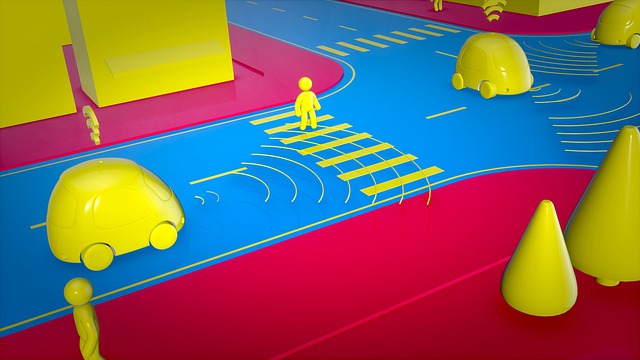

TAMIM Fund: Global Mobility

Process

The Global Mobility strategy utilises long and short equity investments to capitalise on the $7 trillion autonomous vehicle revolution. By analysing first, second, and third order effects, the unit class invests into companies that should benefit from autonomous transportation—from semiconductor chip manufacturers and telecommunications service providers to rare earth miners and beer companies. In parallel, the global mobility unit class takes short positions against businesses that could suffer losses from these same trends—from car dealerships and insurance companies to roadside motels and parking lots.

Investment Process

The unit class will pursue a rigorous investment process to identify investment opportunities, track their progress, and exit when the risk/reward ceases to be favourable. Aquavis pursues a disciplined and patient approach to its investment decisions. The strategy is highly process oriented and reliant on a team focused approach to in depth diligence and intelligent execution. The process involves the consideration and utilisation of the following steps:

The unit class will pursue a rigorous investment process to identify investment opportunities, track their progress, and exit when the risk/reward ceases to be favourable. Aquavis pursues a disciplined and patient approach to its investment decisions. The strategy is highly process oriented and reliant on a team focused approach to in depth diligence and intelligent execution. The process involves the consideration and utilisation of the following steps:

1. Idea Generation

2. Identification of Attractive Long Opportunities

3. Identification of Attractive Short Opportunities

4. Filtering for Target Characteristics - Long Side

- Leverage extensive network of industry experts, globally

- Utilise the Investment Manager’s internal network, highlighting synergies across its funds

- Attend conferences focused on mobility innovation and/or industries of particular interest

- Proactively seek out and review independent and trusted research

- Filter through varied sources of public information to understand key drivers of supply and demand, competition, and market conditions

- Conduct intense screening using sophisticated software

- Run all investments through industry/company/stock framework

2. Identification of Attractive Long Opportunities

- Poised for growth related to the mobility revolution, including its derivative effects

- Top quality technology or products whose business potential is not yet appreciated by markets

- Multiple ways to win beyond just the participation in the autonomous vehicle market

- Unappreciated potential expansion into new geographies or business verticals

- Sustainable competitive advantage, with constant focus on building moats

- Misunderstood or ignored by the investment community

- Look for other asset classes that might provide better risk/reward opportunity than equities

- Look for next order of effects of the same trend

3. Identification of Attractive Short Opportunities

- Poised for disruption related to the mobility revolution, including its derivative effects

- Multiple ways for the target to lose beyond just disruption from autonomous vehicles

- Peers not yet reflecting disadvantages

- No sustainable competitive advantage; not investing in the future

- Keep other asset classes in mind

- Look for next order effects of a trend that has already hurt a given industry, geography or business

- Priced for near term cyclical changes when secular decline is imminent

4. Filtering for Target Characteristics - Long Side

- Start with “top-down” macro level view, informing where to dig deeper on a “bottoms up” fundamental basis

- Unique technology, products, competitive advantages, attractive point in the cycle

- Significant growth in users, volume, revenues, or cash flows not priced by the market

- Bias towards models boasting recurring revenue and strong sales pipeline

- Business model with returns to scale

- Rational cost structure

- Attractive balance sheets; investing in the future

- Under the radar of the investment community

- Near-term catalysts that will force investment community to take notice

5. Filtering for Target Characteristics - Short Side

6. Investment and Monitoring of Positions

7. Closing of Positions

- Start with “top-down” macro level view, informing where to dig deeper on a “bottoms up” fundamental basis

- Low margin or cyclical models that are weak and getting weaker

- Cyclically disadvantaged relative to valuation

- Secular declines or disappearance of businesses without future relevance; not investing in the future

- Businesses propped up with distributions or buybacks not sustained by free cash flow generation

6. Investment and Monitoring of Positions

- Sophisticated valuation models

- Financial statements

- Quarterly earnings calls

- Research reports

- Comparisons to peer group

- In-depth discussions with management team (founder, CEO and CFO)

- Site visits

- 3-5 year industry outlook

7. Closing of Positions

- Company has reached the internal target price and risk-to-reward makes valuation no longer compelling

- Deterioration in investment thesis or business fundamentals

- Significant moves down in shorts that are likely to bounce and can be re-initiated at a better price